You want to expand into Canada. We’ll give you a simple, step-by-step plan to open a foreign company branch fast and legally. What surprises everyone is that in 2024–2025, foreign branch registrations jumped 28% to over 1,400. Yet 62% of those new branches received CRA penalty notices in their first year for missing the key rules.

We at SAL Accounting will show you exactly how to handle the rules, pay the legal minimum, and skip the surprises. Let’s get your branch open the smart way.

Key Takeaways

- Registering a foreign branch in Canada takes 7–10 days and costs $800–$2,500.

- Reinvest profits in Canada and you pay zero branch tax — the smartest legal way to keep more money.

- Every branch needs a real Canadian agent for service; without one, registration fails and banks reject you.

- Branch is faster and cheaper with full control; subsidiary limits risk and protects the parent company.

- Late T2 or NR4 filings trigger 5% monthly interest and penalties up to $2,500 — never miss these dates.

Branch vs. Subsidiary in Canada: Which Is Better for Foreign Companies?

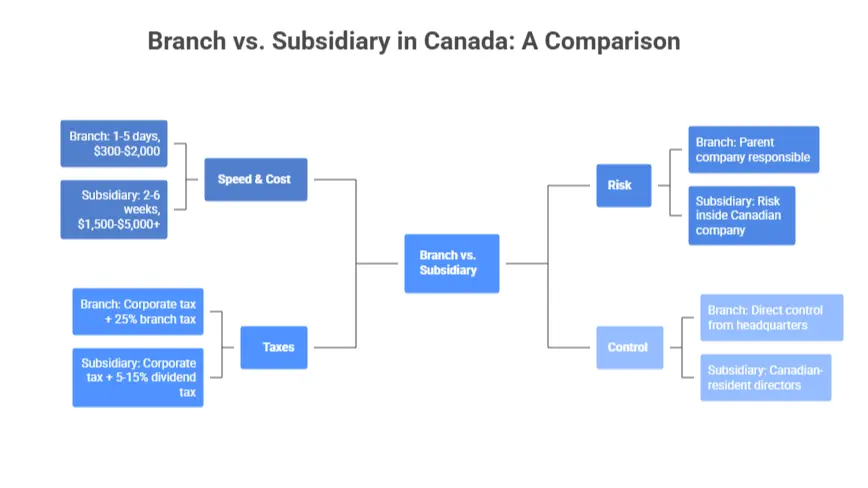

Most foreign owners face the same first decision: branch or subsidiary? There are also other business structures in Canada with their tax implications. Here’s the comparison:

- Speed & cost: A branch takes only 1–5 days and costs $300–$2,000. A subsidiary needs 2–6 weeks and usually runs $1,500–$5,000 or more.

- Risk: A branch means your parent company is 100% responsible for everything that happens in Canada. A subsidiary keeps the risk inside the Canadian company only.

- Taxes: A branch pays normal corporate tax plus a 25% branch tax on profits you send home (unless you reinvest them in Canada). A subsidiary pays normal corporate tax and then a smaller dividend tax, often 5–15% with treaties.

- Control: A branch lets you run everything directly from headquarters. A subsidiary sometimes requires Canadian-resident directors (residency of a corporation) in some provinces.

Most owners choose a branch when they want to test the market fast, sell services, or reinvest profits. They choose a subsidiary for long-term plans, high-risk industries, or to protect global assets. Expand into Canada the smart way with our cross-border tax accountant.

Examples: A Dubai logistics firm opened a Vancouver branch, won Amazon contracts in days, and paid zero branch tax by reinvesting in trucks and warehouses. A German robotics company chose an Ontario subsidiary to shield its European factories from any product-liability claims.

Pro Tip: Move fast and keep profits in Canada → branch. Limit risk and stay forever → subsidiary.

How Do You Register a Foreign Company Branch in Canada in 2025?

