Our goal is to make U.S. sales tax easy for Canadian sellers. We’ll walk you through Nexus, registration, collecting tax, and filing so you can sell in the U.S. safely.

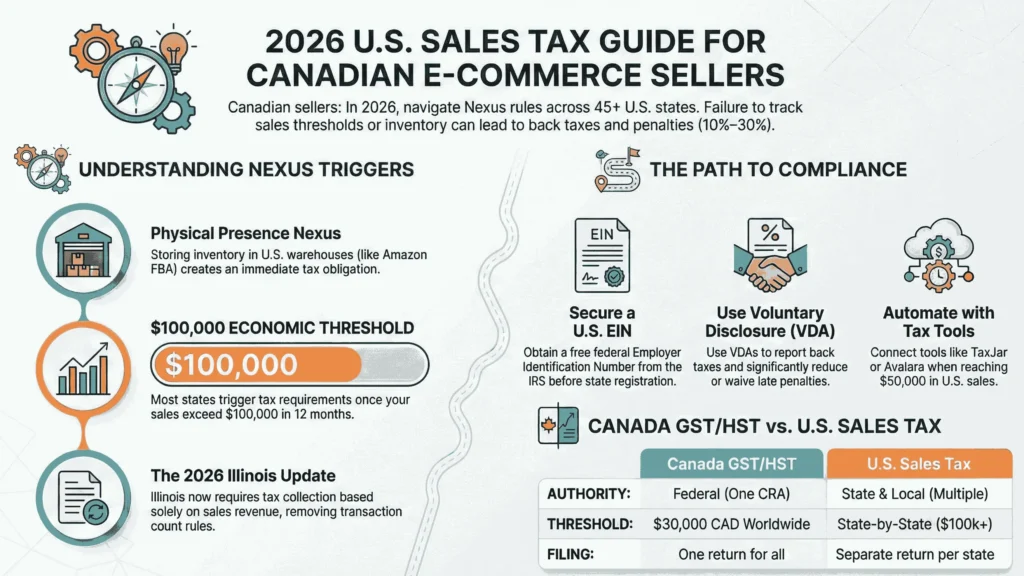

But the biggest thing we want to protect you from is that in 2026, over 45 states have economic nexus rules (usually $100,000 in sales), and changes like Illinois dropping its transaction threshold are catching more Canadians off guard. Miss it early, and back taxes in addition to penalties (often 10–30%) pile up fast.

We at SAL Accounting will cover everything in this post, including nexus, steps, GST/HST differences, and tools, so you stay compliant and away from penalties.

Quick Takeaways

- Canadian sellers must collect U.S. sales tax once they hit nexus, often $100,000 in state sales.

- The U.S. has no federal sales tax; each state has its own rules and rates.

- Register early to avoid back taxes, interest, and penalties.

- Marketplaces don’t always cover all tax duties for direct sales.

- Automation tools help track nexus, calculate tax, and file returns easily.

Do Canadian E-commerce Sellers Need to Collect U.S. Sales Tax?

Yes, many Canadian e-commerce sellers must collect and remit U.S. sales tax if they have nexus in a U.S. state. The U.S. doesn’t have a federal sales tax. Instead, 45 states plus D.C. charge sales tax on goods and some services. Rates usually range from 4% to over 10% when you add local taxes. E-commerce accounting and bookkeeping services help you track sales by state easily.

Example: A Toronto shop sells $80,000 to New York buyers → no nexus (New York’s threshold is $500,000 + 100 transactions) → no New York tax needed.

How Does the U.S. Sales Tax Nexus Affect Canadian Sellers?

Nexus is the legal connection that requires your business to collect and pay sales tax in a U.S. state. For Canadian sellers, it’s the main reason you might suddenly need to handle U.S. sales tax, even if everything you do is based in Canada. Check out the sales tax nexus for e-commerce sellers guide for more. Here are the types of nexus that most often affect Canadian sellers:

1. Physical nexus

This comes from having a physical presence in the state. Common triggers include:

- Storing inventory there (very common with Amazon FBA or other fulfillment services)

- Having employees, contractors, or salespeople in the state

- Owning or renting any property

When a physical nexus exists, you usually have to collect sales tax on all taxable sales to customers in that state, starting from your first sale. Have a look at the Amazon FBA bookkeeping guide as well.

