Tax season doesn’t need to stress you out. Canada has 5.4 million small businesses. On the other side of the border, the U.S. has 33.3 million. Knowing small business tax deductions helps you save big. Scary fact: 30% of small businesses miss write-offs because of bad records.

This guide from SAL Accounting gives Canadian and U.S. entrepreneurs a simple small business tax deductions checklist. You’ll get easy tips to claim expenses the right way. Start saving money today.

Quick Takeaways

- Deduct rent for a dedicated home office used only for business tasks like client calls.

- Track kilometers for client delivery trips to claim vehicle write-offs and save cash.

- Use a business card to separate work and personal expenses for clean tax records.

- File T2125 or Schedule C by CRA or IRS deadlines to avoid costly penalties.

- Claim deductions like ads or training to lower taxes and keep more profits.

What Are Tax Deductions for Canada and the U.S. Small Businesses in 2025

Canada and U.S. small businesses can claim tax deductions for expenses like office supplies, rent, utilities, ads, travel, and home office costs (in C$ or US$). These need to link to your small business income (CRA’s small business income guide). Consult our small business tax accountant to improve your write-offs. We’ll explain everything in detail next.

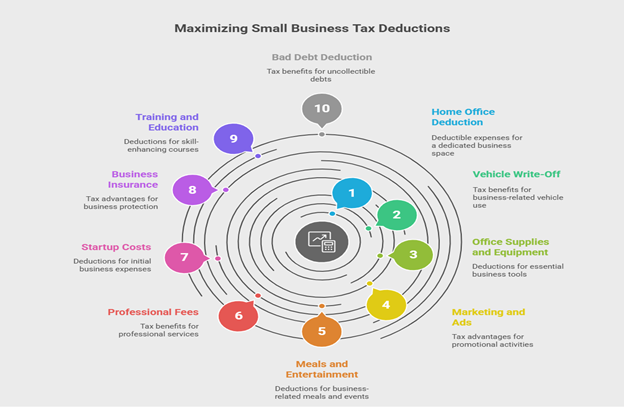

Small Business Tax Deductions Checklist for 2025 (Downloadable)

We will cover 10 awesome business deductions for Canada and the U.S. (IRS small business tax center). Check out these tax write-offs for small business owners to pocket more profits:

1.Home Office Deduction

A home office setup lets you deduct rent, utilities, repairs, or property taxes. Pick a space just for business, like client calls or paperwork. A desk or spare room works, not your kitchen table.

- Canada (CRA): Deduct a chunk based on office size. A 200 sq ft office in a 2,000 sq ft house gives 10% of the costs. Skip personal stuff like curtains. Also, see how small businesses can cut their tax liabilities in Canada.

- U.S. (IRS): Pick $5 per sq ft, up to $1,500, or actual costs. Count only business-only areas (IRS home office deduction)

Example: Emma, a Canadian photographer, has C$50,000 income, deducts C$1,200 (10% of C$1,000 rent), and lowers tax from C$10,000 to C$9,760.

Pro Tip: Snap a pic of your workspace to prove your setup for audits. Store it digitally with a note on business use. This avoids CRA or IRS disputes.

2.Vehicle Write-Off for Small Business

Business driving qualifies for a vehicle write-off for small business costs like gas, repairs, insurance, or lease payments. Count client visits or supply runs, not daily commutes—track work versus personal miles.

- Canada (CRA): Log work kilometres. If 8,000 or 20,000 km are business, deduct 40% (CRA motor vehicle expenses). Parking fees count; speeding tickets don’t.

- U.S. (IRS): Use 70¢ per mile for work trips or actual costs. Add tools, not personal drives.

Example: Liam, a U.S. realtor, has US$60,000 income, deducts US$2,100 (3,000 miles at 70¢), tax drops from US$13,200 to US$12,738.

Pro Tip: Use Driversnote to track miles easily. Log trips weekly to stay accurate. This saves time during tax season.

3.Office Supplies and Equipment Dedication

Buying pens, paper, or laptops cuts taxes with deductible expenses for businesses and startups. Small stuff like ink deducts right away. Using the best bookkeeping tools for small businesses may help. Big items like computers last for years since they last longer.

- Canada (CRA): Claim small supplies now. Spread big items over time. A C$2,000 computer deducts slowly.

- U.S. (IRS): Deduct small supplies fast. Claim up to US$1,160,000 for equipment like monitors, mostly for work.

Example: Sophie, a Canadian florist, has C$55,000 income, deducts C$700 (C$200 pens, C$500 printer), and tax drops from C$11,000 to C$10,860.