Follow these seven steps; almost every foreign company uses this exact order. Also, check out how to set up a corporation in Canada. Most finish in 1 to 4 weeks (some as fast as 7–10 days):

Step 1: Check if you create a “permanent establishment”

A permanent establishment (PE) is the trigger that forces registration and taxes. A small office, warehouse, storage locker, or even a dependent sales agent usually counts as a PE. You should sometimes know about e-commerce taxes in Canada as well. If you only attend trade shows or store goods temporarily, you may avoid it. Most active branches have a PE.

Step 2: Choose your main province

Register first in the province where you’ll have the most activity. Ontario (the biggest market), British Columbia (tech & trade), Quebec (French rules), and Alberta (energy) cover 85% of foreign branches. You can add other provinces later with extra-provincial registration.

Step 3: Reserve or confirm your business name

Do a NUANS name search ($50–$75). Most foreign companies simply use their global name + “Canada Branch” (e.g., “TechFlow Inc. – Canada Branch”). Approval is almost automatic.

Step 4: Appoint a Canadian attorney/agent for service

Canadian law requires someone physically in Canada to accept legal documents on your behalf. You can hire a lawyer, a corporate service company, or even a trusted employee. Annual cost: $300–$800.

Step 5: File the official registration forms

Submit these documents (usually online):

- Certificate of status from your home country (apostilled or notarized)

- List of directors

- Canadian business address and agent details

- Power of attorney (if needed) Provincial fee: $200–$500. Processing time: 24–72 hours.

Step 6: Get your CRA Business Number (BN)

Immediately after provincial approval, apply online at canada.ca for your 9-digit Business Number plus GST/HST, payroll, and import/export accounts. Takes 1–3 business days. Learn more about CRA My Business account signup and fixes for Canadians.

Step 7: Open a Canadian bank account and start trading

Bring your registration certificate and BN to any major bank (RBC, TD, Scotiabank, BMO). Once the account is open, you’re fully legal to invoice, hire, and operate.

Pro Tip: Use a service like Owner, Blakes, or a local registered agent for $800–$1,500 total. They handle steps 3–6 and remove 90% of the paperwork hassle.

- Read More: “GST/HST Return in Canada: A Guide for Businesses”

The table below breaks down the exact 7 steps to register a foreign company branch in Canada:

| Step | What to Do | Key Details & Costs | Time |

| 1 | Check for Permanent Establishment (PE) | Office, warehouse, agent, or server = PE | 1–2 days |

| 2 | Choose main province | Ontario, BC, Alberta, or Quebec | Same day |

| 3 | Reserve business name | NUANS search $50–$75 + “Canada Branch” | 1–3 days |

| 4 | Appoint Canadian agent for service | Real person/company in Canada, $300–$800/year | 1 day |

| 5 | File registration forms | Certificate of status, directors list, agent details – Fee $200–$500 | 24–72 hours |

| 6 | Get CRA Business Number (BN) | Free online application | 1–3 days |

| 7 | Open Canadian bank account | Bring certificate + BN to any big bank | 1–3 days |

How Foreign Branches Pay Taxes in Canada (2025 Rules)

Your branch is open. Now you need to know how taxes work in Canada correctly or the CRA will come knocking. Canada only taxes profits you earn inside the country. On top of regular corporate tax, there’s a special 25% “branch tax” on money you send back home. The good news is that you can reduce or avoid it.

What’s a Permanent Establishment (PE) for Taxes?

A PE is any fixed place where you do business: an office, warehouse, or even a sales agent who signs contracts. In 2025, CRA also counts servers and some remote workers as a “virtual PE” if they close deals.

- No PE = no Canadian income tax.

- With PE = full corporate tax (usually 25–50% total federal + provincial) on Canadian profits.

Example: A U.S. company’s Toronto branch earns $200,000 profit. They pay roughly $50,000 in combined federal and Ontario tax.

Pro Tip: Check treaties (Canada has 90+). U.S. branches pay just 5% on the first $500K sent home. Avoid double taxation with the Canada-US tax treaty and stay compliant.