2. Economic nexus

This is based only on your sales activity, no physical presence needed. Most states set it at:

- $100,000 in sales in the state over the past 12 months, or

- 200 transactions (though many states have dropped the transaction part)

A 2026 update: Illinois removed its 200-transaction threshold on January 1, 2026. Now it’s only $100,000 in sales. Other common thresholds:

- California, New York, Texas: $500,000 in sales

- Alabama, Mississippi: $250,000

- Arizona, Florida, Washington, and most others: $100,000

3. Affiliate/click-through nexus

This happens when you pay commissions to affiliates, influencers, or websites in the state that send you customers. States like New York and California recognize this as a connection.

How Nexus Affects Canadian Sellers

When you have nexus in a state:

- You must register with that state’s tax department

- Charge sales tax at checkout on taxable sales to customers there

- File returns and send the collected tax to the state

If you don’t, you can face back taxes, interest, and penalties. Many remote Canadian sellers trigger economic nexus first as their U.S. sales grow, often without realizing it until sales reports show the numbers. Marketplace platforms (Amazon, Shopify, Etsy) may handle collection for you in some states, but you still need to confirm coverage and handle any direct sales yourself.

Which States Have Economic Nexus Thresholds in 2026?

This table lists the most important economic nexus thresholds that Canadian e-commerce sellers commonly hit in 2026. These are the sales amounts (over the previous 12 months) that trigger nexus. Most states use $100,000 in sales only; a few are higher or have extra rules. Knowing the difference between sales tax and use tax can also help. Have a look at the table below for various states:

| State | Threshold | Extra Rule (if any) | Key Note / 2026 Update |

| California | $500,000 in sales | None | High bar; common for growing sellers |

| New York | $500,000 in sales | + 100 transactions | Both conditions must be met |

| Texas | $500,000 in sales | None | High threshold; popular market |

| Alabama | $250,000 in sales | None | Mid-range |

| Mississippi | $250,000 in sales | None | Mid-range |

| Arizona | $100,000 in sales | None | Standard threshold |

| Florida | $100,000 in sales | None | Very common for Canadian sellers |

| Georgia | $100,000 in sales | None | Standard threshold |

| Illinois | $100,000 in sales | None | Transaction count removed Jan 1, 2026 |

| Michigan | $100,000 in sales | None | Standard threshold |

| North Carolina | $100,000 in sales | None | Standard threshold |

| Pennsylvania | $100,000 in sales | None | Standard threshold |

| Washington | $100,000 in sales | None | Standard threshold |

How Do Canadian E-Commerce Businesses Register for U.S. Sales Tax?

Once you have nexus in a state, register for a sales tax permit (also called a seller’s permit or certificate of authority). This lets you collect and remit sales tax legally. The process is per state; there is no single federal registration.

Step 1: Get a U.S. Employer Identification Number (EIN)

Every Canadian seller needs this free federal tax ID from the IRS before registering in any state. See what an EIN is and how to apply for it. Here are the most common ways to get it:

- Apply online if you qualify (some restrictions for non-U.S. residents).

- Or call the IRS at +1 (267) 941-1099 (Monday–Friday, 6 a.m.–11 p.m. ET) for international applicants. It’s often the fastest for Canadians.

- Or fax or mail Form SS-4. You usually get the EIN immediately by phone or online. It takes about 4 weeks by mail/fax. No U.S. address or SSN required.

Step 2: Gather your information

Most states ask for the same basic details: your Canadian business name and address, EIN, business structure (like sole proprietorship or corporation), an estimate of your annual U.S. sales, and owner or officer contact info. Some may also request bank details for payments, but this is optional in many cases. Have everything ready upfront to make applying quick and easy.

Step 3: Register online with each state

Go to the state’s Department of Revenue website and apply online. It’s free in most states and fastest. Common examples for Canadian sellers:

- California: CDTFA online services, no fee.

- Florida: Florida Department of Revenue, free online via taxapps.floridarevenue.com.

- Texas: Texas Comptroller, free online permit application.

- New York: Department of Taxation and Finance (tax.ny.gov), free online via DTF-17 form.

Many states offer the Streamlined Sales Tax Registration System (SSTRS) for faster multi-state sign-up if you’re in participating states. Check for opening a business in Florida as a Canadian.