Pro Tip: Keep receipts for six years (CRA) or seven (IRS). Scan them monthly to avoid losing any. This proves claims if audited.

4.Marketing and Ads Dedication

Spending on ads, business cards, or websites counts as self-employed tax deductions. Social media ads or flyers work if they push your business.

- Canada (CRA): Deduct ads in Canadian media, like radio. Foreign platforms like Google Ads might not count, so check CRA advertising expenses.

- U.S. (IRS): Claim all ad costs, like website hosting, anywhere, as mentioned in the IRS guide on business deductions.

Example: Noah, a U.S. caterer, has US$70,000 income, deducts US$1,000 (Facebook ads), trims tax from US$15,400 to US$15,180

Pro Tip: Save invoices for each ad campaign. This keeps your records audit-ready.

5.Meals and Entertainment Deduction

Client lunches or event tickets give 50% deductions as write-offs for freelancers. They need a business purpose, like a deal talk. Personal meals don’t count.

- Canada (CRA): Deduct 50% of meal or ticket costs. Jot down who you met and why, like closing a sale (CRA meals and entertainment).

- U.S. (IRS): Deduct 50% of meals, or 100% for some restaurant meals, like team meetups. Note the business goal.

Example: Ava, a Canadian marketer, has C$45,000 income, deducts C$150 (50% of C$300 lunch), shrinks tax from C$9,000 to C$8,970.

Pro Tip: Use a business credit card to keep work and personal meals separate. Note the meeting purpose on the receipts.

6.Professional Fees Deduction

Paying accountants or lawyers for business tasks is deductible. Think tax prep or contract reviews, not personal stuff like family law.

- Canada (CRA): Deduct fees for work tasks, like bookkeeping.

- U.S. (IRS): Deduct fees for business needs, like tax advice. Also, check the strategies of tax expectations for U.S. citizens living abroad.

Example: Ethan, a U.S. designer, has US$50,000 income, deducts US$800 (accountant fees), and saves tax from US$11,000 to US$10,824.

Pro Tip: FreshBooks subscription costs count too. Save invoices for all professional services. This helps justify claims to the CRA or IRS.

7.Startup Costs Deduction

New businesses deduct pre-launch costs like legal fees or logo design. These cover expenses before opening, like website setup.

- Canada (CRA): Deduct costs in your first year. Some limits apply.

- U.S. (IRS): Deduct up to US$5,000. Spread over 15 years.

Example: Olivia, a Canadian startup owner, has C$60,000 income, deducts C$1,500 (website setup), lowers tax from C$12,000 to C$11,700.

Pro Tip: Talk to a tax pro to handle tricky startup costs. Ask about eligible expenses before filing. This ensures you claim everything allowed.

8.Business Insurance Deduction

Business insurance, like liability or property coverage, deducts fully. It protects your work and saves taxes. Personal plans like health insurance don’t count.

- Canada (CRA): Deduct all business policy premiums.

- U.S. (IRS): Deduct all business coverage premiums (business expense resources).

Example: Mason, a U.S. contractor, has US$65,000 income, deducts US$1,200 (liability insurance), cuts tax from US$14,300 to US$14,036.

Pro Tip: Check your policy yearly to match business needs. Update coverage as your business grows. This keeps claims valid and saves money.

9.Training and Education Deduction

Classes boosting business skills, like a marketing course, are deductible. They must tie to your work income, not hobbies like cooking.

- Canada (CRA): Deduct costs for skill-building courses. Personal courses don’t qualify (source).

- U.S. (IRS): Deduct work-related education, like webinars.

Example: Mia, a Canadian tutor, has C$40,000 income, deducts C$600 (webinar course), reduces tax from C$8,000 to C$7,880.

Pro Tip: Save receipts and note how the course helps your work. Keep a short log of course benefits. This supports claims during audits.

10.Bad Debt Deduction

Non-paying clients qualify for writing off unpaid invoices, counted as income. Try collecting first, and confirm the debt won’t be paid.

- Canada (CRA): Deduct after failed collection attempts.

- U.S. (IRS): Deduct for accrual-basis businesses when income is recorded (IRS bad debt deduction).

Example: Lucas, a U.S. consultant, has US$55,000 income, deducts US$900 (unpaid invoice), trims tax from US$12,100 to US$11,902.

Pro Tip: Keep emails showing the collection tries to back your claim. Save copies in a folder for easy access. This proves the debt is uncollectible.

