We’re here to help you handle your Form 1040-NR filing the right way. It’s the US tax form for nonresidents earning US income. What most people don’t realize: they may overpay thousands in taxes even though treaties stop double taxation. In fact, more than 40% of nonresidents, like Canadians with rentals, F-1 students or others, miss valuable tax treaty benefits.

In this 1040-NR tax guide, our team at SAL accounting will walk you through who needs to file, how to file 1040-NR, and easy ways to grab treaty savings. Stay with us to skip penalties and keep more of your money.

Quick Takeaways

- Form 1040-NR reports only U.S. income for nonresident aliens in 2026.

- File by April 15 or June 15, 2026, to avoid costly penalties.

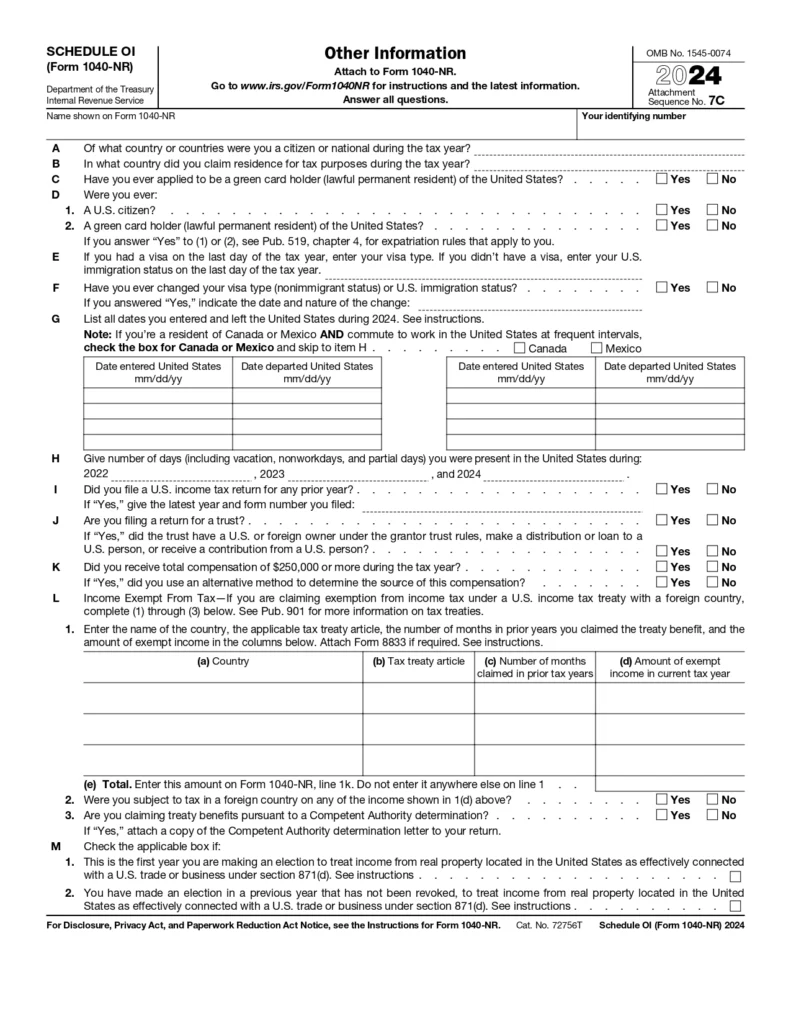

- Use Schedule OI to claim treaty benefits and cut tax bills.

- Track W-2, 1042-S, or 1099 forms for accurate Form 1040-NR filing.

- File Form 1040-NR to recover over-withheld taxes on rentals or scholarships.

What Is Form 1040-NR for Nonresident Aliens?

Form 1040-NR is your go-to US tax form if you’re a nonresident alien. It tracks money you make in the US, like wages, scholarships, or rent. You’re a nonresident if you don’t have a green card or don’t stay in the US long enough. This US tax return for nonresident aliens covers only your US income, not everything you earn globally (IRS Form Guide). Consult our cross-border tax accountant and fill out the form with no worries. Check the form header:

Who Must File Form 1040-NR in 2026?

Nonresident aliens with US income file Form 1040-NR. You need it if you don’t have a green card or don’t spend enough time in the US (183 weighted days over three years). Certain groups use this form. They include:

- Students on F, J, M, or Q visas with US scholarships or stipends.

