For US citizens coming to Canada for work, study, retirement, or family, picking the right bank is really important. About 75,000–85,000 Americans were in Canada in 2024, and many manage finances across the border. High fees, currency exchanges, and US tax rules can complicate things.

This SAL Accounting guide covers everything you need to choose the best banks for US citizens in Canada. We’ll also share tips to make Canadian banking for American expats smooth. Keep reading!

Quick Takeaways

- Pick FATCA-compliant banks like RBC to avoid IRS penalties.

- Get free USD accounts from TD or CIBC to skip conversion fees.

- Use CIBC’s $0.75 transfers or Wise to cut CAD-USD costs.

- Manage funds with BMO or TD apps for quick transactions.

- File FBAR for $10,000+ accounts by April 15 to stay compliant.

Banking Basics for US Citizens in Canada

US citizens in Canada need these banking essentials. The following explains key concepts:

- Fees: Monthly account fees range from $5 to $30. ATM withdrawals outside your bank cost $1.50 to $5.

- Chequebooks: A set of 100 cheques costs about $40. Many landlords require cheques for rent payments.

- Interac e-Transfer: This service sends money via email. It requires a Canadian bank account.

- International Transfers: Services like Wise and CurrencyFair offer low-cost USD-CAD exchanges. Banks also provide transfer options.

- Credit Building: No-fee or secured credit cards help establish Canadian credit. Credit is essential for loans and rentals.

Pro Tip: Ask banks about fee waivers for newcomers. It saves cash. Consult our US-Canada cross-border tax accountant to navigate fees, transfers, and credit confidently.

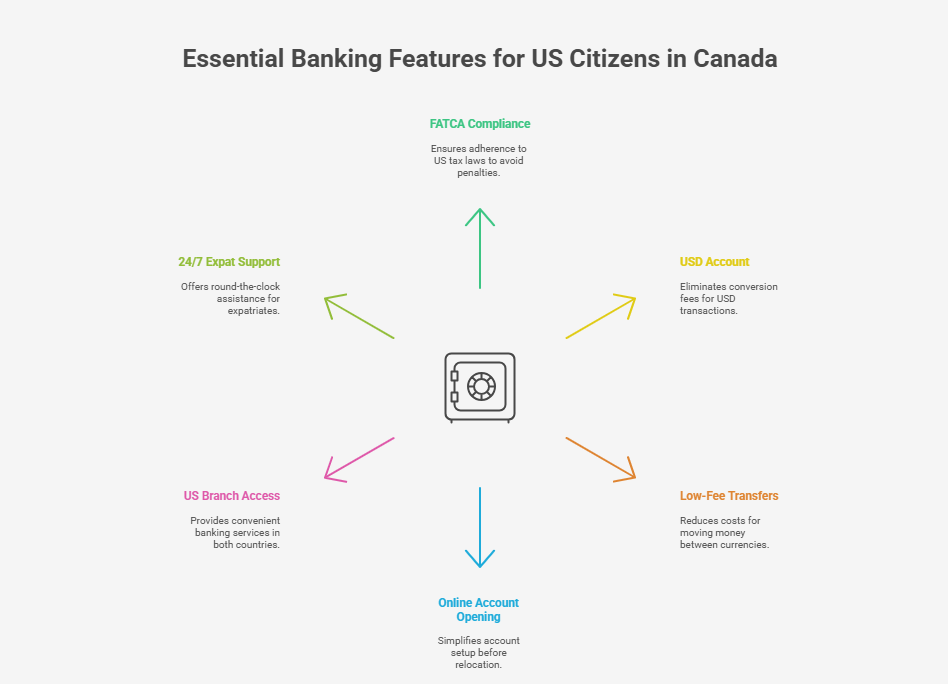

Features US Citizens Need in a Canadian Bank Account

As a US citizen in Canada, choose a bank with these essentials for smooth cross-border money management:

- Choose a FATCA-compliant bank (FATCA Information) to avoid IRS penalties.

- Get a USD account in Canada to skip conversion fees.

- Find low-fee transfers to save on USD-CAD moves.

- Use online banking to open accounts before moving.

- Pick banks with US branches for easy access.

- Go for 24/7 expat-friendly support for quick help.

Read More: “How to Open a US Bank Account as a Canadian in 2025”

Best Canadian Banks for Newcomers and US Citizens

We cover top banks for US citizens and newcomers next. You’ll get their features, like USD accounts and IRS help, plus who should pick each:

1.RBC

RBC is Canada’s biggest bank. Its Newcomers package has 200+ languages. It sends account info to the CRA for IRS rules. It helps with taxes for US citizens working remotely for Canadian firms. RBC USA Canada banking has a USD account in Canada for Americans. With 450 US branches, it’s great for business.

