A CRA business account lets Canadian business owners manage taxes, payroll, and filings online. The Canada Revenue Agency switched to digital notices by May 2025. Over 80% of Canadian businesses already use My Business Account CRA to stay compliant.

This guide from SAL Accounting simplifies signing up, fixes login issues, and helps sole proprietors, companies, and accountants get started smoothly. Keep reading to the end.

Quick Takeaways

- A CRA business account simplifies tax filing for GST/HST, payroll, and T2 returns online.

- Register a Business Number (BN) to set up your My Business Account CRA easily.

- Verify your info and use Chrome or Firefox to avoid signup errors and crashes.

- Enable two-factor authentication (2FA) to keep your CRA account secure.

- Sync your account with accounting apps for faster, hassle-free tax management.

What Is a CRA Business Account?

A CRA business account, or My Business Account CRA, is a super handy online tool from the Canada Revenue Agency (CRA account help). It makes tax tasks easy to handle. Connect with our small business tax accountant for expert help. Here’s what you can do with a CRA business account:

- GST/HST Management: File returns, check them, or adjust them.

- Payroll: Send remittances and handle deductions.

- Corporate Tax: Submit T2 returns or make updates.

- Payments: Pay your balance right away.

- Delegate Access: Let someone else take care of tasks.

Who Needs My Business Account CRA?

A CRA business account helps businesses, sole proprietors, and freelancers manage tax filing with the Canada Revenue Agency. Check the business structures in Canada and their tax implications. Get an account if you are:

- A business with a Business Number.

- A sole proprietor doing taxes.

- A corporation filing T2 returns.

- A partnership handling shared taxes.

- A freelancer with GST/HST or payroll.

The table below shows how My Business Account CRA makes tax tasks easy for your business:

| Benefit | What You Can Do | Why It Helps | Resource |

| GST/HST | File/tweak returns | Fast tax filing | GST/HST Guide |

| Payroll | Send remittances | Easy deductions | Payroll Services |

| T2 Returns | Submit taxes | Quick updates | Tax Services |

| Payments | Pay balance | No hassle | CRA Payments |

| Delegate | Let accountant manage | Saves time | CRA Account |

| App Sync | Link apps | Speeds up taxes | Green Bookkeeping |

| Mobile | Check taxes | Anytime access | CRA Login |

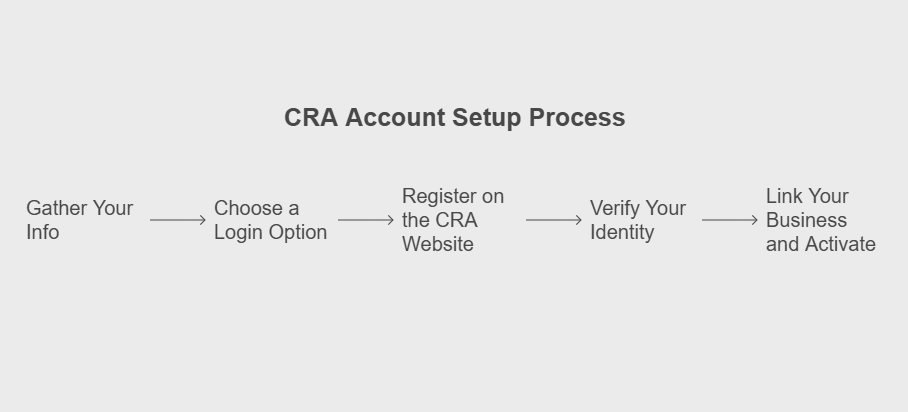

Sign Up for a CRA Account in 5 Simple Steps

My Business Account CRA helps you manage tax tasks like GST/HST returns in Canada for businesses and cross-border taxation. Follow these five steps to set up your account quickly:

Step 1: Gather Your Info

Collect these details for a smooth signup:

- Business Number (BN): Your 9-digit CRA code. Without a BN, register at CRA Business Registration.

