Our aim is to show you exactly how to open a US LLC from Canada. We want to make it simple, so you get liability protection, flexibility, and easy access to the huge U.S. market. Over 230,000 new LLCs form in Delaware every year, and many belong to non-U.S. residents just like Canadians. This number proves how easy and popular it has become for foreigners. You can handle everything online.

In this guide from SAL Accounting, we’ll cover the full process, including state choices, name rules, registered agents, documents, costs, taxes, and compliance, all tailored for Canadians.

Quick Takeaways

- Canadians can easily form a US LLC from home and get strong personal liability protection that Canada doesn’t offer.

- The best states for Canadian non-residents are Wyoming (cheap fees, great privacy), Delaware (top business laws and courts), and Nevada (no state income tax).

- A US LLC gives you pass-through taxation and simple access to US markets like Amazon or American clients—perfect for online sellers and remote businesses.

- Single-owner US LLCs must file IRS Form 5472 every year (even with no income) to skip $25,000 penalties—grab an EIN first.

- US and Canadian tax rules don’t match up; work with a cross-border expert to avoid double taxation and claim treaty benefits properly.

What Is a US LLC and Why Canadians Register One Remotely?

A Limited Liability Company (LLC) is the most popular business structure in the United States. Small business owners, online sellers, and foreign entrepreneurs love it. Here’s why:

- It protects your personal assets. If the business has debts or faces a lawsuit, your home, car, or savings usually stay safe.

- It uses pass-through taxation. Profits go straight to your personal tax return. You avoid the double taxation that hits many corporations.

- It stays flexible and simple. You face fewer rules than with a full corporation — no required board meetings or heavy paperwork.

Important note for Canadians: Canada has no LLCs. The LLC exists only in the U.S. If you searched for “what is an LLC in Canada”, you realized that Canadian law doesn’t offer this structure. A cross-border tax accountant will help you open one as a Canadian.

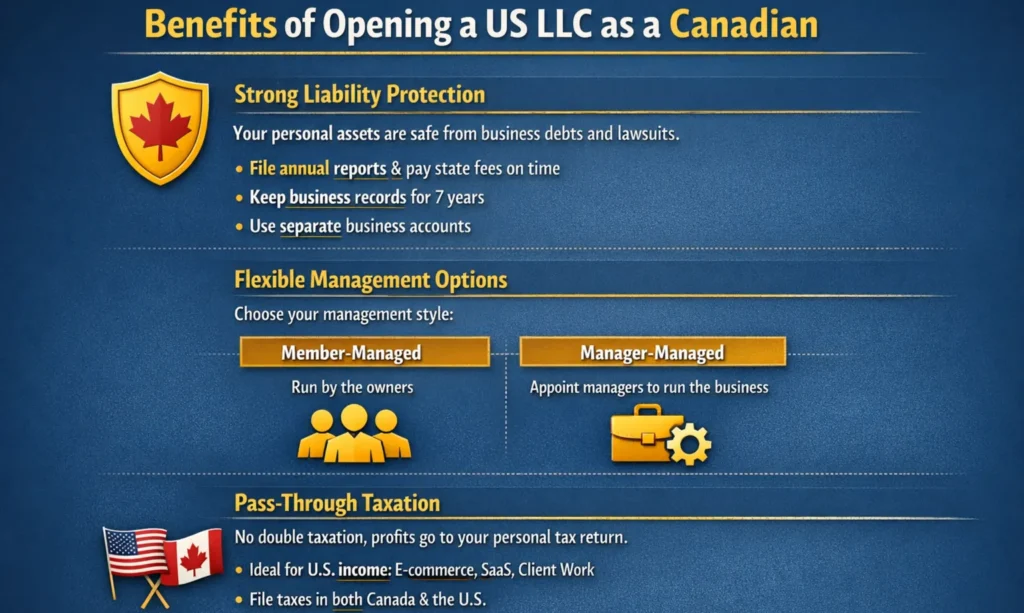

Benefits of Opening an LLC in the US As a Canadian

Before we get into the step-by-step guide on how Canadians can register a US LLC, let’s talk about the real advantages. These benefits often beat what you get with a Canadian sole proprietorship, partnership, or corporation.

