Handling taxes can be overwhelming, especially for businesses juggling both domestic and cross-border transactions. Did you know that one of the most common reasons Canadian businesses face tax penalties is errors in GST/HST filings? If you run a business, understanding GST/HST is essential for staying compliant and running efficiently.

This guide breaks down everything you need to know about how to file GST/HST returns, along with key challenges in cross-border taxation. Plus, we’ll explore how expert support from SAL Accounting can simplify the entire process for you.

Quick Takeaways

- GST/HST Basics – Required for businesses earning $30K+ in Canada. U.S. sellers may need to register.

- Cross-Border Taxes – No GST/HST on exports, but U.S. sellers in Canada must comply.

- Filing & Compliance – Use online tools, avoid errors, and meet deadlines to prevent issues.

What is GST/HST? Why Does it Matter?

In Canada, businesses must charge and remit Goods and Services Tax (GST) or Harmonized Sales Tax (HST) depending on their location. These taxes apply to most goods and services, impacting pricing, compliance, and cash flow for businesses. However, businesses can claim Input Tax Credits (ITCs) to recover GST/HST paid on business expenses.

Read More: US Canada Dual Citizenship Taxes

For cross-border businesses, understanding how GST/HST differs from U.S. sales tax is crucial. Unlike Canada’s value-added tax (VAT) model, the U.S. follows a destination-based sales tax system with varying rates across states. The table below highlights the key differences:

| Category | GST | HST | US Sales Tax |

| Definition | Federal sales tax on goods & services | Combined federal & provincial tax | State/local consumption tax |

| Regions Applied | Non-HST provinces (e.g., Alberta, BC, Quebec) | Ontario, New Brunswick, Nova Scotia, etc. | Varies by state (some have no sales tax) |

| Tax Rate | 5% | 13-15% (varies by province) | 0-9% (varies by state/city) |

| Who Pays? | Businesses collect & remit to CRA | Businesses collect & remit to CRA | End consumers pay; businesses collect & remit |

| Input Tax Credits | Yes – businesses recover GST on expenses | Yes – businesses recover HST on expenses | No – businesses pay tax on purchases |

| Registration Threshold | $30,000 CAD in annual taxable revenue | $30,000 CAD in annual taxable revenue | Varies by state (economic Nexus rules apply) |

| Compliance Complexity | Moderate | Moderate | High – state-level variations |

Difference Between GST/HST and US Sales Tax

GST vs. HST in Canada

In Canada, the Goods and Services Tax (GST) is a federal tax applied to most goods and services. Some provinces, however, have combined their Provincial Sales Tax (PST) with the federal GST, creating the Harmonized Sales Tax (HST) instead.

Here’s how they differ:

- GST (5%) applies in provinces that do not use HST, such as Alberta and British Columbia.

- HST is used in select provinces, with rates like 13% in Ontario and 15% in Nova Scotia.

For businesses, understanding which tax applies is crucial to ensure accurate invoicing, pricing, and tax reporting.

Why GST/HST is Important for Businesses

If your business operates in Canada—whether selling products, providing services, or purchasing taxable goods—you are likely required to charge and remit GST/HST. Failure to do so can lead to penalties, disrupting your operations.

Certain industries, such as healthcare, education, and some real estate transactions, are typically exempt. However, for most small and medium-sized businesses, GST/HST return is a must.

GST/HST and Cross-Border Transactions

Managing cross-border sales tax Canada might make GST/HST compliance more difficult. Let’s break it down:

For Canadian Businesses Exporting to the USA

If your business exports goods or services to U.S. customers, you generally don’t need to charge GST/HST. These sales are typically zero-rated, meaning GST/HST doesn’t apply. However, you must maintain proper documentation, such as customs export declarations, to confirm the zero-rated status.

For U.S. Businesses Selling in Canada

If your business is based in the U.S. but sells to Canadian customers, you might need to register for GST/HST—especially if your taxable sales in Canada exceed $30,000 CAD in revenue. Without proper registration, GST/HST implications for US businesses could become problematic because of claiming input tax credits.

VAT-Like System vs. U.S. Sales Tax

One major difference between Canada and the U.S. is how sales tax is structured:

- In the U.S., sales tax follows a destination-based model, meaning the tax rate depends on the buyer’s location.

- In Canada, GST/HST works more like a value-added tax (VAT)—it applies at multiple stages in the supply chain, but businesses can claim input tax credits to recover GST/HST paid on purchases.

Managing compliance for both systems at the same time requires precise accounting practices and often expert guidance to avoid costly mistakes.

How to File a GST/HST Return Canada

Filing GST/HST returns might seem complicated, but once you break it down into simple steps, it becomes much easier to manage. Here’s what you need to know:

Who Needs to File GST/HST Returns?

If your business earns more than $30,000 in taxable revenue annually, you are required to register for a GST/HST number and file returns. This rule applies to most small businesses, including:

- E-commerce sellers

- Service providers

- Import/export businesses

Even if you’re below the threshold, voluntarily registering for GST/HST can sometimes be beneficial, especially if you want to claim input tax credits (ITCs) on business expenses.

