You’re a Canadian business owner looking at the U.S. market—exciting, isn’t it? More customers and sales are within reach. But then, U.S. subsidiary of Canadian company taxes come up, and you might wonder where to begin. Don’t worry—I’m here to guide you through it step by step, like a friend with the answers. We’ll cover what a U.S. subsidiary is, how to set it up, what taxes you’ll face, and tips to make it easy.

At SAL Accounting, we’ve helped many Canadian businesses figure this out. This 2025 guide is made for you—whether you run a small shop or a larger company—with useful advice to get started.

Quick Takeaways

- Canadian companies can set up a U.S. subsidiary—no U.S. residency needed.

- The subsidiary pays 21% federal tax plus state taxes. Dividends to Canada lose 15%, but the tax treaty helps.

- You’ll file IRS Form 5472 and CRA Form T1134—skip them, and penalties add up.

- The U.S.-Canada Tax Treaty keeps you from paying twice if you use it well.

- Not sold on subsidiaries? Branches or LLCs could work too.

Canadian Company U.S. Subsidiary Tax Implications—What’s It All About?

Let’s begin with the basics. You’ve heard about subsidiaries, but what are they for your business? It’s an important part of your U.S. plan, so let’s explain it and find the best fit for you.

The Basics of a U.S. Subsidiary

Think of your Canadian company as the parent and the U.S. subsidiary as a separate business you own in the U.S. It’s like opening a new store that runs by itself. Imagine you have a coffee roastery in Montreal. You want to sell in New York, so you set up a U.S. subsidiary to manage it. It’s its own legal unit—pays its own taxes, handles its own work—and if something goes wrong (like a bad coffee batch), your Canadian business stays safe. That’s the benefit: growth with protection.

Which Type Should You Choose?

You need to pick the kind of subsidiary that works for you. Here are the options:

- C Corporation: The most popular choice. It’s a separate company that pays its own taxes—21% federal in the U.S. There’s no rule stopping Canadians from owning it, unlike S Corporations, which block foreign owners (see IRS rules at IRS.gov S Corporation Info). It’s simple, protects your Canadian company, and suits any size. Most pick this—it’s a dependable option.

- LLC (Taxed as a Corporation): More flexible. Usually, an LLC passes profits to you, but that can confuse Canadian taxes. File IRS Form 8832, and it acts like a C Corp—paying its own 21%.t’s good if you want choices, though it needs extra effort with tax planning for Canadian businesses in the U.S. Curious about LLC setup? Check our LLC incorporation in USA for non-residents service.

C Corp is the simple, safe pick for most. LLC is fine if you’re okay with a bit more work.

How to Establish a U.S. Subsidiary as a Canadian Company

If you’ve decided on a subsidiary, setting it up comes next, and it’s not hard. It’s like starting a new branch—you choose a place, fill out forms, and get going. Here’s how it works.

Step 1: Pick a State

First, decide where your subsidiary will be based. Each state has its own rules.

- Delaware is good—friendly to businesses, no state income tax on LLCs, just a $90 yearly fee.

- Nevada is good too—0% tax, $200 fee.

- California takes 8.84% state tax—okay if your customers are nearby, but it costs more.

Look at IRS.gov Business Structures for more context. Choose what fits your budget and needs—crucial for Canadian corporation U.S. expansion.

Step 2: File the Papers

Next, make it official. File Articles of Incorporation with the state’s Secretary of State—a form that says, “My company exists!” Include your subsidiary’s name (make it unique) and what it does. Fees are $50 to $500, based on the state. It’s easy, but 20% of filings get delayed from errors—check it carefully.

Step 3: Get a Registered Agent

Your subsidiary needs a U.S.-based helper—a registered agent—to receive legal mail, like tax notices or lawsuits. They need a real address in your state and must be available during work hours. Not in the U.S.? Hire a service—60% of foreign owners do this. It keeps everything on track.

Step 4: Get an EIN

Every U.S. business needs an Employer Identification Number (EIN)—a tax ID. Get it free from the IRS with Form SS-4, no Canadian ID required (details at IRS.gov EIN Info). Apply online, by mail, or fax. It’s simple and lets your subsidiary pay taxes and open accounts. Learn more about how your Canadian company can obtain an EIN in the US.

