Expanding into the U.S. can help Canadian businesses grow. A U.S. Limited Liability Company (LLC) seems like an easy and flexible option, but can a Canadian corporation own a US LLC? More importantly, what are the tax and legal implications?

Understanding these factors is key to avoiding tax issues and staying compliant in both countries. This guide covers the process, tax rules, compliance, and other options for cross-border business.

Quick Takeaways

- Yes, a Canadian corporation can own a US LLC.

- Ownership can be either a single-member LLC or a multi-member LLC.

- The main challenge is double taxation, but the Canada-U.S. Tax Treaty can offer relief.

- Both US and Canadian compliance requirements apply.

- Alternative structures (C-Corporation or Limited Partnership) may be more tax-efficient.

Understanding the Basics: Can a Canadian Open an LLC in the US?

Canadian corporations can open a US LLC with ease. LLCs don’t require US citizenship or residency, making them a great option for Canadian businesses expanding south. Here’s what you need to know:

- No Residency Rules: You don’t need to be a US resident to own an LLC.

- Flexible Ownership: Choose between single-member or multi-member LLCs to fit your needs.

- Tax Implications: The IRS sees a single-member LLC as part of the Canadian corporation’s income. But the CRA views it as a separate company, which may result in double taxation.

How to Set Up a US LLC as a Canadian Corporation: Step-by-Step

Wondering how to set up a US LLC as a Canadian corporation? It’s a smart move to expand your business across the border. To do it right, you’ll need to understand the steps clearly. Let’s break it down so you can handle the process without stress.

Step 1: Choose the Right State for Your LLC

Picking the right state for your US LLC is a big deal. It affects taxes, rules, and how you run your business. States like Delaware, Wyoming, and Nevada are popular, but the best choice really depends on what your business needs.

| State | Income Tax | Legal Protection | Annual Fees | Best For | Notes |

| Delaware | No income tax on LLCs | Strong, established | $90 (approx.) | Large and international firms | Additional taxes if operating outside Delaware |

| Wyoming | No income tax | Minimal regulations | $50 – $100 | Privacy-focused businesses | Limited legal tools for big businesses |

| Nevada | No income tax | Strong business laws | $200 (approx.) | Privacy and tax savings | Higher annual fees than other states |

- Pro Tip: Delaware is popular for big corporations, but Wyoming could be a better fit for smaller businesses or Canadian companies. It’s cheaper, tax-friendly, and easier to manage.

Step 2: Pick a Name for Your LLC

After choosing a state, it’s time to name your LLC. The name should follow state rules, fit your brand, and be unique.

Is Your Name Available?

You can check if your LLC name is available on your state’s Secretary of State website. Most states require including “LLC” or “Limited Liability Company” in the name.

Check the U.S. Patent and Trademark Office (USPTO) too. A name might be available in your state but still trademarked by another business. Using it could cause legal problems later.

- Example: Let’s say you want to name your business “Maple Tech Solutions” in Delaware. First, check the Secretary of State’s database to see if it’s available. Then, search the USPTO database to confirm it’s not trademarked. If the name’s taken, adjust it. Add “LLC” or try something like “MapleTech Innovations LLC” to avoid trouble.

Step 3: Appoint a Registered Agent

Every US LLC needs a registered agent. This is someone or a service that gets legal papers for your business. They must have a physical address in the state where your LLC is formed and be available during normal business hours.

If you don’t live in the state, you can hire a professional. They handle important documents and keep your business compliant.

- Pro Tip: Most foreign LLC owners (about 60%) choose professional services to avoid problems and stay on track with the law.

Step 4: File the LLC Formation Documents

To officially start your LLC, file Articles of Organization with the Secretary of State. This document includes your LLC’s name, registered agent, and ownership details.

State filing fees can range from $50 to $500, so check the cost in your state. Canadian corporations must include ownership details as well if the LLC is foreign-owned.

- Pro Tip: Filing early is a smart way to avoid unexpected issues. Around 20% of LLC filings face delays because of incomplete or incorrect forms. Double-check all your information for accuracy.

Step 5: Obtain an EIN from the IRS

After registering your LLC, you’ll need an Employer Identification Number (EIN) from the IRS. This is like a Social Security Number for your business. You’ll need it for taxes, opening a US business bank account, and hiring employees if needed.