- Canadians with US rental income. Learn about the tax implications of US rental income.

- Freelancers or contractors paid by US companies. Also, see how to file Form 1099-K for e-commerce to gain more info.

- Scholars on J-1 visas with US grants.

- Investors with US dividends or royalties.

Example: A Canadian earning $15,000 from US rentals files Form 1040-NR to report that US rental income for nonresidents. Or, a freelancer with a $20,000 US contract files to report 1099 income.

Pro Tip: Double-check your visa status to ensure you’re a nonresident before filing.

Form 1040-NR vs Form 1040: What’s the Difference?

Form 1040-NR and Form 1040 are different. Form 1040-NR helps nonresident aliens file their US tax return, like Canadians who report their income on the US tax return. Form 1040 is for US citizens and residents. It covers all their money, from anywhere. Here’s what sets them apart:

- Income Reported: Form 1040-NR reports only U.S.-sourced income, while Form 1040 covers worldwide income from all sources.

- Who Files It: Form 1040-NR is used by nonresident aliens, while Form 1040 is used by U.S. citizens and residents.

- Filing Status Options: Form 1040-NR has limited filing status options (Single, Married filing separately, or Qualifying surviving spouse), while Form 1040 offers more choices including Married filing jointly and Head of Household.

- Standard Deduction: Form 1040-NR does not allow a standard deduction (except in limited treaty cases), while Form 1040 includes a full standard deduction ($15,750 single / $31,500 joint for 2025).

- Tax Rates on Income: Form 1040-NR applies graduated rates to effectively connected income and a flat 30% rate to other income (often reduced by treaty), while Form 1040 applies graduated rates to all income with full benefits.

- Best For: Form 1040-NR is best for nonresidents like Canadians with U.S. rentals, F-1 students, or freelancers with U.S. pay, while Form 1040 is best for U.S. residents who report income from anywhere.

| Feature | Form 1040-NR | Form 1040 | Form 1040-NR Limitation |

|---|---|---|---|

| Income Reported | U.S.-sourced only | Worldwide | Limits scope to U.S. only |

| Who Files | Nonresident aliens | U.S. citizens/residents | Designed for nonresidents |

| Filing Status | Single, MFS, QSS | Single, MFJ, MFS, HOH, +more | Fewer options available |

| Standard Deduction | No (limited treaty exceptions) | Yes ($15,750 single / $31,500 joint 2025) | No standard amount |

| Deductions/Credits | Few, itemized/treaty-based | Many (CTC, EITC, etc.) | Restricted access |

| Tax Rates | Graduated on ECI; 30% flat on other | Graduated on all | Flat rate on certain income |

| Best For | Canadians, F-1 students, freelancers | U.S. residents with global income | Suited for U.S.-only income sources |

Pro Tip: Check your residency status before you pick a form. If you are a nonresident alien, always use Form 1040-NR. The wrong form can cause audits or lost refunds.

- Read More: “US–Canada Dual Citizenship Taxes: Filing Requirements and Tax Implications Explained (2025)”