Strong Liability Protection

This is the top reason most Canadians choose a US LLC. As an owner (called a “member”), you usually stay safe from business debts or lawsuits. No one can easily take your personal assets, like your house, car, or savings in Canada. You keep this protection by following a few simple rules. Courts call breaking them “piercing the corporate veil.” Avoid that easily:

- File your annual reports on time and pay any state fees.

- Save key records for at least seven years (contracts, meeting notes, big decisions).

- Always act like a separate business: use your LLC name on invoices, business cards, and emails. Pay business expenses from a business account, never your personal one.

Follow these basics, and your personal stuff stays protected. Check if a Canadian corporation can own a US LLC as well.

Flexible Management Options

US LLCs give you choices that feel much freer than many Canadian structures. You pick one of two easy setups:

Member-Managed:

- Every member helps make decisions.

- Perfect for single-owner LLCs, small teams, or family businesses.

- Most Canadians starting out use this. It’s straightforward and keeps you in control.

- One downside: some investors stay away because they don’t want daily involvement.

Manager-Managed:

- You appoint one or more managers (can be members or outsiders) to run the show.

- Great if you have passive members or a bigger operation.

- Investors often prefer this because they can put in money without handling operations.

- The only challenge: everyone must trust the chosen manager(s).

You decide whatever fits your situation best.

Pass-Through Taxation

US LLCs normally use pass-through taxation. Profits and losses flow straight to your personal tax return. The LLC itself pays no federal income tax. This avoids the double taxation in Canada you see in regular corporations (tax once at the company level, then again on dividends).

For Canadians, this shines with U.S.-sourced income. Thousands use a US LLC for Amazon sales, online stores, SaaS, or U.S. client work. It keeps tax reporting simpler and often more efficient. Just make sure you file correctly in both Canada and the U.S.

Many Canadians want to know how a US LLC compares to other options. Here’s a condensed side-by-side view:

| Business Type | Owner Liability | Taxation | Setup Process | Management Style |

|---|---|---|---|---|

| Sole Proprietorship | Full personal liability | Pass-through (personal return) | Very easy (may need DBA) | Owner manages alone |

| General Partnership | Full personal liability | Pass-through (personal returns) | Simple (need partnership agreement) | All partners share decisions |

| US LLC | Limited (personal assets protected) | Pass-through (no double tax) | Easy & affordable ($50–$500 online) | Flexible (member or manager-managed) |

| C-Corporation | Limited (only company assets at risk) | Double taxation | Complex & expensive (articles, stocks, resolutions) | Board of Directors oversees |

➜ Read More: “LLC vs LLP vs S Corporation: How to Choose the Best Structure“

Can Non-U.S. Residents (Like Canadians) Register a US LLC?

Yes, Canadians can 100% register a US LLC without being a U.S. citizen or resident. You get the same benefits as U.S. owners: liability protection, pass-through taxation, and easy access to American markets. Thousands of Canadians do this every year. You don’t need:

- U.S. citizenship or residency

- A Social Security Number (SSN)

- Any U.S. visa (for formation or remote ownership)

- Ever stepping foot in the U.S.

Pro tip: The LLC doesn’t give you the right to live or work in the U.S. If you plan to move there and run the business in person, you’ll need a separate work visa. For online or remote operations, no visa is required.