Can You Apply Without an SSN?

You can apply without a Social Security Number. Canadian corporations just need to complete Form SS-4 and mark the owner as foreign. Submit the form by mail, fax, or use a third-party service for faster results—learn more about how we can assist you to open an LLC in the USA as a non-resident in Mississauga. About 70% of foreign business owners apply online because it’s quicker and easier.

- Pro Tip: Don’t wait to apply. An EIN is essential for banking and tax filings. Filing early can help you avoid problems later.

Step 6: Open a US Bank Account

Getting a US bank account helps you manage your LLC’s money and keep things organized. Most banks will ask for a few key documents and IDs when you’re setting up. Here’s what you’ll need:

- EIN letter from the IRS

- LLC formation papers

- Proof of your Canadian company

- Photo ID (like a passport)

- A US address (some banks require this)

TD Bank and RBC are great for Canadian businesses. They understand cross-border banking and make the process easier. About 40% of Canadian companies choose these banks to avoid extra hassle.

➜ Read more: Can a Canadian own a business in the us?

Tax Implications & Compliance of Canadian-Owned US LLC

Handling taxes can be tricky if you’re a Canadian corporation owning a US LLC. Both Canadian and US tax rules affect what you need to do and what benefits you might get.

How the US Taxes Your Canadian-Owned LLC

If your Canadian corporation owns a US LLC, understanding taxes on both sides of the border is important. For a US LLC Canadian parent company structure, the IRS offers two taxation options that can significantly impact your bottom line. Choose the one that works best for your business:

- Disregarded Entity: If the LLC has one owner (Single-Member LLC), the IRS doesn’t tax the LLC separately. The income flows directly to the Canadian corporation and is reported as part of its taxes.

- Corporate Election: An LLC can choose to be taxed as a corporation by filing IRS Form 8832. This makes the LLC responsible for its own taxes. It keeps its income separate from the Canadian company that owns it. This setup can help avoid double taxation.

If your US LLC earns money and sends it to the Canadian parent, it might need to pay a branch profits tax. This tax is 30% on profits sent back to the parent company. Yet, you can use the Canada-US Tax Treaty to reduce this to 5%.

What US IRS Forms Do You Need to File?

You’ll need to file Form 5472 each year for transactions between your US LLC and the Canadian parent, like payments or loans.

- Pro Tip: Skipping Form 5472 could cost you $25,000 in penalties. Keep accurate records and file on time to avoid fines.

What Canada Wants from Your US LLC Profits

Owning a US LLC also brings tax obligations in Canada. Here’s what to keep in mind:

- Double Taxation: Canada doesn’t see US LLCs as pass-through entities like the IRS does. This means your LLC income could be taxed twice—once in the US and again in Canada. Plan carefully to avoid this.

- Foreign Tax Credits: Canada gives tax credits for US taxes you’ve paid. These can lower your Canadian tax bill but might not cover everything. Careful math is important.

- Withholding Taxes: If your US LLC sends profits to Canada, the US may withhold 30% in taxes. The Canada-US Tax Treaty can lower this to 5%, helping you save more money.

What CRA Forms Do You Need to File?

If you own a US LLC, you need to file Form T1134 every year with the CRA. It reports your ownership. Filing late or incorrectly can lead to fines.

Challenges for Canadians Owning a US LLC (and How to Fix Them)

Opening a US LLC as a Canadian corporation comes with challenges. Taxes, compliance, and cross-border business structure can get tricky. Here’s a simple guide to these common issues and their solutions.

1. Double Taxation

Canada sees US LLCs differently than the US does. This can mean getting taxed twice—once on LLC income in the US, and again when the profits are brought back to Canada.

The Fix: File IRS Form 8832 to have your US LLC taxed as a corporation. This prevents double taxation and aligns US and Canadian taxes. Be aware it may increase taxes on distributions sent to your Canadian company.

➜ Read more: How to Avoid Double taxation between US and Canada?

Case Study: Avoiding Double Taxation for US-Canada Business

The Problem: A client came to us with a common frustration. Their tech company was doing well in the US, but taxes were becoming a real issue – 21% to the US and another 26.5% to Canada. That’s nearly half their profits going to taxes!