Case Study: The Dubai Logistics Firm That Paid $0 Branch Tax on $4.1 M Profit1

A fast-growing Dubai 3PL contacts SAL Accounting before they open in Vancouver:

Problem: They expect $4+ M profit in Canada in year one. The 25% branch tax would eat all the growth money. UAE has zero corporate tax — any money sent home disappears forever.

What We Do: We plan every dollar of spending (vans, warehouse lease, Canadian hires) as branch reinvestment from day one. We create a simple tracking system in their books. We prepare Schedule 97 ahead of time.

The Result: They pay normal corporate tax only. The remaining $3.05 M counts as reinvested, so the branch tax hits $0. They keep every dollar and grow the Canadian business bigger.

CRA Branch Tax Compliance: How to Pay the Right Amount and Avoid Penalties (2025)

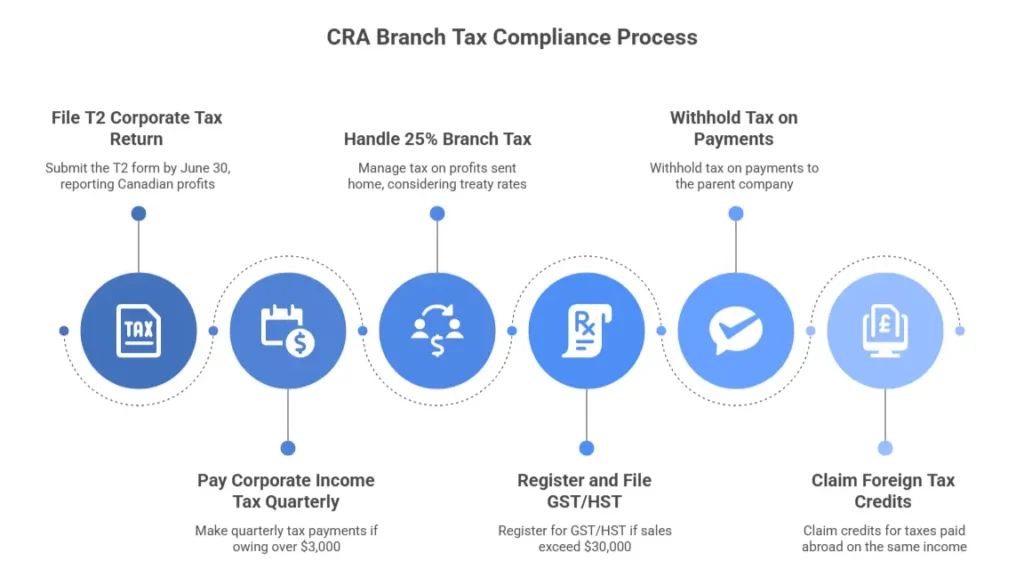

Do these six things and you’ll never hear from CRA auditors.

1. File your T2 corporate tax return

Every branch files a T2 by June 30 (or 2 months after your year-end). Report only Canadian profits. Use Schedule 97 for branch details. You pay 5% interest per month if you are late. Check the CRA tax T2 form complete guide to gain more.

2. Pay corporate income tax quarterly

If you owe more than $3,000, pay installments. Federal base rate is 15% (drops to 14.5% mid-2025), plus provincial tax. Deduct rent, salaries, and other real expenses first.

3. Handle the 25% branch tax correctly

This tax hits after-tax profits you send home. If you reinvest in Canada (equipment, inventory, hiring), you pay zero. Send it home? 25% tax, but most treaties cut it to 5–15%. Here is an example:

- You send $100,000 home, and your country has no treaty → you pay $25,000 branch tax.

- You send the same $100,000 home and you’re from the U.S., EU, UK, or most countries → you pay only $5,000 branch tax (treaty rate 5%)

4. Register and file GST/HST

If Canadian sales go over $30,000, register right away. Charge 5% GST + provincial HST, up to 15% (HST/GST for businesses). File monthly or quarterly and claim your input credits.