➜ Read More: “How to Open a Business in Florida as a Canadian“

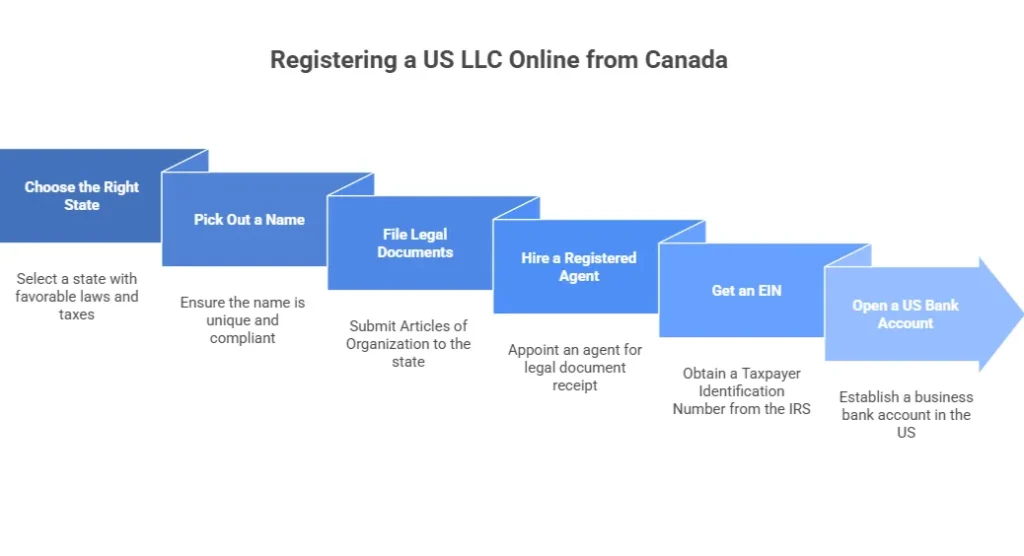

How Canadians Can Register a US LLC?(Step-by-Step)

Thousands of Canadians register US LLCs every year for various purposes. You can do it fully remotely. These steps cover how to register a US LLC online from Canada, required documents, best platforms, registered agents, and costs (source):

Step 1: Choose the Right State for your LLC

Choosing the right state is important when you register a US LLC from Canada. Some states offer better laws, privacy, and tax treatment. Each state has its own rules. Pick one that fits your needs best. If you have a physical office or staff in a U.S. state, form your LLC there. Most Canadians have no physical presence in the U.S. For them, the top choices are Delaware, Wyoming, or Nevada:

Delaware: Business-friendly laws with an efficient Court of Chancery run by corporate law experts. No state income tax if your LLC does no business in Delaware. Member names stay private in public records. Ideal for non-U.S. citizens. Filing fee: $90. Annual franchise tax: $300 (higher than others).

Wyoming: No state income tax for non-residents. Strong privacy. Member names and addresses stay out of public filings. Excellent asset protection. First state to introduce the LLC structure. Filing fee: $100. Annual fee: $60+. See how to claim tax treaty benefits as a nonresident

Nevada: No state income tax. Member information stays private in public records. Business-friendly rules that simplify taxes. Filing fee: $75. Annual franchise tax: $150+.

Pro tip: Compare fees, privacy, and taxes. Many Canadians pick Wyoming for low costs and strong privacy, or Delaware for its reputation. Have a look at the following table:

| State | Key Advantages & Laws | State Income Tax | Privacy Level | Filing Fee | Annual Fee |

|---|---|---|---|---|---|

| Delaware | Business-friendly laws; efficient corporate court | None (if no operations in DE) | Member names private | $90 | $300 franchise tax |

| Wyoming | First state with LLCs; strong asset protection | None | Full privacy (names/addresses hidden) | $100 | $60+ |

| Nevada | Business-friendly rules; no corporate tax | None | Member information private | $75 | $150+ |

Step 2: Pick Out a Name

One crucial step when wanting to know how to open an LLC in the US from Canada is choosing the right name for your LLC.

- The name you choose should be according to the state’s naming guidelines.

- Don’t forget to add the “Limited Liability Company” or “LLC” phrase to the end of your chosen name.

- You should do a deep search and choose an utterly unique name that is not being used by anyone else but you.

- Stay away from names that sound like government agencies’ names. (FBI, CIA, State Department, etc.)

- Make sure to include a translation when registering if you use non-English terms.

After deciding on a name, do as follows:

- Open the selected Secretary of State’s website and search for company names.

- Search for an available domain for the LLC name of your choice.

- Check the name on the USPTO database for trademark purposes.

- Search online for similar names and double-check.

Note: The name you choose for your LLC is only considered “registered” once you hire a registered agent. And also file the LLC Articles of Organization.

Step 3: File the Necessary Legal Documents

Most states require LLCs to file Articles of Organization. Once the Secretary of State approves it, your LLC is finally formed. But what is “Articles of Organization”? It basically acts as a business birth certificate. Every necessary detail and information about the company should be in there, including:

- LLC name

- The registered agent’s necessary information, such as their name and address

- Statement of acceptance by a registered agent

- Is the business member-managed or manager-managed

- Name and address of members

- Purpose

- Statement of limited liability

Make sure the Articles of Organization are done. Then, you may upload them to the Secretary of State websites of your chosen state. Then, you will get a stamped copy of the document, along with the filing receipt, in the upcoming weeks.