What We Did: Having handled this situation many times before, we knew the usual Form 8832 advice wasn’t the best solution. Here’s what works better:

- For companies without a US office: We used our knowledge of the US-Canada Tax Treaty (Article 5) and filed Form 8833. In simple terms? We showed all income should be taxed in Canada only. No double taxation.

- For companies with US operations: We created a smart management fee arrangement between the Canadian parent and US LLC. Quick tip from experience: Keep these fees under $1M yearly – it helps avoid extra IRS attention.

The Result: We reduced that 21% US tax hit. Our client got a great setup that works with both tax rules, and they could focus more on running their business.

2. Cross-Border Compliance

A Canadian corporation owning a US LLC must file taxes in both countries. Missing these filings can lead to heavy penalties. Key forms include IRS Form 5472 and CRA Form T1134.

The Fix: Avoid penalties by filing the right forms. Use IRS Form 5472 to report deals between the US LLC and its Canadian owner. File CRA Form T1134 to report foreign investments. Keep good records and get help from our cross-border tax experts.

Case Study: Saving a Client from Cross-Border Filing Penalties

The Problem: A client running a management consulting business through their US LLC came to us worried. They had no idea they needed to file Form T1134 with CRA for their US operations. Even worse, the IRS charges an automatic $25,000 penalty for missing or late Form 5472 filings (due April 15, or October 15 with an extension).

What We Did: We jumped into action with a two-part solution:

- For the CRA side: We used the Voluntary Disclosure Program (VDP) to file their missing T1134 forms. Here’s a helpful tip from our experience: While CRA asks for US financial statements with the T1134, you can actually select “not available” as an option – something we’ve seen the CRA regularly accept.

- For the IRS side: We got them up to date with Form 5472 filings before any penalties hit. We made sure to hit those crucial deadlines – April 15, or October 15 with an extension.

The Result: Our client avoided all penalties (including that scary $25,000 IRS fee) and got fully compliant with both tax authorities. Instead of paying thousands in penalties, they paid zero. Now they’re on track with a clear filing system for both countries.

3. Withholding Taxes on Distributions

US LLC distributions to a Canadian parent usually come with a 30% US withholding tax. But the Canada-US Tax Treaty can lower this rate a lot—down to 5%. This helps cut the cost of sending profits back to Canada.

The Fix: You should use the Canada-US Tax Treaty. This treaty lowers the tax rate from 30% to 5%, making it much cheaper to bring profits home. Just fill out the necessary forms and follow the treaty’s guidelines.

➜ Read more: What Is an LLC?

Alternative US Corporate Structures for Canadian Corporations

LLCs might look like a good choice, but they can cause tax headaches. Canada and the US have different tax systems, which often leads to problems. Fortunately, there are better options. I’ll show you four ways to avoid double taxation and expand your business smoothly. Let’s find what works best for you.