Download your free 2025 small business tax deductions checklist below:

U.S. vs. Canada SMBs: Business Write-offs Compared

Tax rules for small business write-offs differ in Canada and the U.S., as explored in our comprehensive comparison between the Canadian tax system vs the U.S. This list shows CRA and IRS differences with tips to save SMBs cash:

- CRA sticks to Canadian media for ad claims, foreign ones need a check; IRS takes all ad costs anywhere.

- CRA takes 50% of work meal costs with notes; IRS grabs 100% for some restaurant meals. Pay with a business credit card.

- CRA splits big equipment claims over the years; IRS grabs up to $1,160,000 fast. Save receipts with Expensify.

- CRA takes startup costs in year one with caps (CCA); IRS takes up to $5,000, the rest over 15 years. Ask a tax pro for tricky stuff.

- CRA uses work kilometer share for vehicle costs; IRS picks 70¢ per mile or actual costs. Track with DriversNote for vehicle write-offs.

- CRA takes uncollectible income after collection tries; IRS takes it for accrual-basis businesses. Save collection emails.

- Read More: “E-commerce Accounting in 2025: What Small Businesses Need to Know”

Check this table to compare key write-offs for Canadian and U.S small businesses:

| Deduction | CRA Rule | IRS Rule | Key Requirement |

| Home Office | Office size percentage. | $5 per sq ft or actual costs. | Work-only space. |

| Vehicle Write-Off | Work kilometer share. | 70¢ per mile or actual costs. | Business trips only. |

| Office Supplies & Equipment | Small items now, big over time. | Small items fast, up to $1,160,000. | Business-use items. |

| Marketing and Ads | Canadian media; check foreign. | All ad costs. | Promote business. |

| Meals and Entertainment | 50% client meal/ticket costs. | 50% meals, 100% some restaurants. | Business purpose. |

| Professional Fees | Work-related fees. | Work-related fees. | Business tasks. |

| Startup Costs | First year with limits. | Up to $5,000, rest over 15 years. | Pre-launch costs. |

| Business Insurance | Business policy premiums. | Business policy premiums. | Business coverage. |

| Training and Education | Business-related course costs. | Work-related course costs. | Boost work skills. |

| Bad Debt | Failed collection attempts. | Accrual-basis businesses. | Unpaid invoices as income. |

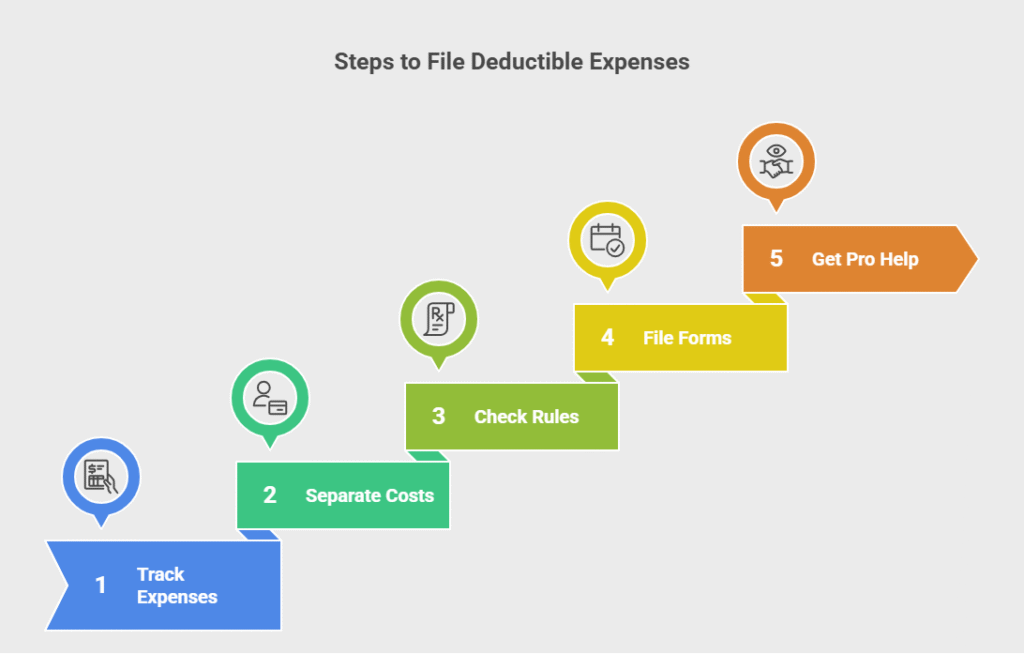

How to File and Send Deductible Expenses for Startups

These five steps help you file write-offs in Canada and the U.S. with ease. Crush taxes like a pro:

1.Track Work Expenses

Write down all business costs, like ads or travel. Use QuickBooks to keep things neat. Log daily to catch every write-off. This makes claims solid for CRA or IRS.