➜ Read More: “How to Start a Business in New York as a Foreigner“

Step 4: Hire a Registered Agent

You’re halfway through registering your LLC. Every state requires your LLC to have a registered agent. This agent needs a physical address in the state where you form the LLC. A registered agent receives important legal documents for your LLC. The agent can be a person or an authorized company. These documents include:

- State notices

- Franchise tax notices

- Lawsuit papers

You can pick a friend or family member who lives in the state. They must stay available during normal business hours (Monday to Friday). Their name and address will appear in public records. Most Canadians use a professional registered agent service instead. These services cost $50–$150 per year. They give you a reliable address and keep your personal info private.

Step 5: Get an Employer Identification Number (EIN)

A Taxpayer Identification Number (TIN) is an identification number issued by the IRS to facilitate the tax laws. If you’re a non-US resident, obtaining an EIN in Canada is a crucial step in the business formation process. The IRS usually handles the EIN issuing part. The EIN is a necessary thing to get since it’s how the IRS holds your business responsible for tax purposes.

How can I get an Employer Identification Number?

Here’s a step-by-step tutorial to apply for an EIN:

- Make sure the state approves your LLC. If your EIN is issued for the wrong business name, a lot of work will be involved in reapplying for an IEN. So make sure your LLC is approved!

- Fill out Form SS-4. As a non-US resident, you do not have a Social Security Number. Therefore, you must obtain an EIN. You need to fill out the SS-4 and then email or fax it.

- Include a US address. It is not necessary to do so, but it will reduce the time you have to wait after sending out the application.

- Send the LLC’s Certificate of Formation: Again, it is not necessary but highly recommended.

Step 6: Open a US Business Bank Account

Now that you almost know how to open an LLC in the US from Canada online, let’s move forward!

Once you have the EIN and LLC formation documents, it is finally time to open up a business bank account in the US. Some banks like Mercury, Wise, and Payoneer agree to open business bank accounts for business owners residing outside of the US.

Opening a US business account is essential because you can:

- Handle and separate your personal and business finances

- Conduct transactions efficiently.

- Apply for credit cards.

The usual necessary documents to open a business bank account as an LLC owner are:

- Passport and your home country ID card

- EIN

- Articles of Organization

- Your LLC’s US address

- LLC Operating Agreement

Note: Depending on your chosen bank, you may need additional documents. It’s best to ask the bank you have chosen to inform you about the additional requirements.

➜ Read More: “CRA My Business Account: Easy Signup for Canadians“

What Taxes Are Applicable to Your LLC?

Your US LLC mainly deals with two types of taxes:

- Federal income taxes (handled by the IRS)

- State income taxes (varies by state)

The state you choose has a big impact on your overall tax bill. As a non-U.S. resident Canadian, you pay no state income tax in Delaware, Wyoming, or Nevada, provided your LLC doesn’t conduct business inside those states. This zero-state tax is the key reason most Canadians pick one of these three.

Federal income taxes follow the rules we explained in the previous section (pass-through treatment, ECI, treaty benefits, etc.). Many Canadians end up owing little or nothing at the federal level. Whatever taxes you do owe, federal or state, pay them on time and file the required forms. Missing deadlines or skipping filings can lead to serious penalties and complications.

For peace of mind and to stay fully compliant, work with our US LLC formation expert at SAL Accounting, familiar with both U.S. and Canadian rules.

➜ Read More: “LLC vs LLP vs S Corporation: How to Choose the Best Structure“

How Much Does It Cost for Canadians to Set Up a US LLC?

Setting up a US LLC from Canada is affordable, most spend $200–$600 in the first year. Here’s the typical breakdown:

- State filing fee: $75 (Nevada), $90 (Delaware), or $100 (Wyoming).

- Registered agent service: $50–$150/year (required for your U.S. business address).

- Optional extras (expedited processing, operating agreement, EIN help): $100–$200 through platforms like Northwest Registered Agent or IncFile.

Ongoing costs drop to $100–$400/year (mainly agent + state reports/franchise tax). Many Canadians keep total setup costs under $400. It is great value for the protection and market access you gain. you can also claim US LLC tax deductions as a Canadian.