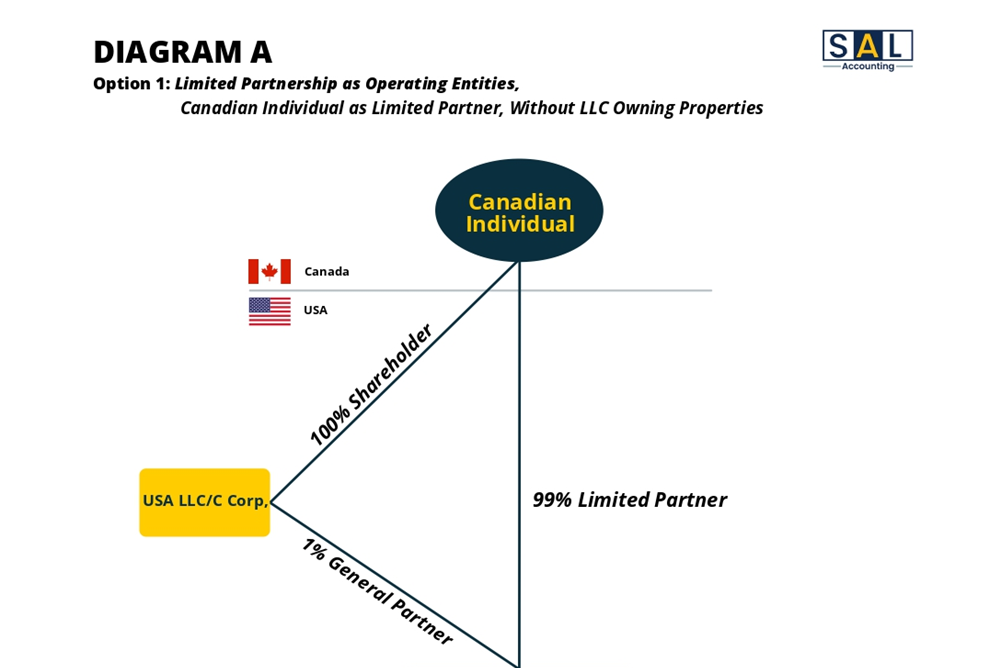

1. The Basic Limited Partnership

Think of this as “Business Structure 101” – this setup is simple and hassle-free. You, as the Canadian owner, hold 99% of the partnership as a limited partner, while a US company owns the other 1% as a general partner. Together, the partnership directly owns the properties.

It looks like renting a business “apartment.” You’re the main tenant, and the US partner acts as the building manager.

See Diagram A – Limited Partnership as Operating Entities, Canadian Individual as Limited Partner, Without LLC Owning Properties

Having an LP allows real estate investors the following benefits:

Pros:

- No double taxation

- Liability protection

- Ease of doing business

Cons:

- Multiple returns to file

- If the tenant from property A sues the LP, all assets owned by the LP (including properties B & C) can be at risk

Best For: In my experience, this is perfect for clients who aren’t already in a high income tax bracket in Canada. If you prefer simplicity and are okay with some risk to your assets, this is a solid choice.

Forms You Need to File

US Tax Filings:

- W-7: For first-time filers to get a US ITIN

- Form 5472 & Proforma Form 1120-F: $25,000 automatic penalty if filed incorrectly

- Form 1065: For the Limited Partnership

- K-1 Slip: Issued to distribute partnership income to partners

Canadian Tax Filings:

