We want to help you expand your Canadian business into the US by getting a US Employer Identification Number (EIN), your company’s essential tax ID for everything cross-border. What surprises most owners we talk to is that the US buys about 76% of Canada’s merchandise exports (over $420 billion USD in 2024), yet many of you lose thousands every year to 30% automatic US withholding tax, just because you don’t have an EIN.

We at SAL Accounting will show you exactly when you need one, how to apply fast, the benefits, pitfalls, and real examples. Keep reading.

📌 Quick Takeaways

- Canadian companies can easily get a free US EIN without a US address, SSN, or citizenship.

- You only need an EIN if you have US income, banking, payments, hiring, or platforms like Amazon.

- An EIN lets you claim Canada-US tax treaty benefits and reduce 30% withholding to 0-15%.

- Apply by phone for same-day approval, fax for 4 days, or mail for 4-6 weeks.

- Avoid common mistakes like not submitting W-8BEN-E to prevent unnecessary tax losses.

Can Canadian Companies Get a US EIN? Understanding the Basics

Yes, Canadian companies can easily get a US Employer Identification Number (EIN), also called a Federal Tax Identification Number (TIN). This nine-digit code from the IRS acts as your business’s tax ID for anything US-related. It works like your Canadian Business Number (BN), but only for US compliance.

You apply for free. You don’t need a US address, SSN, ITIN, or citizenship. Thousands of businesses in Toronto, Mississauga, Vancouver, and across Canada get one every year when they start dealing with the US. Our cross border tax accountant can help you with a Canadian perspective on US taxes.

Do Canadian Companies Need an EIN?

No, not every Canadian company needs one. If your business stays completely in Canada and has zero US ties (no US customers, income, banking, employees, or platforms), you can skip it entirely. But if you deal with the US in any way, you often need an EIN. Without it, you risk 30% automatic withholding on US payments, frozen accounts on platforms, or other compliance headaches.

Many businesses in Toronto, Mississauga, Vancouver, and across Canada only get one when they start cross-border work and it saves them a lot of trouble. You can withhold taxes under US-Canada tax treaty.

When Does a Canadian Company Need a US EIN?

Here are the most common situations where a Canadian company requires (or strongly benefits from) a US EIN, based on current IRS rules as of 2026:

1. Filing US Taxes

You need an EIN to handle your US taxes properly. If you’re running a corporation, you’ll use Form 1120-F. Solo business owner? You’ll use Form 1040-NR instead. You’ll also need forms like W8-BEN (for yourself) or W8-BEN-E (for your business) to ensure proper tax withholding.

2. US Banking

A US bank account requires an EIN – it’s that simple. Banks use this number to verify your business and comply with their regulations. This applies whether you’re a small online seller or a large corporation. Look for the US banks that work best for Canadians.

3. Working with US People

When hiring US employees or contractors, an EIN is required. You’ll use it for payroll taxes and to provide the right tax forms (W-2 for employees, 1099 for contractors).

4. Taking US Payments

For online sales to US customers, you need an EIN to use payment systems like PayPal or Stripe. This applies to all US platforms, including Amazon, Shopify, or eBay.

5. Getting Tax Treaty Benefits

The Canada-US tax treaty can save you money, but you need an EIN to claim these benefits. This helps avoid double taxation and reduces withholding rates on certain types of income. Explore all key tax treaty benefits available to Canadian businesses.

6. Setting Up in the US

Opening a physical location in the US requires an EIN. This includes offices, stores, or warehouses. You’ll need it for leases, permits, and local business registration.

How Do Canadian Companies Apply for a US EIN in 2026? Step-by-Step Guide

A US EIN for your Canadian company costs nothing and comes easily. You need no US address, SSN, or ITIN. Canadians cannot apply online because the system requires a US-based person with an SSN/ITIN. Choose phone for speed, fax for ease, or mail. Here are the clear steps to get yours:

Step 1: Gather Your Information

Before you apply for your EIN, grab all the documents you’ll need. This will save time and make things easier.

What You’ll Need About Your Business

Let’s start with the basics – how your business appears on paper. You’ll need three key pieces of information:

- Your official registered company name – the one on your legal papers

- Any other names you use for business (we call these DBAs)

- Your regular address in Canada – yes, that’s perfectly fine to use

Who’s Taking Charge?