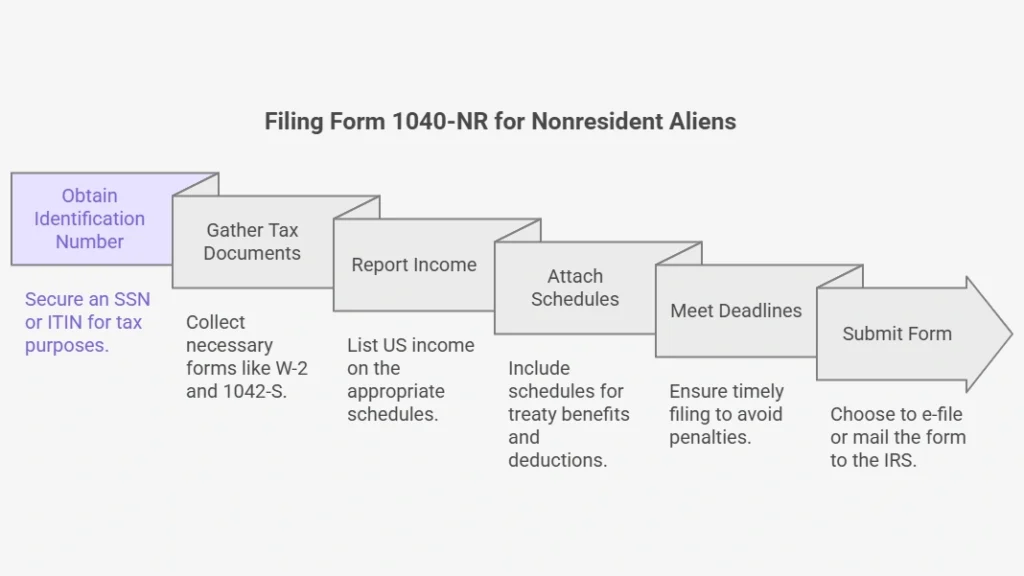

How to File Form 1040-NR: Step-by-Step Guide

Below are easy steps to file Form 1040-NR in 2026. This form tracks your US cash for nonresident aliens. Use these steps to stay on top and dodge IRS trouble.

Step 1: Get an ID Number

You need an ID for Form 1040-NR. Grab your SSN if you have it. Get an ITIN if you don’t. Check how to get your ITIN as a Canadian. Fill out Form W-7 and send it with your return. This shows the IRS who you are.

Pro Tip: Kick off your ITIN application early. It can take 7 weeks.

Step 2: Gather Your Papers

Grab your tax papers first. Pick up W-2 for wages or 1042-S for scholarships. Knowing instructions on Form 1042-S for reporting US income and claiming refunds may be helpful. Snag 1099 forms for US rental income or royalties. Include Schedule K-1 for partnerships. These list your US cash.

Pro Tip: Save copies of every paper. The IRS might want them later.