- T1134: For your ownership in a foreign (US) corporation

- T5013: Partnership tax return in Canada

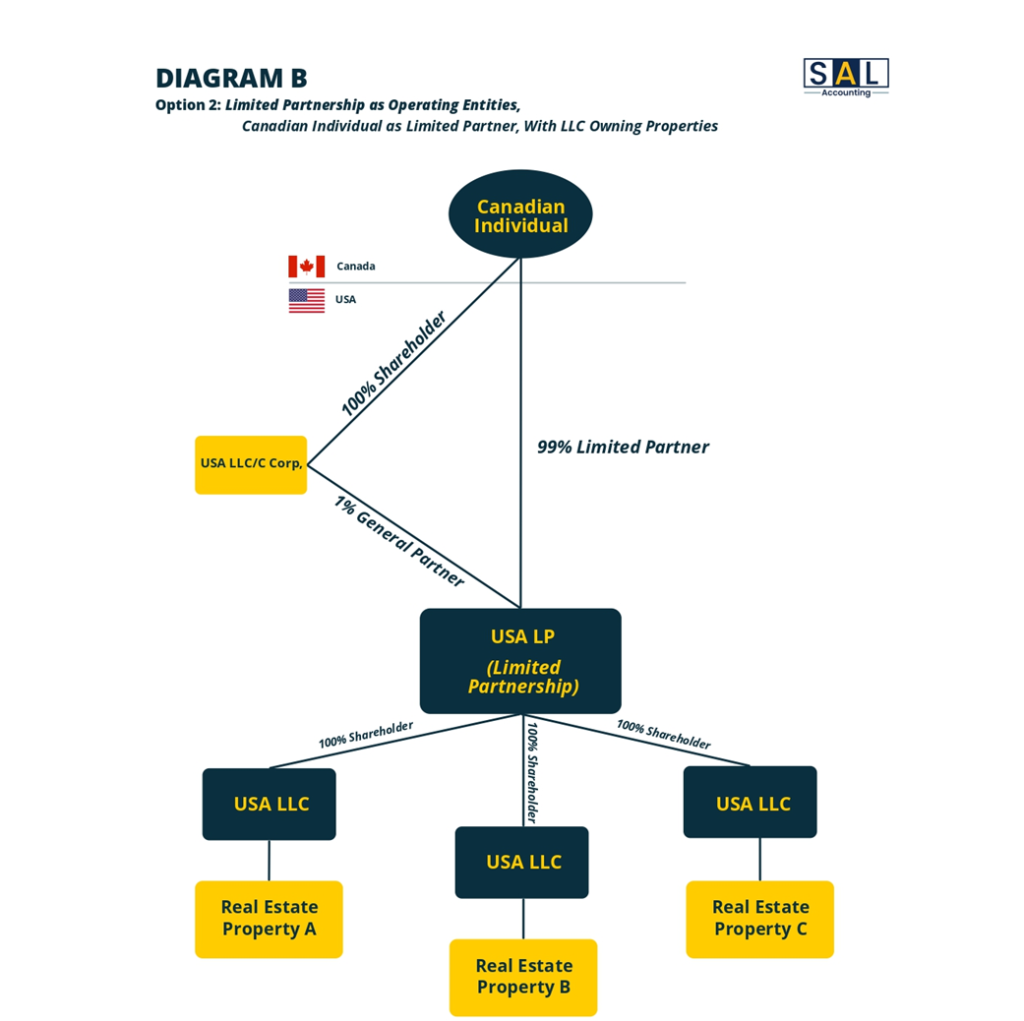

2. The Enhanced Protection Setup – for Real Estate Investors

This option is like Option 1, but with better protection. Each property gets its own LLC instead of being owned together, and these LLCs act like separate safety “bubbles.” The LP, still owned 99% by you as the Canadian owner and 1% by a US general partner, is 100% shareholder of all the LLCs.

If a tenant from Property A sues, only Property A is at risk. Your other properties stay safe in their own bubbles.

See Diagram B – Limited Partnership as Operating Entities, Canadian Individual as Limited Partner, with LLC Owning Properties

Pros:

- No double taxation

- Liability protection

- Ease of doing business

- Additional asset protection for each real estate property

Cons:

- Multiple returns to file

Best For: It’s a great choice if you want more safety without making things too complicated.

Forms You Need to File

US Tax Filings:

- W-7: For first-time filers to get a US ITIN

- Form 5472 & Proforma Form 1120-F: $25,000 automatic penalty if filed incorrectly

- Form 1065: For the Limited Partnership

- K-1 Slip: Issued to distribute partnership income to partners

- Form 1040-NR: For single-member LLCs (or Form 1065 if multi-member LLCs)

Canadian Tax Filings:

- T1134: For your ownership in a foreign (US) corporation

- T5013: Partnership tax return in Canada

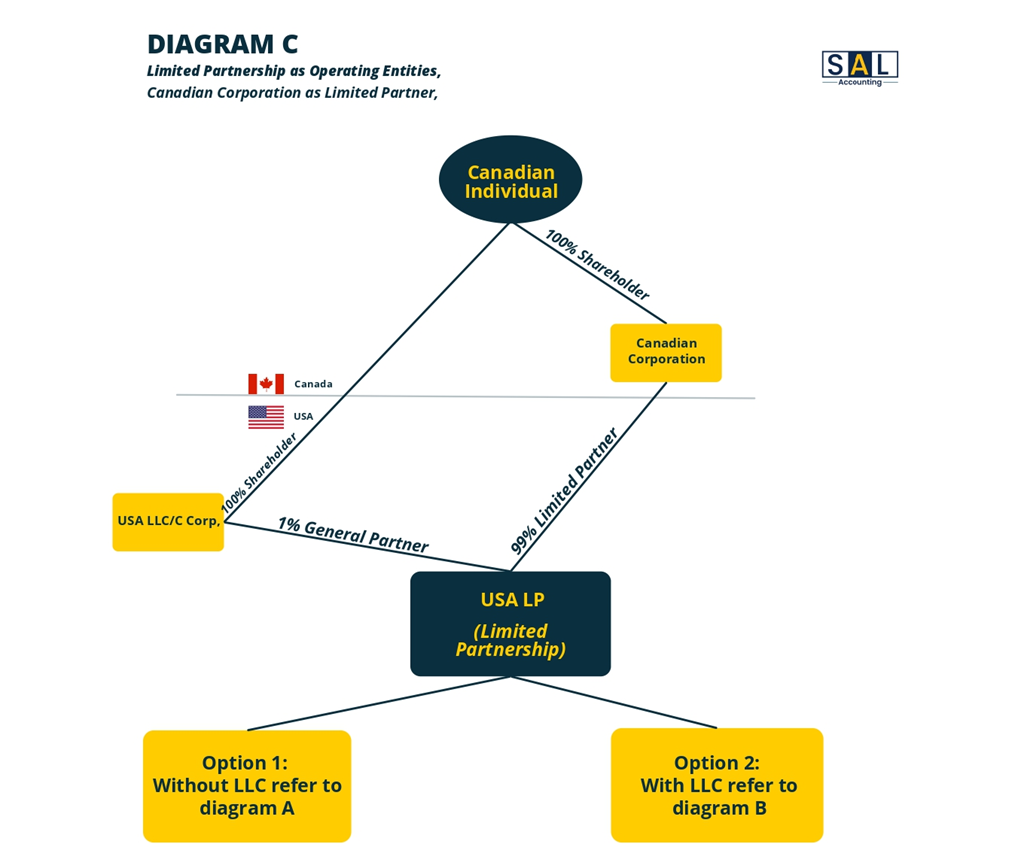

3. The Corporate Shield – ideal for high income earners

Think of this as a flexible and secure option. You own a Canadian corporation, and your corporation holds 99% of the partnership. A US LLC holds the remaining 1%. You get to choose how to hold the properties—either directly or in separate LLCs.

It’s like wearing both a belt and suspenders—extra secure and reliable.

See Diagram C – Limited Partnership as Operating Entities, Canadian Corporation as Limited Partner

Pros:

- No double taxation

- Liability protection

- Ease of doing business

- Better personal protection

- Lets you decide how to organize your properties

- Tax-efficient

Cons:

- Slightly more complex setup

- Multiple returns to file

Best For: It’s especially beneficial for people who are already in the high income brackets. Having a Canadian corporation ensures you are only paying 12.2% tax (assuming you are in Ontario) and not up to 53% tax on the income.

Forms You Need to File

US Tax Filings:

- W-7: For first-time filers to get a US ITIN

- Form 5472 & Proforma Form 1120-F: $25,000 automatic penalty if filed incorrectly

- Form 1065: For the Limited Partnership

- K-1 Slip: Issued to distribute partnership income to partners

- Form 1040-NR: For single-member LLCs (if used) or Form 1065: For multi-member LLCs (if used)

Canadian Tax Filings:

- T1134: For your ownership in a foreign (US) corporation

- T2: Corporation tax return for the Canadian company

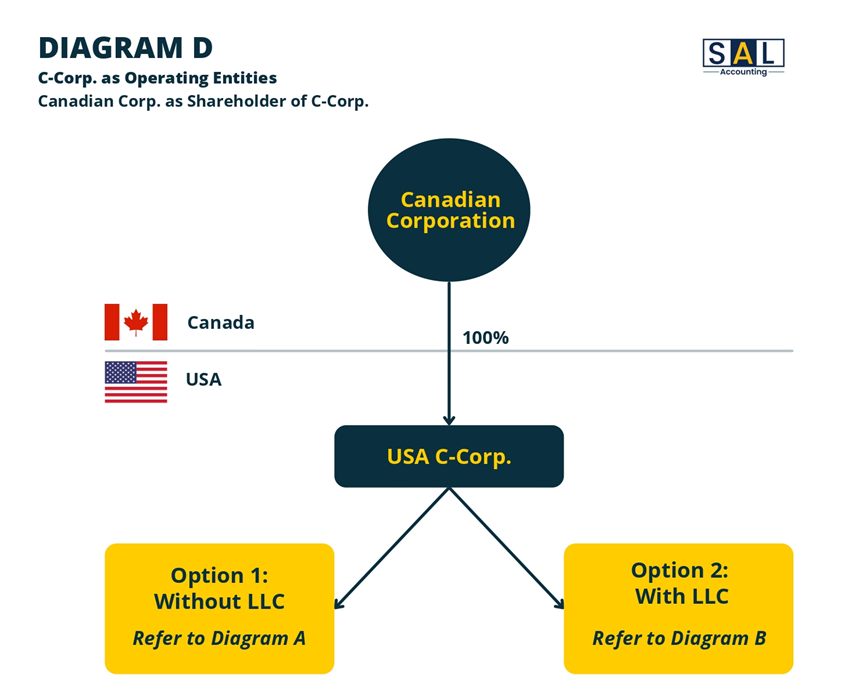

4. The Traditional Corporate Route

This is the go-to setup for many businesses—your Canadian corporation owns a US corporation. Ownership is straightforward and easy to manage.

It’s kind of like taking the highway—straightforward and efficient, though you might end up paying a bit more.

See Diagram D – C-Corp as Operating Entities, Canadian Corp as Shareholder of C-Corp

Pros:

- Simple ownership and management

- You get a 21% US corporate tax rate

Cons:

- Double taxation risk—once Canadian taxes are added, the total tax rate is around 33%

- Less flexibility than partnership options

Best For: Most of our smaller clients go for this option. American citizens in Canada can also go for a S-Corporation, which is only available for American citizens or Green card holders.

Forms You Need to File

US Tax Filings:

- W-7: For first-time filers to get a US ITIN

- Form 5472 & Proforma Form 1120-F: $25,000 automatic penalty if filed incorrectly

- Form 1120: For the US C-Corporation

- Form 1042: To report taxes withheld on dividends paid to the foreign shareholder

Canadian Tax Filings:

- T1134: For your ownership in a foreign (US) corporation

- T2: Corporation tax return for the Canadian company

How to Choose the Right Cross-border Business Structure?

The best setup depends on what you need. Here’s a quick guide:

- Simplicity? Go with Option 4

- Looking for balance between simplicity and tax efficiency? Go with Option 1

- Worried about lawsuits? Option 2 gives solid protection

- Looking for the most tax saving? Option 3 mixes protection, flexibility, and tax efficiency

- Prefer tradition? Option 4 is straightforward and classic

For most Canadian businesses, Option 3 is a great fit. It offers strong protection, keeps taxes low, and adjusts as you grow. But there’s no one-size-fits-all. Your decision should consider your business size, future goals, and how much complexity you’re okay with.

Talk to our US tax experts at SAL Accounting before deciding. We’ll help you pick the best option for your business.

Conclusion

Setting up a US LLC as a Canadian corporation is exciting, but it can get tricky. That’s where we come in. At SAL Accounting, we make things easy. We’ll help with tax treaties, filings, and all the compliance stuff. Need advice on the right structure? We’ve got you covered—explore how we can help with setting up an LLC in the USA from Toronto to ensure your business thrives. Contact us now and book your free consultation. You focus on growing your business—we’ll handle the rest.

Frequently Asked Questions (FAQs)

Yes. Pick a US state, get a registered agent, and file the required documents, like the articles of organization. States like Delaware and Wyoming are popular with foreign owners—interested in Florida? See our guide on starting a business in Florida as a Canadian for more insights.

Usually, the Canadian corporation files US taxes directly. Income gets taxed in both countries, but the Canada-US Tax Treaty offers credits to offset double taxation. Filing Form 8832 might make sense if you’d rather be taxed as a corporation.

For the US, you may need:

- W-8BEN-E to claim treaty benefits

- 8833 for treaty positions

- 8992 if GILTI rules apply

For Canada, common forms include:

- T2 corporate tax return

- RC1161 for cross-border services

- T1134 if your LLC’s assets exceed certain thresholds

If transactions with your LLC are over $1M, transfer pricing documentation is required.

Yes. You’ll need an EIN, LLC documents, proof of your Canadian corporation, and ID for major owners. Some banks want a US address too. TD and RBC make it easier for cross-border banking.

Yes, but keep US-dollar records, track all transactions, and file Form 5472 on time to avoid hefty penalties. You’ll also need agreements for any services or goods exchanged.

If your LLC sells in the US, check state rules. Sales tax usually applies if you store inventory or hit certain sales thresholds. You might need to register in multiple states.

It’s not required, but it’s smart to get liability insurance. It protects you against lawsuits and helps with contracts and leases.