Best for: Dual citizens and business owners who need US branches and IRS compliance.

2.TD Bank

TD follows IRS rules with its New to Canada program (TD’s New to Canada). Apply online, but visit a branch to show your ID. The TD cross-border account gives a free USD account with Zelle. It’s $15/month, free with $100. Wire transfers cost $15, free from Canadian TD accounts. People like it, but customer service can be slow.

Best for: Expats who seek seamless cross-border transfers with a free USD account.

3.CIBC

CIBC’s Newcomers Plan works for Canadian banking for American expats (According to CIBC’s New to Canada guide). You get a free USD account with instant transfers. It follows IRS rules but needs a US address and Social Security Number. US transactions cost $0.75. It’s not big in Quebec, but it’s good for cheap transfers.

Best for: Budget-conscious expats wanting low $0.75 US transaction fees.

4.BMO

BMO’s Newstart package suits workers, students, and businesses. It follows IRS rules with free USD accounts via 600+ BMO US branches. Free wire transfers take one day. Smart Advantage Checking requires a $6,000 balance for benefits.

Best for: Professionals and dual citizens who value free wire transfers and US access.

5.Scotiabank

Scotiabank’s StartRight program follows IRS rules. It switches international accounts to check when you arrive (source). It has 4,000+ ATMs but costs $30/month, plus $1.25 for extra transactions. No US branches.

Best for: Newcomers in Canada looking for easy account setup and ATM access.

6.HSBC

HSBC follows IRS rules and allows you to apply at some US branches. It’s great for global banking. Fees hit $30/month, not great for small accounts. It’s perfect for Canadian bank accounts for US citizens who travel.

Best for: Travelers and high earners needing global banking flexibility.

Here’s a table comparing the top banks for US citizens and newcomers in Canada:

| Bank | USD Accounts | IRS Reporting | Cross-Border Services | Fees | Newcomer Programs |

| RBC | Yes | Yes | Good (450 US branches) | $39.50/year, $15 wire transfers | Newcomers package |

| TD | Yes (Free) | Yes | Great (Zelle, free wires) | $15/month (free with $100) | New to Canada |

| CIBC | Yes (Free) | Yes | Good (instant transfers) | $0.75/US transaction | Newcomers Plan |

| BMO | Yes (Free) | Yes | Great (600+ US branches) | Free wire transfers, $6,000 for perks | Newstart package |

| Scotiabank | Yes | Yes | Limited (no US branches) | $30/month, $1.25/extra transaction | StartRight Program |

| HSBC | Yes | Yes | Global (some US branches) | $30/month | Global banking focus |

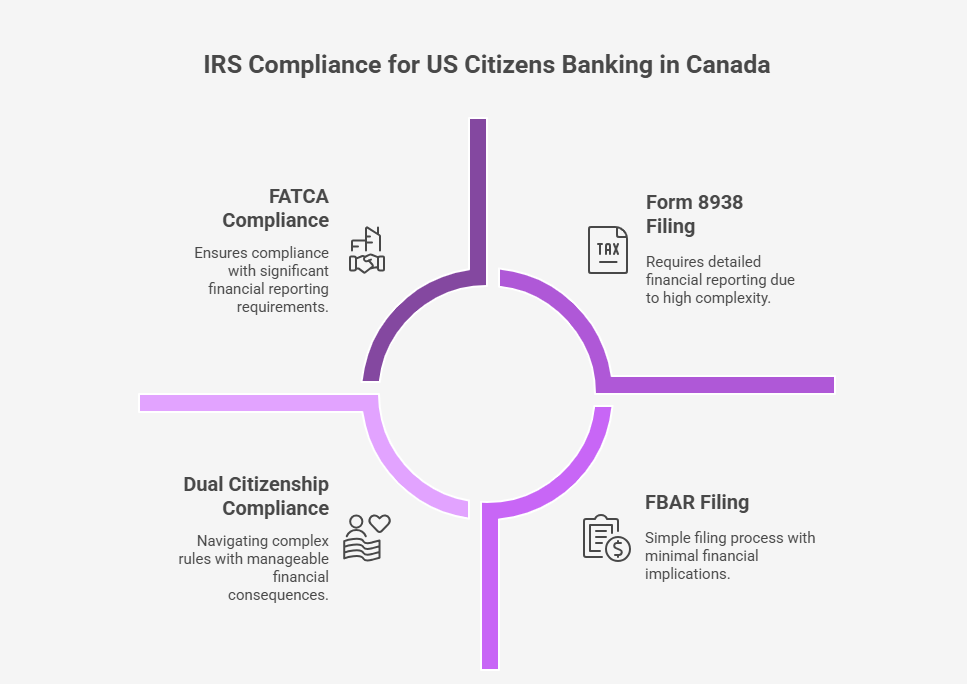

IRS Rules for US Citizens Banking in Canada

US citizens in Canada must follow IRS rules. It’s clear and manageable. Here’s what you need to know about taxes for your Canadian bank accounts:

- FATCA: Banks like RBC and TD tell the CRA your account details. The CRA passes them to the IRS. This keeps you out of trouble.