Methods of Filing GST/HST

There are multiple ways to file GST/HST returns in Canada:

Filing GST/HST Online in Canada

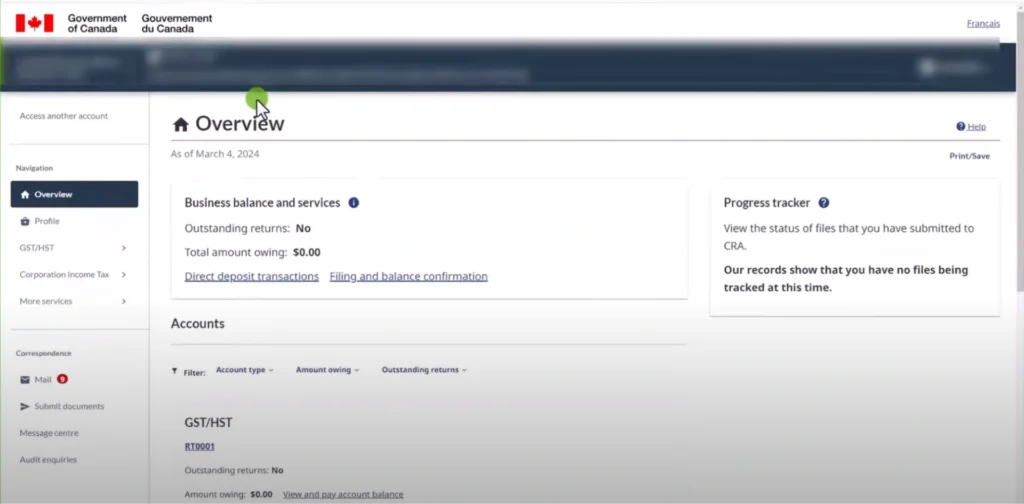

Filing online is the quickest and most secure method. The Canada Revenue Agency (CRA)’s online portal allows you to:

- Submit your GST/HST return instantly.

- Track previously filed returns.

- Verify your input tax credits to maximize refunds.

Using online tools helps reduce errors and speeds up the filing process.

Paper Returns

You can also mail your GST/HST return to the CRA if you prefer filing manually. This method involves mailing the completed return to your designated tax center. It is important to note that paper returns take longer to process and may result in delays in receiving refunds or assessments.

Authorized Accounting Software

Many businesses use CRA-approved accounting software, like QuickBooks or Xero, to streamline tax filing and ensure accuracy. These platforms integrate with the CRA’s portal to automatically submit your returns.

GST/HST Filing Deadline Canada

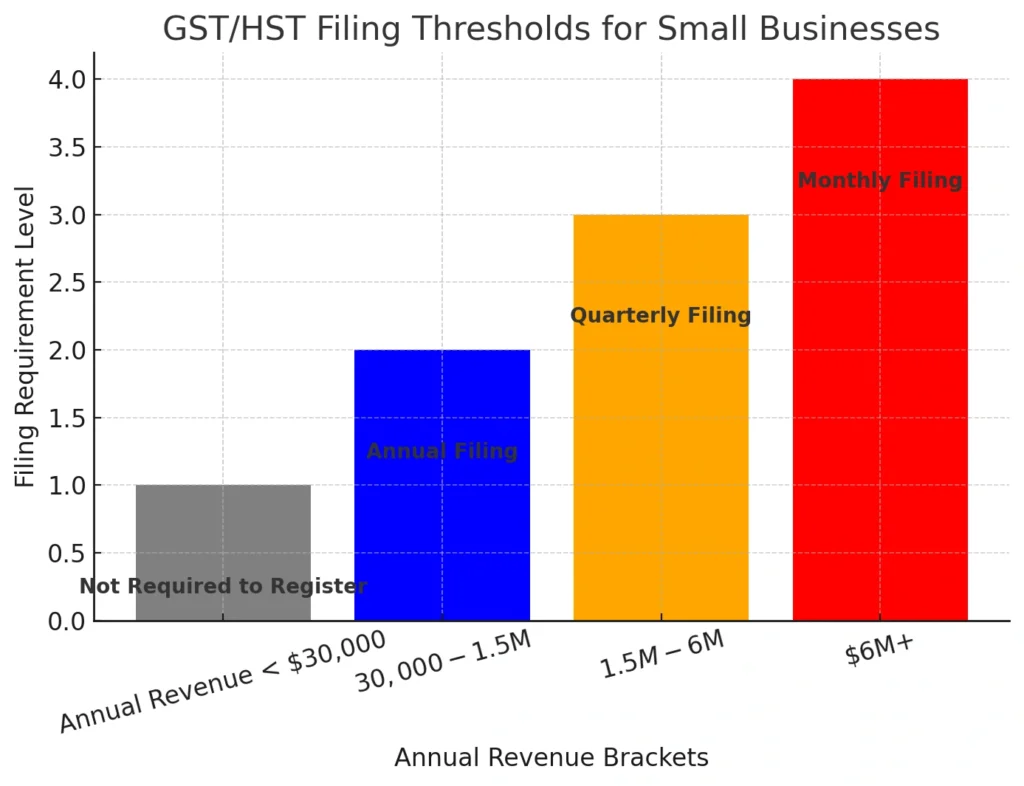

Your filing frequency depends on your annual revenue:

- Monthly Filing – Required for businesses earning more than $6 million per year.