5. Withhold tax on payments to your parent company

If you have management fees, royalties, or loans to head office, withhold 15–25% and send it to CRA by month-end. You can also withhold taxes under the US-Canada tax treaty. Common payments that trigger withholding:

- Management or admin fees

- Royalties for trademarks or software

- Interest on inter-company loans

6. Claim foreign tax credits

If you already paid tax at home on the same income, claim the credit on Form T2209 and reduce what you owe Canada. See how to claim the federal foreign tax credit in Canada with the Form T2209.

Pro tip: Track every dollar you reinvest in Canada. It’s the fastest legal way to cut the branch tax to zero. Open your foreign branch without surprises; our US Canada tax accountant helps.

Running Your Foreign Branch in Canada: Banking, Hiring & Ongoing Compliance (2025)

Your branch is now operating. Here’s how to keep everything smooth.

Opening a Canadian Business Bank Account

It will take 1–3 days. Bring four items: registration certificate, CRA Business Number, passport of the signer, and a Canadian address (virtual office works). RBC, TD, Scotiabank, BMO, and CIBC all accept foreign branches. Choose the best banks for US citizens in Canada, one with USD wires to save on exchange fees.

Hiring Staff or Transferring Employees

Two fast options:

- Transfer key people from headquarters with an Intra-Company Transfer (ICT) permit — no labour test, approval in 2–10 weeks.

- Hire Canadians the normal way: Post jobs, pay market rates (Toronto developer $100K–$150K, Vancouver warehouse $50K–$70K), and run payroll through CRA. If involved with e-commerce, use the best payroll apps for Shopify and other platforms.

Extra Licences and Permits

You need an import/export account (free from CRA), a municipal business licence ($150–$800), and any industry-specific permits. Check your province’s portal and learn how to file foreign business income taxes in Canada.

Never-Miss Compliance Calendar

Mark these dates every year:

- January 31 – T4/T5 slips

- March 31 – T2 return (December 31 year-end)

- June 30 – Final T2 deadline

- Monthly or quarterly – GST/HST + payroll remittances

- March 31 – NR4 for money sent home ($2,500 penalty if late)

Pro Tip: Pay a payroll provider $250–$400/month (ADP, Ceridian, Payworks). They handle all filings, so you stay safe.

Here’s your super-simple “daily operations” cheat sheet for a foreign branch in Canada:

| Category | What to Do | Cost / Details | When |

| Bank account | Open at RBC, TD, Scotiabank, BMO or CIBC | Just bring cert + BN + passport + address | 1–3 days after BN |

| Hiring / transfers | ICT permit for HQ staff • Hire locals | ICT 2–10 weeks, no labour test Normal salaries | Ongoing |

| Payroll & compliance | Use ADP, Ceridian or Payworks | $250–$400/month | Set up month 1 |

| Import/export account | Register free with CRA | Free | Before first shipment |

| Municipal business licence | Get from city hall | $150–$800 | Within 30 days of start |

| Key deadlines | Jan 31 → T4/T5 Mar 31 → T2 + NR4 Jun 30 → Final T2 Monthly/quarterly → GST + payroll | NR4 late = $2,500 penalty | Every year |