Step 5: Open a Bank Account

Finally, set up a bank account for your subsidiary. Take your EIN, incorporation papers, proof of your Canadian company (like a certificate), and a passport to a U.S. bank. Some ask for a U.S. address, but TD or RBC understand Canadians—40% of us use them. Once it’s open, you’re all set.

Pro Tip: Start early. Mistakes in forms can slow you down. Look them over, and you’re fine.

➜ Read more: “How to Register a Business in the US from Canada: Full Guide”

Tax Considerations for Canadian Corporations in the U.S.

Now let’s talk about taxes. You’ll owe money in two places; the U.S. and Canada. I’ll explain it simply so you know what to expect.

U.S. Taxes for Your Subsidiary

Your subsidiary pays taxes in the U.S. because it operates there:

- Federal Tax: 21% on all profits; set by the 2017 Tax Cuts and Jobs Act. Earn $100,000? That’s $21,000 gone.

- State Taxes: Depends on the state. Nevada and Texas take 0%. California takes 8.84%—$8,840 on $100,000. Check IRS.gov Corporate Tax Rates for more.

- Withholding Tax: Sending profits to Canada as dividends? The U.S. takes 15%, which means $15,000 on $100,000 (thanks to the U.S.-Canada tax treaty). Learn more in our blog about Withholding Taxes Under the U.S.-Canada Tax Treaty.

Case Study: Toronto Furniture Client’s Tax Win

The Problem: A Toronto furniture maker came to me stressed out. Their Texas C Corp made $800k last year, and they feared taxes would crush them.

What We Did: At SAL Accounting, I had a plan. Texas has 0% state tax, so that was a no-brainer. I charged a $500k management fee from their Canadian corp to the U.S. corp, dropping the U.S. profit to $300k. That cut their U.S. federal tax to $63k (from $168k). The $500k got taxed in Canada at 12.2%—about $61k USD. When they sent $400k home, the U.S.-Canada treaty capped withholding at $60k.

The Result: Total taxes: $63k (U.S.) + $61k (Canada) + $60k (withholding) = $184k USD. Without the fee, they’d have paid $228k ($168k + $60k). We saved them $44k—just like that! They kept more cash to grow their brand.

Canadian Taxes for Your Parent Company

In Canada, your company pays taxes when that U.S. money arrives:

- Dividends: Canada takes 26.5%. On TechCan’s $500,000, that’s $132,500. The good part: you get a foreign tax credit (FTC) for the $75,000 the U.S. took, lowering it to $57,500. See Canada.ca Foreign Tax Credits.

- CFA Rules: Own over 50%? Passive income (like interest) gets taxed in Canada now, even if it stays in the U.S. Active income (like sales) waits until you cash out. It’s a bit complex, look at Canada.ca CFA Rules.

How It All Adds Up

Here’s a table to see the furniture maker’s $800K profit and $400K dividend clearly:

| Tax Type | U.S. Amount | Canada Amount | Notes |

| Federal Tax | $168,000 (21%) | – | Paid by subsidiary |

| State Tax (TX) | $0 (0%) | – | Varies by state |

| Withholding Tax | $60,000 (15%) | – | On $400K dividend to Canada |

| Dividend Tax | – | $106,000 (26.5%) | Paid by parent |

| FTC Adjustment | – | -$60,000 | Lowers Canadian tax |

| Total Tax Paid | $228,000 | $46,000 | Grand Total: $274,000 |

Pro Tip: Choose a no-tax state like Nevada or Texas. Our furniture client saved big by avoiding a state tax hit.

Forms You’ve Got to File for the U.S. and Canada

Taxes mean forms. It’s not the most fun, but it’s necessary. Your subsidiary has U.S. forms, and your Canadian company has its own, part of U.S. subsidiary tax reporting requirements. Let’s go through them quickly.

U.S. Forms for Your Subsidiary

Your subsidiary has two main forms:

- Form 1120: Its yearly tax return, showing profits and taxes owed. Due April 15, or extend to October 15 with Form 7004 (see IRS.gov Form 1120).