- Quarterly Filing – Applies to businesses with annual revenue between $1.5 million and $6 million.

- Annual Filing – Businesses earning less than $1.5 million can file once per year, but they must still remit GST/HST regularly.

Tip: Filing on time is essential to avoid penalties and interest charges.

Important Documents for Filing

Before submitting your GST/HST return, make sure you have:

- Sales invoices – To verify the GST/HST collected from customers.

- Purchase receipts – To claim input tax credits.

- Export documentation – If you sell zero-rated goods outside Canada.

Keeping these records organized will make filing easier and help in case of a CRA audit.

GST/HST Refund Process

If your business paid more GST/HST than it collected, you may be entitled to a refund. This typically happens when you run into the following issues:

Your expenses exceed your taxable sales

If your expenses are higher than your taxable sales, it means you’ve spent more on business operations than you’ve earned from sales. This can happen during business expansion, when buying major assets, or facing high upfront costs. By filing your GST/HST return, you can claim input tax credits (ITCs) for the GST/HST paid on expenses, potentially resulting in a refund to support your cash flow and growth.

You purchase large capital assets for your business

Buying large assets like machinery, equipment, or buildings often means paying significant GST/HST upfront. These purchases are key for growth, and the GST/HST paid can be recovered through input tax credits (ITCs). Including these credits in your GST/HST return can help offset the cost and support your business’s financial stability.

You export goods, which are zero-rated for GST/HST

Exports are zero-rated for GST/HST, so no tax is charged on goods sold outside Canada. However, you can still claim input tax credits (ITCs) for GST/HST paid on expenses related to exports. This helps you recover input costs while staying competitive globally, as no tax burden is passed to international customers.

To claim a refund, file your return as usual and apply for input tax credits (ITCs) to recover the excess tax paid.

Common Challenges and How to Avoid Them

Staying compliant with GST/HST regulations can be tricky. Here are some of the most frequent mistakes businesses make—and how to prevent them:

Applying the Wrong Tax Rate

Some businesses mistakenly charge GST instead of HST (or vice versa) depending on the province.

Solution: Hire Experts – Working with professionals like SAL Accounting ensures your GST vs HST in Canada are accurate and compliant.

Missed Deadlines

Late filings result in fines and interest charges.

Solution: Set Reminders – Keep track of your filing deadlines to avoid unnecessary late fees.

Record-Keeping Errors

Incomplete or missing invoices and receipts can lead to tax disputes.

Solution: Automate Tax Management – Use accounting software like QuickBooks or Xero, which include built-in tax calculations to minimize errors

Case Study: Navigating Cross-Border Taxation for an E-Commerce Business

Background

A fast-growing e-commerce company selling in both Canada and the U.S. faced tax compliance challenges—from determining Nexus obligations in U.S. states to managing GST/HST filings in Canada. Inconsistent accounting practices and rising sales volume increased the risk of filing errors and penalties.

Solution

SAL Accounting stepped in with a structured approach:

- Audit & Compliance Review – Identified U.S. sales tax Nexus and GST/HST obligations.

- Automated Tax Solutions – Integrated real-time tax calculation tools to reduce errors.

- Registration & Filing – Ensured accurate tax registration and filings in all required jurisdictions.

- Ongoing Support – Provided regular updates to keep the business compliant with changing tax laws.

Results

Penalty Prevention – Eliminated errors and late filings, avoiding costly fines.

Operational Efficiency – Automated tax compliance, reducing manual workload.

Financial Confidence – Enabled the business to scale without regulatory roadblocks.

With a clear tax strategy in place, the company expanded internationally with confidence.

Final Thoughts

Staying compliant with GST/HST and cross-border tax regulations isn’t just about avoiding penalties—it’s about creating a smoother, more scalable business. If you’re ready to simplify GST/HST compliance and cross-border taxes, SAL Accounting is here to help. Book a consultation today and let’s take the stress out of tax management so you can focus on growing your business!

Frequently Asked Questions

GST/HST is a value-added tax applied at different rates across Canadian provinces, while U.S. sales tax is a destination-based charge varying by state.

Any business with over $30,000 in annual taxable revenue must file returns.

Deadlines depend on your filing type (monthly, quarterly, annual). Ensure timely submissions to avoid penalties.

U.S. businesses may claim refunds for GST/HST paid on Canadian transactions if properly registered.

You can calculate input tax credits by summing up GST/HST paid on applicable purchases and deducting it from the total taxes collected.

Businesses earning $30,000 or more in taxable supplies over four consecutive calendar quarters are required to register for GST/HST.

Non-residents may need to register for GST/HST if they carry on business in Canada, even without a physical presence.