Step 3: Report Your Cash

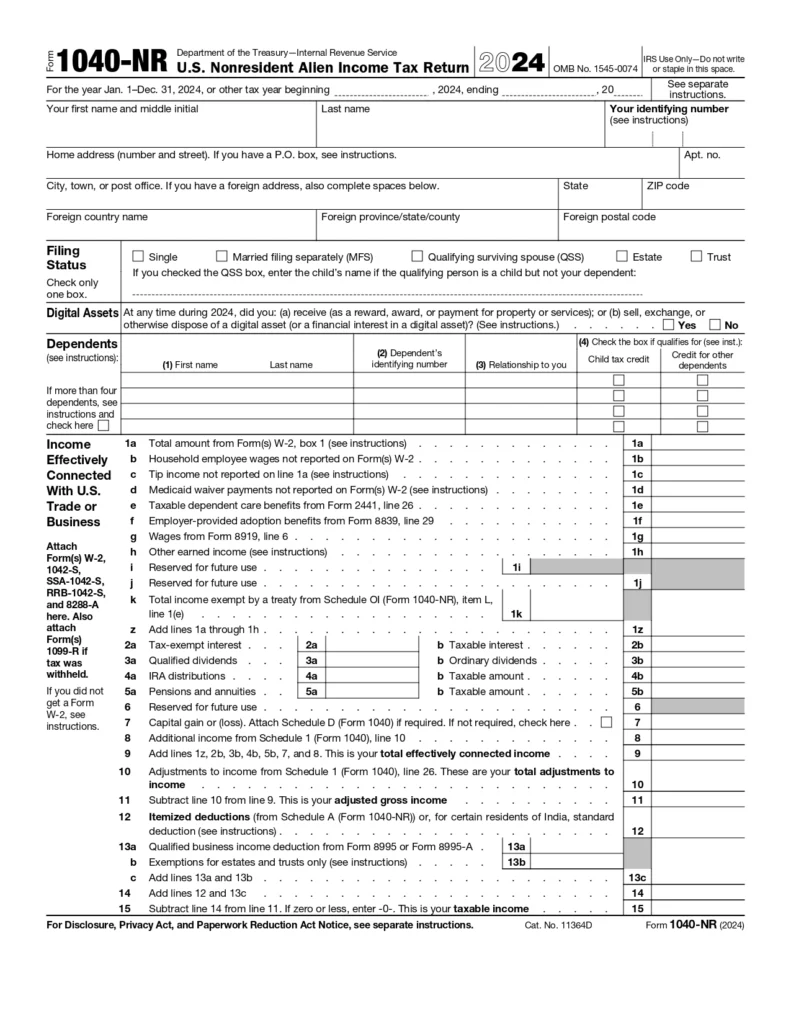

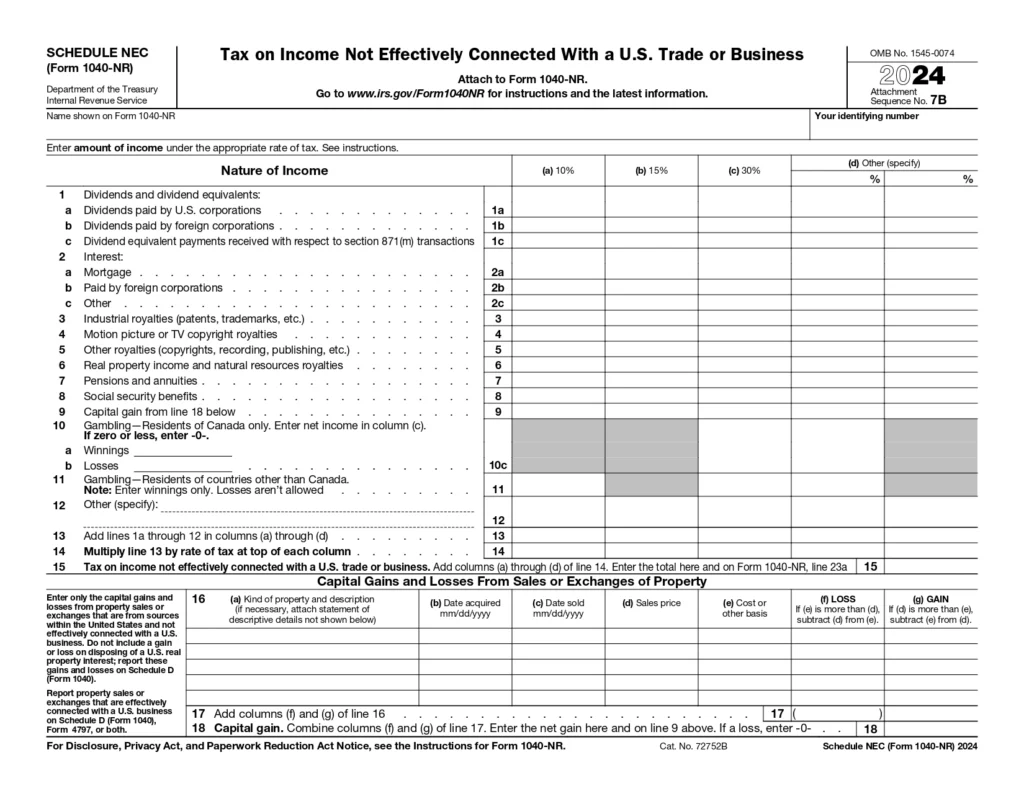

Put your US cash on the form. List wages or business money (ECI) on page 1. Add dividends or interest (FDAP) on Schedule NEC. Use Schedule E for rental income if it’s ECI.

Pro Tip: See if your cash is ECI. It usually gets lower tax rates.