- Social Insurance Number (SIN): Your 9-digit ID.

- Date of Birth: The business owner’s birth date.

- Recent Tax Return Details: Info like line 15000 from your last return. This saves time.

Step 2: Choose a Login Option

Pick one of these login methods:

- CRA User ID and Password: Create a secure CRA account. Takes a bit longer but is reliable.

- Sign-In Partner: Use your bank login, like RBC or TD. Faster but may have issues. CRA User ID suits regular use; Sign-In Partner is quicker. Choose what works.

Pro Tip: Turn on 2FA with an app like Google Authenticator when you set up your account. It keeps your tax info safe from hackers.

Step 3: Register on the CRA Website

Visit the CRA My Business Account page and:

- Select “CRA Register” for a User ID or pick Sign-In Partner.

- Enter BN, Social Insurance Number (SIN), birth date, and tax return info.

- Agree to CRA’s terms. Double-check info to avoid errors.

Pro Tip: Connect your Business Number (BN) to your Social Insurance Number (SIN) in the “Profile” section. It makes managing multiple businesses super easy.

Step 4: Verify Your Identity

Confirm it’s you to secure your account. Choose one:

- Document Verification Service: Submit a photo ID, like a driver’s license, via phone. Activates instantly.

- Security Code by Mail: Receive a code in 5–10 days. Works without a smartphone. Enable two-step verification for a login code sent to your phone or email.

Step 5: Link Your Business and Activate

After verification, log in and:

- Go to “Profile” and select “Add a Business.”

- Enter your BN to link your business.

- Confirm activation, usually instant. If the BN doesn’t appear, check with CRA.

Pro Tip: Opt for Document Verification for instant activation. Store your User ID in a password app to avoid login issues.

CRA Portal Sign-Up Issues + Quick Solutions

CRA Business Account signup can mess you up. These easy fixes help you fast.

1.Why Does Login Fail for CRA Business Account?

You put in the wrong login info. Maybe your CRA User ID or bank login is wrong. This stops you from getting in.

Solution: Verify your info. If you can’t log in, call CRA at 1-800-959-5525 to reset (CRA login services).

2.Why Does the “Can’t Validate Info” Error Pop Up?

Your Business Number (BN, your business ID) or tax info doesn’t match CRA’s records. Typos or old tax papers cause trouble.

Solution: Look at your newest tax papers. Fix mistakes and try again.

3.Why Doesn’t the Two-Factor Authentication Code Show Up?

Your phone or email is old. Spam filters or weak signals can block codes, too.

Solution: Update your contact info in the CRA Business Account profile. Or use an app like Google Authenticator (CRA’s fraud protection).

4.Why Can’t You Remember GCKey or Sign-In Partner Credentials?

Solution: Reset GCKey on the CRA login page with security questions. For a Sign-In Partner, reset on your bank’s site.

5.Why Doesn’t a Business Number Appear in an Account?

Your BN isn’t linked or set up. CRA won’t show it if they don’t know it.

Solution: Add it by hand in the “My Business Account” profile. Make sure it’s active with CRA (CRA Account Support).

6.Why Does Linking Business to CRA Business Account Fail?

You used a wrong or unlisted BN. A typo or inactive BN breaks it.

Solution: Check it’s right and listed. Try linking again in the “Profile” section.

7.Why Can’t You Use a Business Account Without a Business Number?

CRA needs a BN for business accounts. It tracks your taxes and accounts like GST.

Solution: Sign up for a BN at CRA Business Registration to get started and manage your taxes efficiently, and see how to minimize tax liabilities in Canada as a small business.

8.Why Does Account Lock After Too Many Login Tries?

Too many wrong logins start a safety lock. CRA blocks you to stop hackers.

Solution: Wait 15–30 minutes for it to unlock. Or call CRA at 1-800-959-5525 to fix it quickly.

9.Why Doesn’t the Program Account Register?