Red flags that mean you should register right away

Here are some common red flags that mean you should register right away:

- You are already over a state’s economic nexus threshold in your sales reports

- You store inventory in a U.S. state through FBA or another service

- You have employees or contractors in a U.S. state

- You pay commissions to U.S.-based affiliates or influencers

- You are getting close to a threshold in a high-volume state like Florida, Texas, or California

These situations mean you need to register quickly to avoid back taxes and penalties.

Pro Tip: Check your sales-by-state report weekly. Register first in your top 3 U.S. states (often Florida, Texas, California) to protect your biggest sales before back taxes build up.

Case Study: Toronto Seller Near Yonge-Dundas Square Recovers from $9,800 Hit

A Toronto e-commerce seller near Yonge-Dundas Square sells apparel via Shopify and Amazon in 2026.

Problem: They exceed Illinois’ $100,000 economic nexus threshold (post-2026 update) but don’t register or collect tax, assuming Amazon handles it all. An audit notice arrives.

What We Do: We calculate owed tax from reports, file a Voluntary Disclosure Agreement (VDA), register in Illinois, submit back returns, and implement TaxJar automation.

The Result: Penalties drop from $9,800 to $2,900 via VDA. They recover quickly, file automatically now, and avoid future surprises with monthly alerts.

How Is the U.S. Sales Tax Different from Canada’s GST/HST?

U.S. sales tax and Canada’s GST/HST both tax sales, but they operate very differently. See what happens if an e-commerce seller is not registered for GST/HST. Below you can see their differences:

Level of Government

GST/HST is a federal tax in Canada (with provincial portions added in HST provinces). It’s managed through one system by the Canada Revenue Agency.

U.S. sales tax is entirely state and local. There is no federal sales tax at all. Each state sets its own rules, and cities or counties can add extra local rates.

Tax Rate Structure

GST/HST has consistent rates across Canada: 5% for GST or 13–15% for HST, depending on the province. The rate is the same everywhere in a given province.

U.S. sales tax rates vary widely. They range from 0% in states with no sales tax to over 10% when state and local taxes combine. The exact rate depends on the buyer’s exact location (city, county, district).

How the Tax Is Applied (Value-Added vs. Retail)

GST/HST is a value-added tax. Businesses charge it at every stage of production and distribution, but they claim input tax credits for the Canadian GST/HST returns and what they paid on their own purchases. This means the tax burden ultimately falls on the final consumer.

U.S. sales tax is a retail sales tax. It is only charged once at the final sale to the end consumer. Businesses do not receive input credits for sales tax they pay when buying inventory, supplies, or equipment.

Input Tax Credits / Recoverability

Canadian businesses can claim credits for GST/HST paid on business expenses, which reduces their net tax cost. Also, you can file a T2209 Form to claim the Federal Foreign Tax credit in Canada.

U.S. businesses receive no credits for sales tax paid on their purchases. Any sales tax they pay when buying goods for resale becomes a cost of doing business.

Registration Threshold / Nexus

Canada: Businesses register for GST/HST once they reach $30,000 CAD in worldwide taxable supplies (a single national threshold).

U.S.: There is no national threshold. Registration depends on nexus in each individual state, which can be triggered by as little as $100,000 in sales (or less in some cases) or physical presence.

Filing and Compliance

GST/HST is filed in one return with the Canada Revenue Agency, usually quarterly or annually, depending on revenue. If you need help with your GST/HST filing, contact us today.

U.S. sales tax requires separate returns for every state where you have nexus. Filing frequency varies by state (monthly, quarterly, annual) and depends on your sales volume in that state.

Here is a quick comparison table showing the main differences between U.S. sales tax and Canada’s GST/HST.

| Aspect | Canada GST/HST | U.S. Sales Tax | Key Impact for Canadian Sellers |

| Level of Government | Federal + provincial (one CRA) | State & local only | One return vs. many per state |

| Tax Rate Structure | Fixed 5% or 13–15% | 0%–10%+ (varies by location) | Uniform vs. location-specific |

| Tax Application | Value-added (every stage) | Retail (final sale only) | Multi-stage vs. single-stage |

| Input Credits | Yes – credits on expenses | No – tax is a cost | Reduces cost in Canada |

| Registration Threshold | $30,000 CAD worldwide | State-by-state ($100k+ or physical) | One rule vs. multiple triggers |

| Filing & Compliance | One CRA return | Separate per state | Simple in Canada vs. complex in U.S. |

How Can You Automate U.S. Sales Tax Compliance (Best Tools for Canadians)?