Step 4: Add Schedules

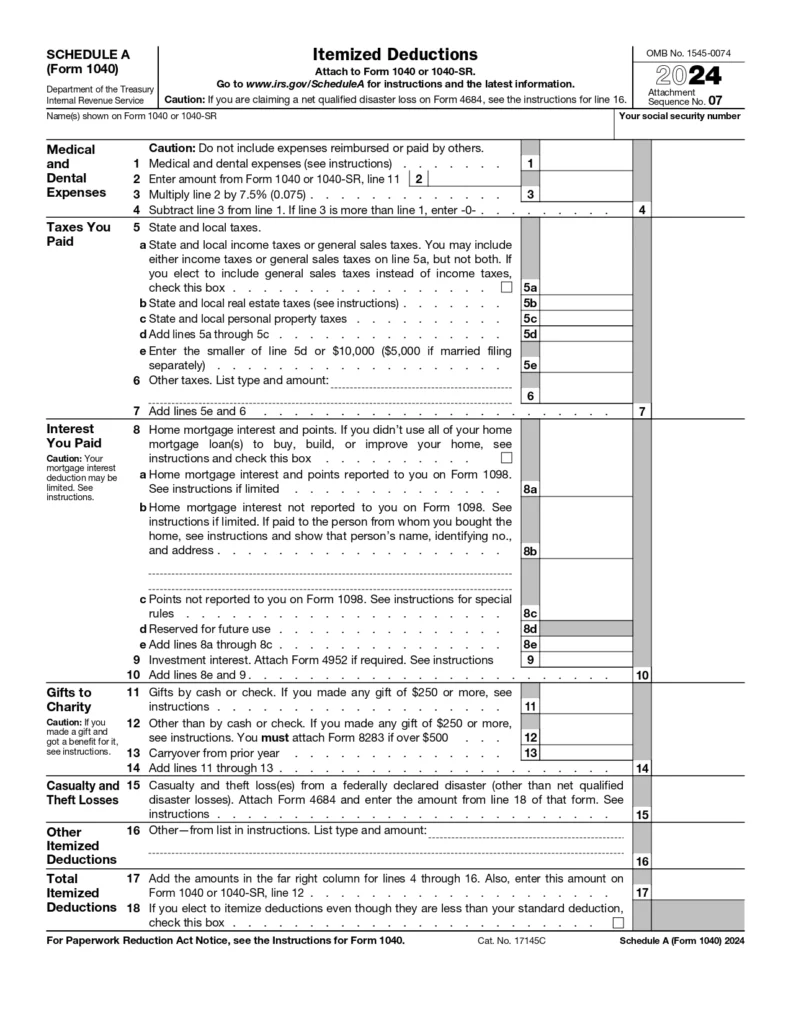

Tack on schedules to your form. Use Schedule OI for treaty benefits and residency info. Include Schedule NEC for non-ECI-like interest. Add Schedule A if you itemize deductions. You can check the forms below:

Pro Tip: Check your country’s treaty rules. Mess-ups can spark IRS audits.

Step 5: Check Deadlines

File by April 15, 2026, if you were an employee and received wages subject to U.S. income tax withholding. File by June 15, 2026, if you didn’t receive wages as an employee subject to U.S. income tax withholding. Get more time with Form 4868 if needed.

Pro Tip: File on time to avoid penalties. Late filing adds 5% per month on unpaid taxes.

Step 6: Send Your Form

Pick how to send your return. E-file for quick processing if you can. Mail paper forms to the IRS Austin Service Center if you can’t e-file. Include payments, but don’t staple.

Pro Tip: Use certified mail for paper forms. It proves you sent them on time.

What Tax Treaty Benefits Can You Claim on Form 1040-NR?

Tax treaties lower your taxes on Form 1040-NR. They stop double taxation on your US income as a nonresident. The US has deals to cut or skip taxes on some income. Schedule OI lets you claim treaty benefits on Form 1040-NR. List your country’s tax deal. Your country and income type decide eligibility. Common benefits include:

- Canada: 0% tax on royalties and certain rental income from US properties, if not business-related. Learn more about how the US-Canada tax treaty works.

- India: No tax on stipends or scholarships for students on F or J visas.

- UK: Reduced tax rates on dividends and interest from US investments.

Pro Tip: File Form 8833 to claim specific treaty exemptions, like reduced rates or exclusions for certain income types.