Your EIN needs a point person who can make decisions for your business – usually an owner or manager. This person will be your official contact with the IRS. They’ll need to provide their full legal name. Having a U.S. social security number or ITIN application for Canadians helps, but it’s not required for Canadian companies.

How Your Business is Set Up

The IRS needs to know the structure of your business. Here are the key details they’re looking for:

- Your entity type (like LLC, corporation, or partnership)

- What you do (such as online retail, consulting, or manufacturing)

What’s Your Future Plan?

Be clear about why you need an EIN. Are you opening a U.S. bank account? Selling on Amazon? Let the IRS know your plans. If you’re thinking about hiring U.S. workers, give them a rough idea of how many – it’s just an estimate and can change later.

- Pro Tip: Take a moment to check all these details against your business papers. Getting it right now saves headaches later.

Step 2: Choose Your Application Method

There are several ways to get your EIN, and the best method depends on your timeline. Here’s a complete overview of all available options:

| Method | Processing Time | Best For | Contact Information | Note |

| Phone | Immediate | Urgent needs | +1 (267) 941-1099 (not toll-free) | Call 7-8 AM EST for shortest wait times; prepare for possible fax follow-up |

| Fax | 4 business days | Standard cases | +1 (855) 215-1627 | Keep fax confirmation as proof |

| 4-6 weeks | Complex cases | IRS, Attn: EIN Operation, Cincinnati, OH 45999 | Most secure but slowest option | |

| Online | Immediate (if eligible) | Quick processing | IRS website | Only for those with U.S. SSN/ITIN |

Phone Application (Best for Urgent Needs)

The phone method is perfect for urgent cases. Call the IRS at +1 (267) 941-1099 during business hours to get your EIN immediately during the call. The best time to call is between 7-8 AM EST when wait times are shorter.

- Pro Tip: This isn’t a toll-free number, and the IRS might request follow-up documents by fax after your call.

Fax Application (Most Common Method)

Most Canadian businesses choose this method. Send your Form SS-4 to +1 (855) 215-1627, and expect your EIN within 4 business days. Also keep your fax confirmation as proof of submission.

Mail Application (Best for Complex Cases)

Sometimes you’ll have extra papers to send with your application. For these cases, mail everything to:

Internal Revenue Service

Attn: EIN Operation

Cincinnati, OH 45999

The mail takes longer (about 4-6 weeks), but it’s a reliable way to send all your documents together.

Online Application (Limited Availability)

You can get your EIN online right away, but you’ll need a U.S. Social Security Number (SSN) or Tax ID Number (ITIN). Since most Canadian companies don’t have these, you’ll probably need to use the phone, fax, or mail options.