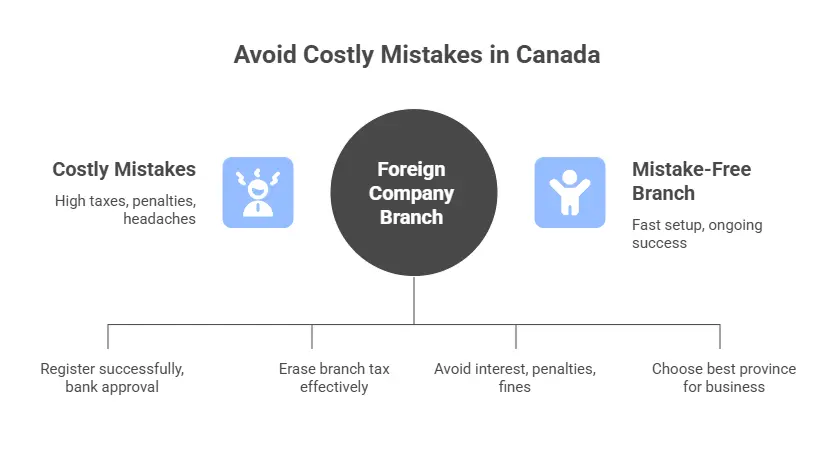

Costly Mistakes to Avoid When Opening a Foreign Company Branch in Canada

Fix these mistakes before you start, and you’ll save tens of thousands in tax, penalties, and headaches:

- Thinking “no office = no registration”: Warehouse, agent, or server still creates permanent establishments. CRA taxes it. Register or pay back taxes plus interest.

- No Canadian agent for service: Registration fails, and banks reject you. Delays stretch months.

- Poor tracking of reinvested profits: Equipment, inventory, or salaries erase the 25% branch tax. Lose receipts and you pay $10K–$100K extra.

- Late or wrong tax filings: CRA rarely reminds branches. Miss T2 and face 5% monthly interest plus up to 50% penalties. Check the corporate tax deadlines in 2025 for Canadian businesses for more.

- Registering in the wrong province: Ontario is popular, but Quebec adds French rules, Alberta lowers taxes, and BC speeds tech permits. Wrong picks cost you for years.

Set up your Canadian branch fast with our business incorporation services in Toronto and keep going mistake-free.

Case Study: The German Software Company That Paid $187,000 It Didn’t Owe2

A mid-sized Berlin SaaS company contacts SAL Accounting:

Problem: Their Ontario branch makes $1.2 M profit. They send €600,000 home. They use a virtual mailbox as their agent. CRA says no treaty rate, hits them with full 25% branch tax plus penalties. The bank freezes the account. Audit is coming.

What We Do: We appoint a real Canadian attorney for service. We dig up proof of money spent on salaries, servers, and marketing in Canada. We file a voluntary disclosure and fix the T2 + Schedule 97.

The Result: CRA drops the big penalties, accepts the 5% treaty rate, and refunds $142,000. The account unfreezes fast. The client now pays $0 branch tax every year.

Final Thoughts

Opening a foreign company branch in Canada stays fast and profitable when you avoid the five costly mistakes and handle the 25% branch tax correctly. This guide gave you the exact steps to register quickly, pay the legal minimum, and run your branch penalty-free in 2025.

At SAL Accounting, we help international companies open branches the smart way every month. Clients save thousands in tax and avoid all headaches. Contact us today. Let’s make your Canada expansion smooth and profitable. Do not forget that if you have an e-commerce store, you can always ask for free consultation about retail bookkeeping and accounting services too.

FAQs: Opening a Foreign Company Branch in Canada

Check permanent establishment, pick provinces, run name search, appoint Canadian agent, file registration, get CRA Business Number, and open bank account. Done in 1–4 weeks.

Fast setup, full parent control, no resident director needed, easy to close, and zero branch tax if you reinvest profits in Canada.

Branch is faster and cheaper for testing. Subsidiary protects the parent from liability and suits long-term plans.

Seven steps: confirm PE, choose province, name search, appoint agent, file documents, get CRA BN, open bank account. Cost $800–$2,500 total.

Corporate tax on Canadian profits (25–50%), 25% branch tax on money sent home (0–15% with treaties or reinvestment), plus GST/HST and payroll/withholding taxes.

Yes, 100% foreign ownership is allowed for both branches and subsidiaries in almost every industry.

Apply free online at canada.ca after provincial registration. You receive the 9-digit BN in 1–3 business days.

Only Canadian profits are taxed at regular corporate rates. After that, a 25% branch tax applies to profits sent home unless you reinvest in Canada or use a tax treaty (drops to 0–15%).