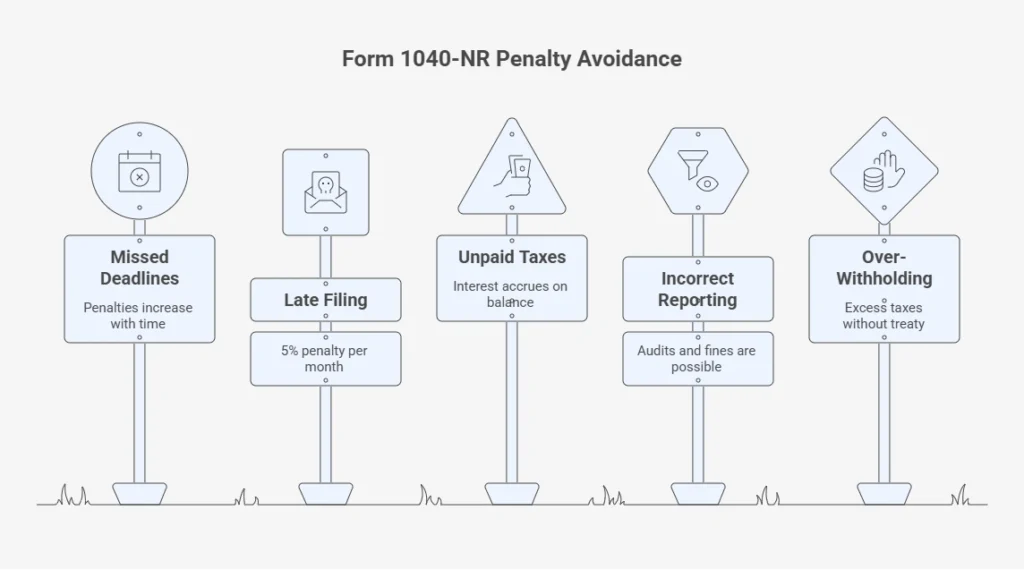

How to Avoid Penalties with Form 1040-NR

You can avoid penalties by filing Form 1040-NR correctly. Messing up deadlines or reports costs you cash. File smart to keep the IRS happy.

Deadlines:

- April 15, 2026, for wages or business income (if wages subject to withholding).

- June 15, 2026, for other cases without withheld wages.

- Extend to October 15, 2026, with Form 4868.

Penalties:

- Late filing: 5% per month (or part of a month) on unpaid taxes, up to 25%.

- If more than 60 days late, minimum penalty is $525 or 100% of tax due (whichever is less).

- Interest on unpaid taxes: 7% per year (compounded daily) for Q1 2026.

Withholdings:

- IRS takes 30% from rentals or scholarships. Have a look at the guide on FRITA tax for property sellers in the US.

- Over-withholding happens without treaty claims.

- File Form 1040-NR to get excess taxes back.

Pro Tip: File even if you owe nothing to grab withheld taxes back.

What Are the Most Common Mistakes When Filing Form 1040-NR?

Below are common mistakes to avoid when filing Form 1040-NR in 2026. These errors can cost you cash or spark IRS trouble for nonresidents.

1. Late Filing

Miss the April 15 or June 15, 2026 deadline. This triggers a 5% penalty per month on unpaid tax, up to 25%. If more than 60 days late, minimum penalty is $525 or 100% of tax due (whichever is smaller). Interest adds 7% per year.

Fix it: Mark your calendar now. File on time or get an extension to October 15, 2026 with Form 4868. Pay any tax owed by the original deadline.

2. Wrong Form

File Form 1040 instead of Form 1040-NR. This causes audits, delays, or wrong tax results. It can even affect your visa or green card.

Fix it: Check if you are a nonresident. Use the substantial presence test or green card test. Always file Form 1040-NR for U.S.-sourced income.

3. Missed Treaty Benefits

Skip Schedule OI or Form 8833. This means you pay full 30% tax on income a treaty can reduce or remove. Canadians often lose money on rentals. Students from India or China lose on scholarships.

Fix it: Look up your country’s treaty in IRS Publication 901. Fill out Schedule OI completely. Attach Form 8833 if your treaty position changes the rules.

4. Untracked Forms

Miss Form 1042-S, 1099, or W-2. This makes your return incomplete. You lose refunds or report income wrong. Fix it: Collect all U.S. income forms first. Check each one against your records.

5. Skipped Form 8843

F, J, M, or Q visa holders must file Form 8843 — even with no income. Skip it and get IRS notices or residency problems later.

Fix it: File Form 8843 by June 15, 2026 if you have no income. Attach it to Form 1040-NR if you file a return. It is a simple form, not a tax return.

6. Non-U.S. Cash Reporting

Put foreign income on Form 1040-NR. This form only covers U.S. income. Foreign income causes audits or penalties.