How US LLCs Are Taxed for Canadian Owners

Many Canadians form a US LLC for online sales, Amazon, or U.S. clients. U.S. tax rules depend on how the IRS classifies your LLC and whether your income connects to a U.S. trade or business. The IRS uses these default classifications for foreign-owned LLCs:

- Single-member LLC (one owner): Treated as a “disregarded entity.” The LLC isn’t taxed separately. Income passes through to you.

- Multi-member LLC (multiple owners): Treated as a partnership. Income passes through to members.

- Elect corporate taxation: You can choose to tax the LLC as a C-corporation by filing Form 8832 (within 75 days of formation).

Pro tip: If your LLC has no U.S.-sourced income or no “effectively connected income” (ECI) from a U.S. trade or business, you usually owe no U.S. federal tax. Many remote Canadian owners pay zero U.S. tax, thanks to the US-Canada tax treaty and no permanent establishment in the U.S. See how to withhold taxes under US-Canada tax treaty.

Case Study: What Taxes Apply to a Toronto E-Commerce Seller in Queen West1

A Toronto-based e-commerce entrepreneur lives in Queen West and runs an Amazon FBA business through his single-member US LLC in Wyoming. This year, the LLC earned $180,000 USD in profits with inventory stored in U.S. warehouses.

Problem: He worries about unexpected state sales tax obligations from FBA nexus and potential penalties for non-compliance.

What We Do: We confirm no state income tax in Wyoming for non-resident operations. We register him for sales tax in nexus states (Amazon handles most collection/remittance) and ensure pass-through treatment avoids entity-level federal tax. We leverage the Canada-U.S. treaty to eliminate U.S. federal income tax on profits.

The Result: He pays zero U.S. state or federal income tax, stays fully compliant on sales tax, and reports everything correctly on his Canadian return. He grows his business confidently from Queen West, avoiding surprises and maximizing profits.

Default Treatment: Disregarded Entity or Partnership (Most Common for Canadians)

You get pass-through taxation, no entity-level U.S. tax. Main requirement:

File Form 5472 (with a pro forma Form 1120) every year if there are “reportable transactions” with related parties (e.g., contributions when forming, loans, distributions, or services). Even zero transactions count if the LLC forms or funds. The formation itself often triggers this. Check the step-by-step guide for filing Form 5472.

- Deadline: April 15 (for calendar year; extensions available with Form 7004).

- Penalty for missing: $25,000 per year (plus more if continued after IRS notice).

- You need an EIN for the LLC (easy to get online).

If you have ECI (U.S. business income):

- File Form 1040-NR to report and pay U.S. tax on it (graduated rates 10%–37%). You must know how to file Form 1040-NR as a canadian.

- Deadline: June 15 (automatic for non-residents; extendable to October).

- You may need an ITIN (apply with Form W-7, like a Canadian SIN for U.S. tax purposes).

If you claim Canada-U.S. tax treaty benefits (e.g., no permanent establishment in U.S.):

- File Form 8833 with your return. Learn more about the Form 8833 for tax treaty benefits.

If You Elect C-Corporation Taxation

The LLC pays 21% flat corporate tax on worldwide income. Dividends to you face double taxation (plus possible 30% withholding, reduced by treaty).

Forms include:

- Form 1120 (corporate return) — due April 15.

- Form 5472 (if 25%+ foreign-owned and reportable transactions).

- Form 1042-S (for certain income paid to foreigners).

Few Canadians choose this, it adds complexity and tax. Here is a comparison table:

| LLC Type | U.S. Entity Tax | Owner-Level U.S. Tax | Main Forms Required | Common for Canadians? |

|---|---|---|---|---|

| Single-Member (Disregarded) | None | Only on ECI | Form 5472 + pro forma 1120 (if reportable transactions); 1040-NR if ECI; 8833 for treaty | Yes — most popular |

| Multi-Member (Partnership) | None | Only on ECI (via K-1) | Form 1065 + K-1/K-2/K-3; Form 5472 if applicable | Less common |

| C-Corporation Election | 21% flat | On dividends (double taxation) | Form 1120; Form 5472; 1042-S | Rare |

➜ Read More: “Form 1120-F Guide: What Foreign Corporations Must Know About U.S. Tax Filing“

Canadian Side Reporting

Your US LLC is a “foreign affiliate” to the CRA.