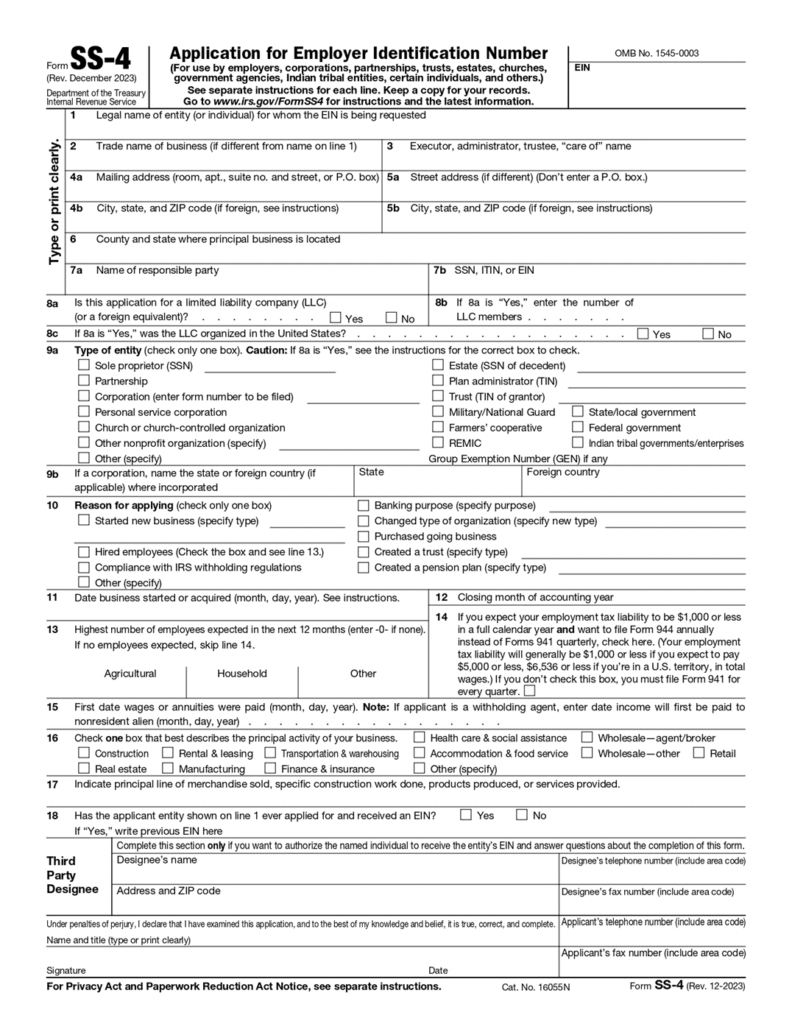

Step 3: Completing IRS Form SS-4

Now it’s time to fill out Form SS-4 to get your EIN. Let’s go through the main parts you need to know.

- Download the official Form SS-4 here. Also you can visit the IRS website if you are looking for more information.

Line 7a-b (SSN/ITIN)

Don’t worry about this section if you’re a Canadian company. Learning how to get an EIN without an SSN is simple. You can leave it empty since you don’t need a Social Security Number.

Line 9a (Type of Entity)

This part is important because it determines how you’ll pay taxes in the U.S. Most Canadian companies pick one of these:

- LLC (Limited Liability Company): Great for online businesses because it’s flexible.

- Corporation (C-Corp or S-Corp): Best for service companies or businesses that want to grow big.

- Partnership: Good when you run a business with others.

Let me show you what each business type means for your taxes, including US LLC Canadian tax filing requirements:

| Business Type | Who It’s For | Tax Rules | Common Uses | Tax Form | Extra Info |

| LLC | Online sellers, small businesses | Can choose how to be taxed | Online stores, startups | Form 1120 | Use 1120 if taxed as corporation, 1065 if partnership |

| Corporation | Big companies, service firms | Pays its own taxes | Large businesses, professional work | Form 1120 | All U.S. corporations use this |

| Sole Owner | One-person businesses | Owner pays taxes personally | Freelancers, small shops | Form 1040-NR | For money made in the U.S. |

| Partnership | Business with partners | Partners share tax duties | Family businesses, team ventures | Form 1065 | Required when you have partners |

Take your time choosing your business type – it affects how much tax you’ll pay and your legal responsibilities. If you’re incorporating as an LLC or corporation, our US business incorporation experts can guide you through the process.

Line 10 (Reason for Applying)

Tell the IRS exactly why you need an EIN – whether you’re opening a U.S. bank account, hiring American workers, or starting to sell on platforms like Amazon USA. Keep your explanation clear and brief. A simple sentence stating your main reason will help process your application faster.

- Read More: “How to Choose between LLC, LLP and S Corporation“

Step 4: Submit Your Application and Wait for Your EIN

Once you’ve completed your Canadian Corporation EIN application, submit it through your chosen method:

- Phone: You’ll get your EIN right away

- Fax: Expect your EIN in 4 business days

- Mail: Wait time is 4-6 weeks, so plan ahead

Once you send everything in, make sure to keep your EIN letter safe. You’ll need this paper a lot – for doing taxes, setting up a bank account, and accepting payments from customers.

When you get your EIN letter, make a few copies and keep them in different places. You can store one on your computer or in cloud storage, another in a safe at home, or share one with your tax person.

This way, you’ll always have your EIN handy when you need it, and you won’t have to worry if you misplace the original letter.

Next Steps After EIN Approval for Canadian Businesses

Now that you have your EIN, you can open U.S. bank accounts to handle your money. You’ll need to file some tax forms too – Form 1120-F if you run a corporation, or Form 1040-NR if you’re a solo business owner. Want to hire people? Make sure to set up payroll taxes. Also, check the rules in each state where you do business. They all have different requirements for sales tax and hiring.