Your program accounts aren’t ready. Things like GST/HST or payroll need to be set up.

Solution: Check they’re active with CRA. Link them in the “My Business Account” section.

Case Study: Bakery Owner’s Account Lock Fix

Problem: A Toronto bakery owner called us after their account got locked. Three wrong login tries froze their tax filings. They couldn’t submit GST/HST, risking fines. Old contact info blocked 2FA codes, causing delays.

What We Did: We told them to call CRA at 1-800-959-5525 and wait 15 minutes to unlock. We suggested updating their email and phone in their profile for 2FA codes. We advised checking login details often.

The Result: The account was unlocked in 15 minutes. New contact info fixed 2FA. The owner now files taxes easily and logs in safely.

The table below shows quick fixes for common CRA signup problems:

| Issue | Cause | Fix | Resource |

| Login Fails | Wrong ID | Verify; Call 1-800-959-5525 | CRA Login |

| Info Error | Bad BN | Check papers | CRA Register |

| No 2FA Code | Old info | Update profile | CRA Security |

| Lost Login | Forgotten GCKey | Reset questions | CRA Support |

| BN Missing | Unlinked | Add in profile | CRA Account |

| Link Fails | Wrong BN | Verify BN | Update Info |

| No BN | BN needed | Register BN | Get BN |

| Locked | Too many tries | Wait 15 min; Call CRA | Contact CRA |

| Program Error | Inactive accounts | Activate; Link | GST/HST |

Why Use My Business Account CRA for Taxes?

My Business Account CRA simplifies taxes for sole proprietors, corporations, partnerships, and freelancers. It saves time, syncs with apps, and lets you check taxes on your phone anytime. Set it up in your app’s tax settings for a smooth business flow. Here’s what you get:

- File GST/HST returns fast or tweak them easily.

- Manage payroll tasks without a hitch.

- Send T2 returns for corporate taxes quickly.

- Pay your tax balance with no fuss.

- Let an accountant handle tasks for you.

- Link with accounting apps to make taxes faster. Check our guide on green accounting and bookkeeping.

- Check tax info on your phone anytime, anywhere.

Pro Tip: Use the Progress Tracker to check GST/HST and T2 filings fast. It gives you instant updates with no hassle. Get started today with our accounting and tax services at SAL Accounting.

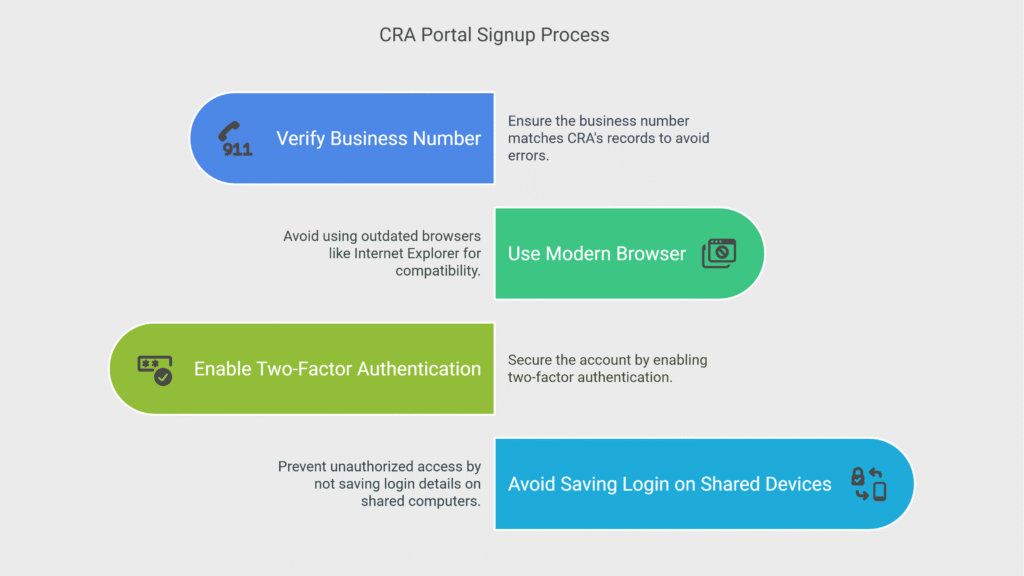

How to Avoid CRA Portal Sign-Up Mistakes

Set up your CRA business account quickly. Avoid these errors for a smooth portal signup:

1.Wrong Business Number

Don’t use the wrong BN. It stops signup. A bad BN doesn’t match CRA’s list. This causes errors and slows things down. Check it on CRA’s site first.

2.Old Browser

Don’t use Internet Explorer. It breaks the signup page. Old browsers don’t work with CRA’s system. You get crashes or slow pages. Use Chrome or Firefox instead.

3.Skipping Two-Factor Authentication

Don’t skip 2FA. It leaves your account unsafe. Hackers can get in with just your password. Turn on 2FA for a phone code. This keeps your info safe.

4.Saving Login on Shared Computer

Don’t save your login on shared computers. Others might use the device. This can let them into your account. It risks stolen info. Use your own device only to access CRA’s services safely.

Case Study: Freelancer’s Signup Success

Problem: A Vancouver freelancer reached out during their signup. A wrong Business Number caused an error. Internet Explorer made the page crash. They nearly skipped 2FA and saved their login on a café computer, risking a hack.

What We Did: We told them to check their BN on CRA’s site to fix the error. We suggested using Chrome for a smooth signup. We advised turning on 2FA for safety. We recommended a personal device to keep logins safe.

The Result: The right BN cleared the error. Chrome stopped crashing. 2FA and a personal device kept their account secure. The freelancer signed up fast and safely.

CRA Business Account Security Tips + Safe Login

Your CRA business account holds key tax info, so you must keep it safe. These quick tips lock it tight and protect your business. Here’s what to do:

- Pick a hard password with letters, numbers, and signs. Swap it every few months to stop bad guys.

- Update your email and phone in your profile. This gets login codes fast and keeps it safe.

- Spot fake CRA emails. Odd links can take your info. Trash them right away.

- Use a private browser tab. It skips timeouts and clears risky auto-fill.

- Save your login in a password app. Paper notes get lost or seen. This keeps it safe.

Keep your CRA account secure. Consult our tax accountant for small businesses for safe management.

Final Thoughts

A Canadian business needs a CRA business account to make taxes easy. Follow tax rules to keep your cash safe. Stay updated to skip big errors. This guide shows easy ways to do taxes and stay right. It has signup steps, fixes for issues, and tips to save time. Get help from SAL Accounting.

We fix hard tax problems for you. Contact us today for a free chat to make tax time really easy.

Frequently Asked Questions (FAQs)

You entered the wrong login info. Check your CRA User ID or bank login. Call CRA at 1-800-959-5525 to reset if you’re still stuck.

Your Business Number (BN) or tax info doesn’t match CRA’s records. Look at your latest tax return. Fix any errors and try again.

Your phone or email is outdated. Spam filters or bad signals might block codes. Update your contact info in your CRA profile or use an app like Google Authenticator.

You lost your login details. Reset GCKey with security questions on the CRA login page. For a Sign-In Partner, reset it on your bank’s website.

Your BN isn’t linked or registered. Add it manually in the “My Business Account” profile. Make sure CRA knows it’s active.

Photo ID verification activates your account instantly. A mailed security code takes 5–10 business days.

You used a wrong or unlisted BN. Check if it’s correct and registered. Retry linking in the “Profile” section.

No, you need a BN for a business account. Sign up for one at CRA Business Registration first.

Old browsers or heavy traffic cause crashes. Clear your cache. Switch to Chrome or Firefox, or use another device.

Old browsers or autofill mess things up. Clear your cache. Turn off autofill or use a private browser tab.