- File Form T1134 (details on ownership and finances). check out this comprehensive Form T1135 foreign asset reporting guide.

- Deadline: 12 months after your tax year-end (for years starting 2021+).

- Penalty: Up to $2,500 for late filing.

- Report US LLC income on your T1 personal return (line 12100 for business income).

Pro tip: Many Canadians pay little or no U.S. tax thanks to the treaty and pass-through rules. Always track transactions for Form 5472. It’s the biggest compliance trap.

Case Study: How US LLCs Are Taxed for a Toronto Tech Consultant in Yorkville2

A high-earning tech consultant lives in a Yorkville condo and serves U.S. startups exclusively through his single-member US LLC. This year, the LLC generated $280,000 USD profit and holds a U.S. business bank account averaging $150,000 USD (pushing foreign property well over the $100,000 CAD threshold).

Problem: He fears skipping T1135 filing or missing subsection 20(12) opportunities, which could trigger CRA notices and unnecessary double taxation on retained earnings.

What We Do: We complete his US Schedule C first, then report income on T2125. We file T1135 on time (April 30), claim full foreign tax credits on T2209, and apply subsection 20(12) deduction for U.S. taxes on undistributed profits. We also confirm no FBAR issues.

The Result: He avoids potential $2,500 T1135 penalties, recovers over $35,000 through proper credits and deductions, and eliminates double taxation on retained earnings. He files each year confidently from his Yorkville office, knowing everything stays fully compliant on both sides of the border.

Final Words

This guide showed you what a US LLC is, why it’s great for Canadians (strong liability protection, flexibility, and pass-through taxation), and how to register one remotely — including state choices, documents, costs, and taxes. Forming a US LLC from Canada unlocks the massive American market. It boosts growth, improves payment options, and safeguards your assets. The process is simpler than it looks, and getting it right sets your business up for success.

Take the action today and start your US LLC from Canada. Contact our experts at SAL Accounting and book a free consultation.

FAQs for Canadians Registering a US LLC

In order to start an LLC in the US as a Canadian, you need to prepare some things first. These include filing Articles of Organization and Operating Agreement, hiring a registered agent, getting an EIN from the IRS, and a physical US address that usually your registered agent provides you with.

Yes, you can do the whole LLC formation process online. You can do it yourself through the state’s Secretary of State website or with the help of third-party firms. The requirements are:

- Picking an LLC name.

- Filing the Articles of Organization.

- Paying up the filing fees.

- Obtaining an EIN for tax purposes.

- Open a business account.

- Filing the proper forms for tax purposes.

Hire a professional registered agent service. They provide a real U.S. street address in your state for legal mail. Top picks for Canadians: Northwest Registered Agent, IncFile ($50–$150/year). Keeps your Canadian address private.

Yes. No SSN needed to form a US LLC. File Articles of Organization directly. For EIN (banking/taxes), IRS issues one to foreigners via Form SS-4 (fax/mail). Thousands of Canadians do this yearly.

Yes, Canadians can start and own a business in the US. No rules prevent other nationalities from opening or owning a business in the US. However, to own a business in the US as a Canadian, you must be fully aware of Canadian and the chosen state tax regulations and immigration challenges. You can choose between owning an LLC, a C-corporation, an S-corporation, a partnership, or a sole proprietorship.

Yes, the ownership of a US LLC can be entirely by foreign people. No rules or regulations prevent non-US residents from owning US LLCs. The only things you must remember are tax regulations, legal aspects, and operational considerations before opening an LLC in the US.

You can choose any state that suits you, but remember to choose one that fits your business interests. There are three popular states where non-US residents prefer to open an LLC: Delaware, Wyoming, and Nevada. Each state has its advantages, offering no corporate income tax collection and their business-friendly regulations.

Because of the business-friendly regulations and not imposing corporate income taxes on foreign business owners, Wyoming is a choice for many business owners. Especially for non-US citizens, as you can form an LLC in Wyoming even if you aren’t a state resident. The fees are also lower compared to other states.

Disclaimer: This blog post provides general information only and is not personalized legal, tax, or financial advice. US LLC rules, taxation, and cross-border requirements change often and vary by situation. Consult a cross-border tax professional or attorney for your specific case. SAL Accounting is not liable for errors, omissions, or actions taken based on this content.