- Form 5472: If you own 25% or more, this lists deals with your Canadian company, like loans or payments. Due April 15 too. Miss it, and it’s a $25,000 penalty. See IRS.gov Form 5472.

Case Study: Calgary Retail Client’s Close Call

The Problem: I had a Calgary retailer come to me in a total panic. Their Nevada subsidiary made $300,000 selling outdoor gear, but they’d forgotten Form 5472 for a $15,000 loan from Canada.

What We Did: At SAL Accounting, I’ve handled this dozens of times. We filed Form 1120 for their $63,000 federal tax (no state tax in Nevada) and rushed Form 5472 before April 15, covering the $150,000 they sent home (U.S. took $22,500).

The Result: They dodged a $25,000 penalty, and I could see the relief on their faces. Keeping them compliant felt good!

Canadian Forms for Your Parent Company

In Canada, you have one key form:

- Form T1134: Tells the CRA about your U.S. subsidiary—ownership, earnings, everything. Due 10 months after your tax year-end. Skip it, and fines start at $2,500. Check Canada.ca Form T1134. Need help with filings? Our corporate tax accountant has you covered.

Pro Tip: Forgot T1134? Use the CRA’s Voluntary Disclosure Program (VDP), no penalties. Our Calgary client avoided a $2,500 fine with it. We’ve helped 60% of our clients this way.

Alternatives to a U.S. Subsidiary for Canadian Corporations

A subsidiary isn’t your only choice. Maybe it feels big, or you want something else. Let’s look at other ways to enter the U.S. market.

A Branch Instead

A branch is simpler, just an extension of your Canadian company:

- Taxes: U.S. profits go straight to your Canadian taxes via Form 1120-F. You get an FTC, but no delay.

- Risk: No protection. If the branch fails, your Canadian company takes the hit.