Automating saves time and avoids errors. Choose the best e-commerce accounting software in 2026 to get the most. Here are the best tools for Canadian e-commerce sellers:

- Avalara: Calculates tax, tracks nexus, files returns, and integrates with Shopify & Amazon.

- TaxJar: Easy tax calculation, nexus alerts, return prep, and filing for Shopify, Amazon, and eBay.

- TaxCloud: Free tax calculation and nexus tracking, low-cost filing, works with Shopify.

- Quaderno: Handles U.S. sales tax + GST/HST, invoicing, good for digital/international sales.

Most integrate directly with your platform and offer free trials. Start with the one that matches your store size and budget.

Pro Tip: Connect a tool once you hit $50,000–$75,000 in U.S. sales. It alerts you early about nexus risks so you can register before penalties hit.

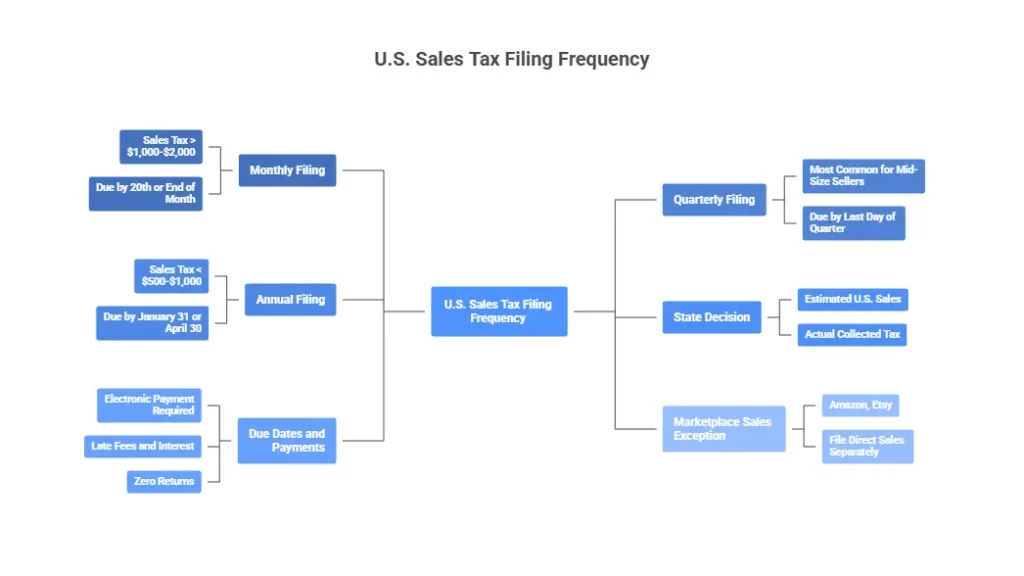

How Often Do You Need to File and Pay U.S. Sales Tax Returns?

Filing frequency depends on the state and your sales volume in that state. Most states assign one of three schedules: monthly, quarterly, or annual.

- Monthly filing is required when sales tax collected is high (usually over $1,000–$2,000 per month, depending on the state). Returns are due by the 20th or the end of the following month.

- Quarterly filing: The most common schedule for mid-size Canadian sellers. Returns are typically due by the last day of the month following each quarter (e.g., April 30 for Q1). Many states start you here if your collected tax is moderate.

- Annual filing is allowed when the collected tax is very low (often under $500–$1,000 per year). Returns are due once a year, usually by January 31 or April 30 of the following year.

How states decide your frequency

When you register, the state looks at your estimated U.S. sales and assigns a filing schedule. If your actual collected tax increases (or decreases), they may change your frequency later. Some states let you request a change if your volume shifts.

Key due dates and payments

- Pay the tax at the same time you file the return (electronic payment is almost always required).

- Missing a deadline triggers late fees (usually 5–25% of the tax due) plus interest.

- Even if you collected $0 in a period, you usually still need to file a “zero return” to stay compliant.

Marketplace sales exception

If most or all of your sales go through Amazon, Etsy, or another marketplace facilitator, they often file and pay on your behalf in many states. You still need to check your account statements and file any returns for direct (non-marketplace) sales yourself.