Fix it: Report only U.S.-sourced income like wages, rentals, or dividends. Keep foreign income off this form. Report it on your home country return if needed. Connect with our US Canada tax accountant for a consultation and stay free of mistakes. This table shows mistakes and fixes:

| Mistake | What Goes Wrong | Impact | Fix It |

| Late Filing | Miss April 15/June 15, 2026 | 5% monthly penalty, max $10,000 | File by deadlines |

| Wrong Form | Use Form 1040, not Form 1040-NR | Audits, delays | Use Form 1040-NR |

| Missed Treaty Benefits | Skip Schedule OI for U.S. rental income nonresidents | Overpay taxes | Add Schedule OI; see treaty benefits |

| Untracked Forms | Forget 1042-S/1099 | Ruins return | Track U.S. cash forms |

| Skipped Form 8843 | No Form 8843 despite visa, no income | IRS notices | Submit Form 8843 |

| Non-U.S. Cash Reporting | List non-U.S. money | Fines | Report only U.S. money |

Case Study: Toronto Resident’s Form 1040-NR Mix-Ups1

Problem: Sarah, a homeowner in Toronto, earns $20,000 in rental income from her U.S. condo. She files Form 1040-NR late and misses the June 15 deadline. She overlooks tax treaty benefits under the U.S.-Canada agreement and forgets to include her 1099 forms. The IRS withholds 30% ($6,000) of her rental income. A 5% monthly penalty applies to any unpaid tax, and she receives an IRS notice for the missing documents.

What We Do: Our SAL Accounting team reviews her situation and files an accurate Form 1040-NR on time. We claim the proper treaty benefits to reduce or eliminate the tax on her rental income. We track down and include all required 1099 forms. We also submit a request to abate the penalty based on reasonable cause.

The Result: Sarah receives a full refund of the $6,000 withheld. The penalty is removed. Her U.S. tax filing is now correct and compliant, with no further IRS issues.

What Are the Best Tips for Filing Form 1040-NR Correctly?

Here’s key advice for filing Form 1040-NR. These tips help nonresidents save money and file right:

- Timely filing hits April 15 or June 15, 2026, deadlines.

- Correct form picks Form 1040-NR for nonresidents only.

- Treaty benefits on Schedule OI cut taxes for Canadians on US rental income.

- Tracked forms save 1042-S and 1099 for US money.

- Form 8843 submission covers nonresidents with no money but a visa.

- Residency check confirms you’re a nonresident for the right form.

Pro Tip: Use IRS Free File for fast, free e-filing if you can. It makes Form 1040-NR easy and saves time. Our cross-border personal tax accountant is here if you need more help.

Case Study: Liberty Village Freelancer’s Form 1040-NR Win2

Problem: Liam, a freelance tech consultant living in Toronto’s vibrant Liberty Village neighbourhood, earns $30,000 from U.S. clients through remote work. He feels confused about Form 1040-NR requirements and U.S.-Canada tax treaty benefits. The IRS withholds 30% ($9,000) from his payments, putting him at risk of a significant tax loss.

What We Do: Our SAL Accounting team verifies Liam’s nonresident status. We prepare and file his Form 1040-NR by the April 15 deadline using IRS Free File. We gather and include all 1099 forms accurately. We apply the relevant U.S.-Canada treaty benefits to reduce withholding on his service income. We also file Form 8833 to properly claim the treaty position.

The Result: Liam saves $6,000 in taxes through treaty relief. He recovers the full $9,000 withheld. His U.S. tax filing is now accurate, compliant, and free of IRS issues.

Final Thoughts

Form 1040-NR helps nonresidents save money and stay compliant. You can skip penalties by filing on time and claiming treaty benefits. This US tax return for nonresident aliens ensures you keep more cash in 2026. Follow our steps to file right and avoid errors.

If you need help with Form 1040-NR or US tax rules, contact us at SAL Accounting and make compliance easy and boost your savings.

FAQs on Form 1040-NR

Yes, if you’re a U.S. citizen living in Canada or a Canadian with U.S.-sourced income, you are required to file a U.S. tax return.

Report U.S. income on your Canadian tax return, then use CRA’s foreign tax credits to offset Canadian taxes paid on the same income.

Yes, as a U.S. citizen or green card holder, you must file taxes annually regardless of where you live.

Utilize the U.S.-Canada Tax Treaty, the Foreign Earned Income Exclusion, and the Foreign Tax Credit to eliminate double taxation.

If your foreign bank account balances exceed $10,000 at any time during the year, you must file an FBAR (Form 114).

Yes, unless you file Form 8891 to defer taxation.

Yes, you may be able to deduct Canadian health care premiums as medical expenses on Schedule A if you itemize deductions on your U.S. tax return.