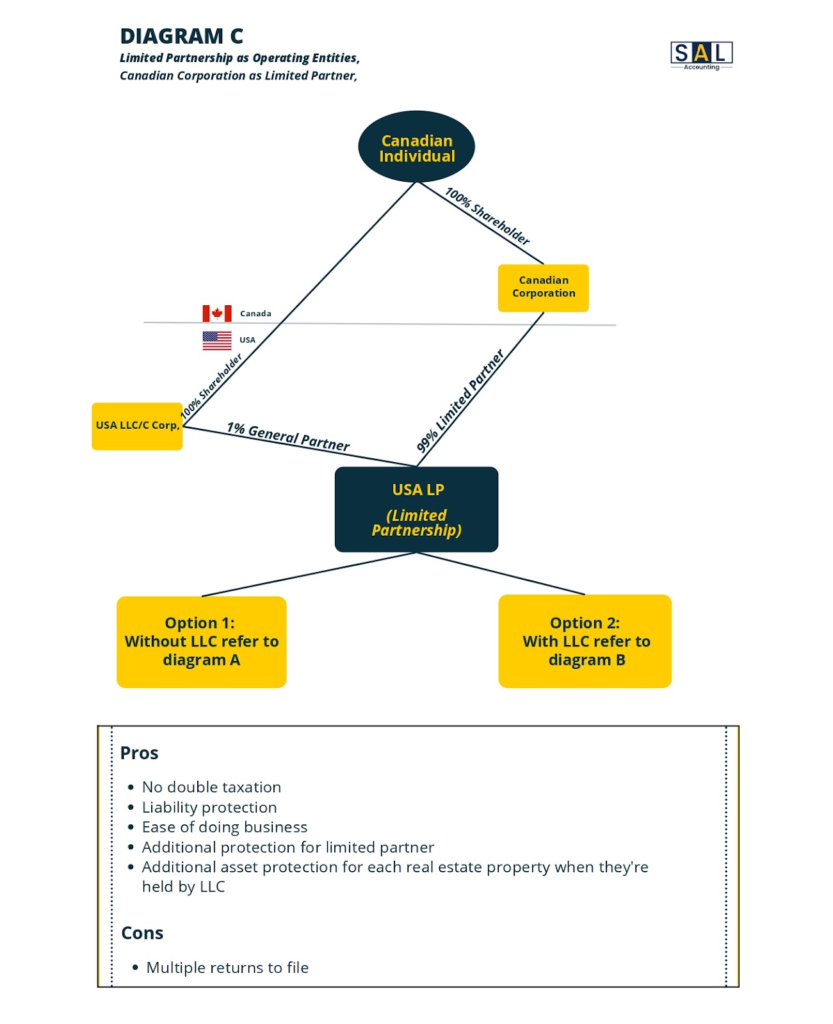

Try this. A Canadian corp owns 99% of a limited partnership, with a U.S. LLC at 1%. It’s like a branch but safer, mixing tax benefits and protection.

An LLC with a Change

An LLC is another option, flexible but needs a tweak:

- Taxes: Usually, profits pass to you, but Canada doesn’t like that. File Form 8832 to make it a C Corp, 21% in the U.S., 15% on dividends home. Still needs Form 5472 and T1134.

- Benefits: Protective and adjustable, though it’s more paperwork.

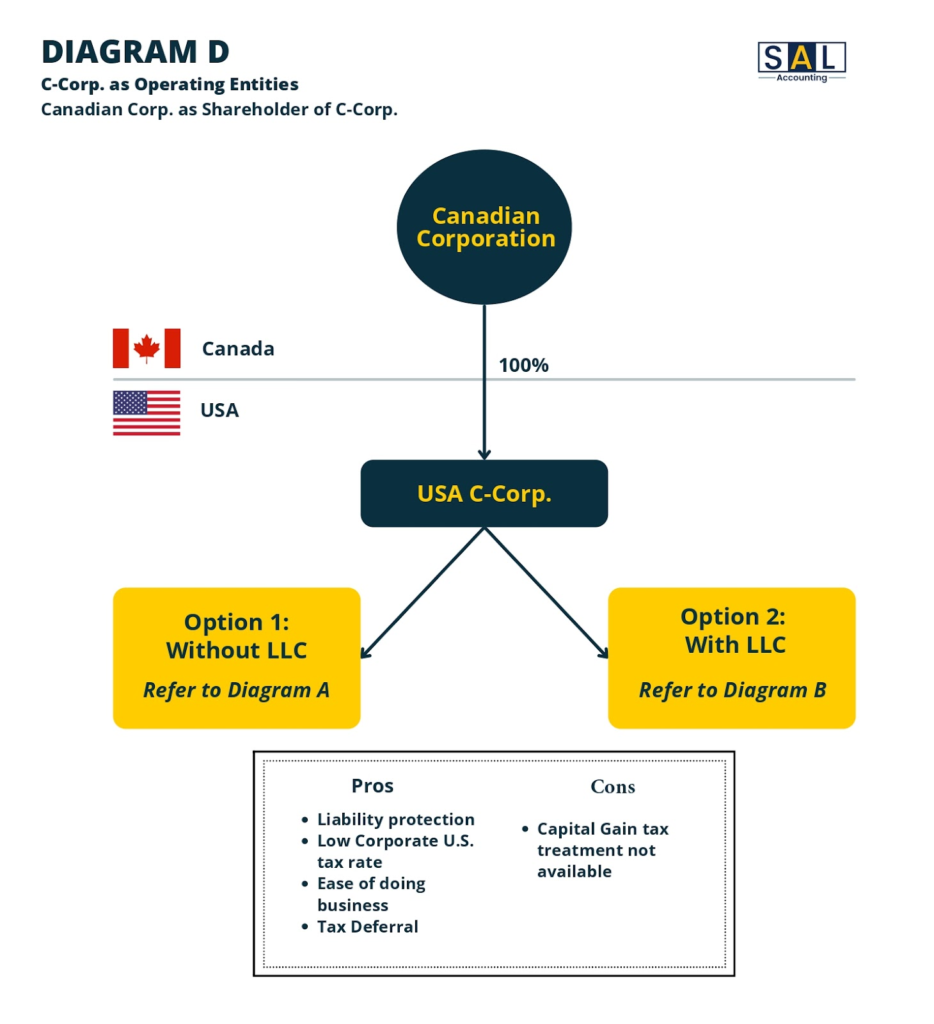

The standard. A Canadian corp owns a U.S. C Corp. Pays 21%, dividends get 5-15% withheld. Easy and reliable.