2.Split Work and Personal Costs

Mixed costs mess up claims and cause trouble. Get a business card to keep work stuff separate. Use it for client meals or office gear. This shows that costs are work-only. A CRA business account for Canadian small business owners may be helpful.

3.Check Expense Rules

Line up costs with CRA or IRS rules (CRA SMBs deduction rules). Use DriversNote to measure office space or miles correctly. Review rules for each cost type. This keeps claims clean.

4.File with Required Forms

Late filings slap on fees, so stay on time. Add receipts to prove claims. Save them with Expensify.

- Canada (CRA): Use Form T2125 by June 15 for self-employed or May 1 for taxes owed.

- U.S. (IRS): File Schedule C by April 15.

5.Get Tax Pro Help

Tough self-employed tax deductions stump solo filers. Grab an accountant to snag all CRA business expenses. They tackle hard rules and boost savings. It’s a smart play. Check out our accounting and tax services at SAL Accounting to nail your write-offs.

Common Tax Mistakes to Avoid for SMBs: Deductible Expenses

This list shows six slip-ups with easy fixes to ace your write-offs:

- Mixed Work and Personal Cash: One account for all expenses jumbles stuff. Grab a business card to stay tidy.

- Lost Receipts: Tossed receipts nix write-offs.

- Guessed Costs: Guessed office space or miles spark errors. Measure with DriversNote.

- Personal Cost Claims: Family dinners in claims pull audits. Stick to work stuff only.

- Missed Deadlines: Late filings slap on fees. Hit May 1 for Canada taxes, June 15 for self-employed, or April 15 for U.S.

- Skipped Tax Pros: Solo tricky self-employed tax deductions lose savings (business taxes for self-employed). Grab an accountant to win. Connect with our small business accountants to save more cash.

Use this table to file deductible expenses for startups and dodge mistakes:

| Action | CRA Filing | IRS Filing | Mistake to Avoid |

| Track Expenses | Track business costs daily. | Track business costs daily. | Mixed work/personal cash. |

| Separate Costs | Business card for work costs. | Business card for work costs. | Jumbled expenses. |

| Check Rules | CRA rules for measurements. | IRS rules for measurements. | Guessed office space/miles. |

| File Forms | T2125 by June 15/May 1. | Schedule C by April 15. | Missed deadlines. |

| Save Receipts | Receipts for audits. | Receipts for audits. | Tossed receipts, lost deductions. |

| Get Pro Help | Accountant to boost savings. | Accountant to boost savings. | Skipped pros for tricky deductions. |

Case Study: Freelancer’s Tax Win

Problem: A Toronto freelancer contacted our team. Mixed expenses in one account cost her C$2,000 in write-offs. Lost receipts nixed C$1,000 in claims. Guessed office size sparked a C$1,500 audit fine. Personal meal claims added C$800 in penalties. Missed the June 15 deadline cost C$500.

What We Did: We told her to use a business card for work costs. We suggested saving receipts and measuring office space with DriversNote. We advised filing T2125 by June 15 with an accountant.

The Result: Her 2025 taxes were clean. She claimed C$3,500 in write-offs, dodged fines, and saved C$2,000 with pro help.

Final Thoughts

Tax deductions for small businesses save SMBs a lot of money. Clear records and smart planning keep profits safe in Canada and the U.S. Miss write-offs, and you lose cash. This guide from SAL Accounting breaks down easy steps to claim expenses correctly.

Stay sharp with current rules to avoid costly slip-ups. Contact us for a free consultation to simplify your taxes and boost savings.

Frequently Asked Questions (FAQs)

Deduct expenses like home office, vehicle, supplies, ads, meals, fees, insurance, and training. Link costs to business income.

Claim all insurance, professional fees, and small supplies. The U.S. allows full restaurant meal deductions.

Deduct rent or utilities for a work-only space. CRA uses size percentage; IRS allows $5 per sq ft.

Sole proprietors deduct without registration. Corporations need CRA or IRS registration for deductions.

Home office deduction covers rent or utilities for work-only spaces.

Track costs daily. Use a business card and save receipts for audits.

Deduct startup costs like legal fees or website setup. CRA allows first-year claims; IRS up to $5,000.

Personal expenses, unverified home office, or large meal deductions trigger audits.