- FBAR: Accounts over $10,000 require an FBAR filing by April 15 yearly. It’s a quick IRS form.

- Form 8938: Large accounts may require IRS Form 8938. Consult a tax professional to confirm.

- Dual Citizens: You still report to the IRS. Choose FATCA-compliant banks in Canada, like BMO, for easy filing.

Pro Tip: Hire a tax advisor to simplify FBAR and FATCA filings to ensure compliance without the hassle Contact our small business tax accountant at SAL Accounting for expert help.

Case Study: Dual Citizen’s IRS Penalty Reduction

- Problem: A US citizen in Calgary contacted us, facing $3,000 in IRS penalties for missing FBAR filings due to unreported Canadian accounts.

- What We Did: We recommended BMO’s FATCA-compliant accounts for seamless IRS reporting and linked them with a cross-border tax advisor to file accurate FBARs promptly.

- Result: The IRS reduced penalties to $500 after proper filings, saving the citizen $2,500 and ensuring compliance.

Quick Tips for CAD and USD Accounts

CAD and USD accounts help US citizens in Canada manage cross-border funds. These tips make Canada banking for American expats easy:

Pick Cheap CAD-USD Swaps

Choose BMO or Wise to swap CAD and USD at a low cost. Wise keeps transfer fees under $1. BMO avoids high conversion charges. Check each bank’s fee schedule to maximize savings.

Use Your Bank’s App

Download your bank’s mobile app for fast money transfers. BMO’s app handles CAD-USD swaps quickly. TD’s app lets you monitor USD and CAD balances. Explore app features like bill payments for convenience.

Set Rate Alerts

Set up alerts to find the best CAD-USD exchange rates. Wise sends texts when rates are high. RBC’s online tool highlights ideal swap times. Enable alerts to transfer at peak rates.

Read More: US Canada Dual Citizenship Taxes: Ultimate Guide for Dual Nationals

Do Big Transfers

Make one large transfer to reduce fees. Wise offers low-cost monthly transfers. CIBC supports quick bulk transfers. Schedule transfers monthly to minimize costs.

Find No-Fee Banks

Select RBC or TD for free CAD-USD transfers. RBC waives fees on premium accounts. TD skips wire fees with a $100 balance. Ask banks about no-fee options to keep more money. Reach out to our US expat tax accountant for top-notch cross-border tax support.

This table outlines essential tips for managing CAD and USD accounts:

| Tip | Action | Banks/Tools | Benefit |

| Cheap CAD-USD Swaps | Compare fees for low-cost swaps | BMO, Wise | Saves fees (<$1 with Wise) |

| Bank’s App | Use app for fast transfers | BMO, TD | Quick swaps, bill payments |

| Rate Alerts | Set alerts for best rates | Wise, RBC | Transfers at peak rates |

| Big Transfers | Make one monthly transfer | Wise, CIBC | Cuts fees with bulk transfers |

| No-Fee Banks | Seek no-fee transfer options | RBC, TD | Free CAD-USD moves |

Case Study: Citizen’s Fee-Free Banking Success

- Problem: A US expat in Montreal reached out to us, frustrated with $300 in annual CAD-USD transfer fees eating into their savings.

- What We Did: We advised switching to RBC’s premium account, which waives CAD-USD transfer fees and guided them in confirming eligibility.

- Result: They eliminated $300 in fees yearly, keeping more money for personal expenses.

- Read More: “Best US Banks for Canadians in 2025”

Final Thoughts

US citizens in Canada need a bank that simplifies cross-border money management. Top banks like RBC, TD, CIBC, BMO, Scotiabank, and HSBC provide USD accounts, IRS compliance, and low fees for expats and newcomers. This guide covers the best banks for US citizens in Canada, tax rules, and tips to save cash.

SAL Accounting provides expert banking and tax support. Contact us for a free consultation today.

Frequently Asked Questions (FAQs)

Yes, with a US passport, Social Security Number, and Canadian address. TD and RBC allow online applications.

Yes, FATCA requires banks like RBC and TD to send account details to the IRS via the CRA.

TD excels for cross-border banking, CIBC for cheap transfers, and HSBC for travelers.

Yes, banks like BMO need your SSN for IRS compliance under FATCA.

RBC, TD, CIBC, BMO, Scotiabank, and HSBC all provide USD accounts.

No, they’re separate but linked, offering seamless cross-border accounts with Zelle.

Yes, you report interest income to the IRS. File FBAR for accounts over $10,000.