What Happens If Canadian Sellers Don’t Comply with U.S. Sales Tax Requirements?

Failing to meet U.S. sales tax requirements for Canadian sellers can lead to serious financial and legal issues. There are common errors in e-commerce accounting that you should avoid. Below are the main consequences, each followed by how to fix it.

Back Taxes

You owe sales tax on every taxable sale made since you first had nexus — even if you never charged customers for it. This can add up quickly over months or years.

How to fix it: Calculate the exact amount owed using your sales reports and a tax tool. Pay it voluntarily through a Voluntary Disclosure Agreement (VDA) to limit penalties and interest.

Interest

Most states charge interest on unpaid tax, usually 0.5% to 1% per month, compounding over time.

How to fix it: Pay the back taxes as soon as possible. Request a VDA to cap or reduce the interest period, often limiting it to 3 years instead of longer look-back periods.

Penalties

Late filing or payment penalties range from 5% to 25% of the tax due, plus possible flat fees. Combined with interest, extra costs can reach 10–30% or more.

How to fix it: Apply for a Voluntary Disclosure Agreement before the state contacts you. Most states waive or greatly reduce penalties for voluntary compliance.

Audits

High-revenue states like California, New York, and Texas actively audit remote sellers. Audits can go back 3–7 years and require detailed records.

How to fix it: If audited, cooperate fully and provide records. If you’re not yet audited, come forward with a VDA first — this usually prevents or stops an audit and shortens the review period.

Business Restrictions

In extreme cases, states can block future sales, seize assets, or report to credit agencies.

How to fix it: Resolve the issue through a VDA or payment plan before it escalates. Register, file past returns, and set up ongoing compliance with automation tools to avoid future restrictions. Contact our cross-border accounting experts at SAL Accounting to avoid any mistakes.

Pro Tip: Request a Voluntary Disclosure Agreement (VDA) in each affected state immediately. It usually reduces penalties, limits the look-back period, and avoids serious issues. Register now, file overdue returns, pay what you can, and automate compliance going forward.

Case Study: Toronto Seller Near CN Tower Avoids $7,200 Penalty

A Toronto Amazon FBA seller near the CN Tower grows U.S. sales rapidly in 2026.

Problem: They cross Florida’s $100,000 economic nexus threshold but miss the red flag—no FBA inventory there, no affiliates, just steady Shopify sales. They ignore sales-by-state reports and delay registration.

What We Do: We review their Amazon and Shopify data, flag the nexus trigger, register them in Florida immediately, and set up automatic tax collection.

The Result: They avoid $7,200 in back taxes + penalties by acting before Florida audits. Compliance now takes minutes per month, and margins stay strong.

Final Thoughts

U.S. sales tax rules can seem tricky for Canadian sellers in 2026, but they are simple to follow once you know the steps. Track sales by state. Register when you hit nexus. Use tools to automate tax collection and filing. If you are already behind, ask for a Voluntary Disclosure Agreement (VDA) right away to cut penalties and interest.

At SAL Accounting, we help Canadian online sellers stay compliant every day. If you are unsure about your situation or need help with setup, just reach out to us today. We will keep things clear and simple.

FAQs: U.S. Sales Tax Requirements for Canadian Sellers

Yes, if you have nexus in a U.S. state — you must collect and remit sales tax on taxable sales to customers there.

Get an EIN from the IRS first (call +1 (267) 941-1099 or apply online), then apply for a sales tax permit online on each state’s revenue website (free in most states).

Nexus is the connection (physical like FBA inventory or economic like $100,000+ sales) that requires you to collect U.S. sales tax. It matters because you must register, collect tax, and file returns — or face back taxes and penalties.

Use tools like TaxJar, Avalara, TaxCloud, or Quaderno. They calculate tax, track nexus, and file returns automatically, with integrations for Shopify, Amazon, and Etsy.

Yes — Delaware, Montana, New Hampshire, Oregon, and mostly Alaska have no state sales tax. Local taxes or future changes can still apply in some cases.

It depends on the state and your sales volume: monthly (high sales), quarterly (most common), or annual (low sales). Check your state permit for your exact schedule.

GST/HST is value-added with input credits and one national return. U.S. sales tax is retail-only, no credits, and requires separate returns per state with nexus.