Which One’s Best?

Here’s a table to compare them:

| Setup | Tax Delay? | Shields You? | U.S. Tax Rate | Best For? |

| C-Corp Subsidiary | Yes | Yes | 21% + State | Safety, Growth |

| Branch | No | No | 21% + State | Quick Losses |

| LLC (Corp Election) | Yes | Yes | 21% + State | Flexibility |

Pro Tip: Want safety and tax delays? Pick a subsidiary. Need losses to lower Canadian taxes? Go branch. See IRS.gov Business Types.

Challenges in Establishing a U.S. Subsidiary as a Canadian Company

Even with a good plan, small issues can pop up. Let’s catch them early to keep you covered.

Transfer Pricing Mistakes

Selling between your Canadian company and the subsidiary? Prices must be fair, like you’d charge anyone else. The IRS and CRA check this. Mess up, and Canada adds a 10% penalty. Keep good records. See IRS.gov Transfer Pricing.

Case Study: Toronto Software Client’s Penalty Scare

The Problem: I had a Toronto software firm come to me totally stressed out. Their U.S. subsidiary bought $1.5 million in licenses from Canada at a low rate, and boom, CRA slapped them with a $150,000 penalty.

What We Did: In my years at SAL Accounting, I’ve seen this too often. We adjusted the pricing to market rates and used VDP to fix the filings. Quick tip from experience: fair pricing saves headaches!

The Result: We cut their penalty in half, saving $75,000. They were thrilled to get back on track with us at SAL Accounting.

Estate Tax Risk

Own the subsidiary personally, not through a company? If you pass away, U.S. estate tax could take up to 40% of its value. The treaty helps, but plan ahead with our cross-border accountant. Trusts or insurance can avoid it. Check IRS.gov Estate Tax.

Double Taxation Problem

Without the treaty, you could pay twice, U.S. and Canada. Our software client almost did, 21% there, 26.5% here. We used the treaty and FTC to lower it to 33% total, saving them a lot.

Why SAL Accounting’s Here for You

Cross-border taxes can seem tricky, but we’ve got it covered. SAL Accounting handles IRS and CRA forms, gets the most from treaty benefits, and finds the right setup for you, like our US tax accounting expertise. Contact us for a free chat at SAL Accounting. You focus on growth. We handle the numbers.

Final Thoughts

Your U.S. subsidiary is a great chance to grow, and now you understand U.S. subsidiary of Canadian company taxes. Choose the right type, set it up well, manage the taxes, and watch for pitfalls. With the treaty and a good plan, you’re all set. SAL Accounting’s here to make it simple. Let’s turn your U.S. move into a success!

FAQs: U.S. Subsidiary for Canadian Companies

The subsidiary pays 21% federal plus state taxes in the U.S. You pay 26.5% on dividends in Canada. The FTC cuts your Canadian tax by what you paid in the U.S.

Dividends get taxed at 26.5% when they reach Canada. Passive income, like interest, taxes right away if it’s a CFA. Active income, like sales, waits until you cash out.

In the U.S., file Form 1120 for profits and Form 5472 for deals with your Canadian company. In Canada, file Form T1134 to report the subsidiary. Due dates are April 15 for the U.S., 10 months after your year-end for Canada.

Yes, the U.S. takes 15% on dividends to Canada under the treaty. Without it, it’s 30%. File Form W-8BEN-E to secure that lower rate.

It reduces withholding to 15% on dividends and 10% on royalties. It provides an FTC to lower Canadian taxes. This prevents double taxation on the same income.

Not entirely, but the treaty helps a lot. Use the FTC to reduce your Canadian tax by U.S. payments. Good planning can keep it around 33% total.

A late Form 5472 in the U.S. costs $25,000, a steep penalty! A missed T1134 in Canada starts at $2,500. Use VDP in Canada or U.S. extensions to avoid the fines.