- Read more: “How to Report Canadian Income on a US Tax Return“

What Are the Benefits of a US EIN for Canadian Companies?

A US EIN opens doors for Canadian businesses dealing with the US. It saves money, removes barriers, and keeps things compliant. Many companies get one for these reasons:

Makes Business Simple

A U.S. EIN makes life easier for your business. You can open a U.S. bank account and keep your business money separate from personal funds. This keeps things clean and makes taxes less of a headache. It also helps you build credit in the U.S., so you can get loans or other funding to grow your business. Learn more about US-Canada cross-border personal loans tax implications to stay safe.

Helps You Hire in the U.S.

If you’re hiring U.S. employees, you’ll need an EIN. It’s your ID with the IRS for handling payroll and taxes. This number keeps things legal when paying your team and dealing with taxes. Without it, hiring gets tricky.

Saves on Taxes

An EIN can save you money on taxes. Thanks to the Canada-U.S. tax treaty, you might pay less or avoid some U.S. taxes on certain income. It also keeps your business on track with taxes, so you skip fines.

Adds Credibility

An EIN makes your business look more legit to U.S. clients, vendors, and partners. It shows you’re serious and trustworthy. If you do cross-border deals, an EIN is a must. Our US business incorporation services can help smooth out customs and tax rules for better operations.

What Are the Common EIN Mistakes Canadian Companies Make (and How to Avoid Them)?

You got your EIN, awesome! Many Canadian businesses celebrate too early. A few common pitfalls still catch people off guard. Here are the biggest ones and simple ways to avoid them:

1. Wrong Business Classification

Picking the right business type on your EIN form is tricky. Let’s say you run a small online shop. You might think registering as a C-Corporation sounds fancy, but an LLC could save you money on taxes. Get this wrong, and you’ll end up paying more taxes than you need to. Not sure which to pick? Talk to our tax expert who knows both US and Canadian rules.

Case Study: Fixing a Toronto Consultant’s EIN Application Mistake1

The Problem:

Mike, a freelance consultant based in Toronto, applies for a US EIN to work with US clients. He checks the “hiring employees” box and lists himself as an employee, thinking that’s required for sole owners. In reality, he has no employees or payroll. This triggers unnecessary IRS payroll tax filings (Forms 940 and 944).

What We Do:

We contact the IRS on Mike’s behalf and submit a short clarification letter. We explain that Mike operates as a single-member entity with no employees and no payroll.

The Result:

The IRS removes the payroll requirements immediately. Mike avoids extra filings, potential penalties, and wasted time. He stays fully compliant and focuses on growing his Toronto-based consulting business with US clients instead of dealing with paperwork.

2. Payment Processing Holdups

Want to accept US payments? You’ll need more than just an EIN. Payment processors need to see your EIN and a W-8BEN-E form. Without these, your account could get frozen, blocking your ability to receive payments. See how to file Form W-8BEN as a foreign individual.

Case Study: How a Toronto E-Commerce Owner Got Her EIN Fast2

The Problem:

Sarah runs an online store in Toronto and decides to expand sales to the US market. She needs a US EIN to open a US bank account and register as a seller on Amazon. Sarah applies by fax on her own, but weeks pass with no response or updates. Her US launch stalls completely.

What We Do:

We take over and call the IRS international line directly at +1 (267) 941-1099 on Sarah’s behalf. With her prepared Form SS-4 details ready, we complete the phone application during the call.

The Result:

Sarah receives her EIN instantly on the spot. She opens her US bank account the same week, finishes Amazon seller registration, and starts selling to US customers right away. Her expansion moves forward smoothly with no further delays.

3. Missing State Requirements

Here’s a surprise – your EIN only works for federal stuff. Each state has its own rules too. You’ll need extra permits and paperwork if you sell stuff online, hire US workers or open a US shop. Check what each state needs before you start doing business there.

- Read more: “How to Open a Business in Florida as a Canadian”

4. Documentation Gaps

The IRS is quick to reject incomplete applications. Make sure you have:

- Your Canadian company papers

- Your CRA business number

- Your ID

- Proof of your Canadian address

Save digital copies of everything. You’ll need them again for banks and payments.

5. Bank Account Setup

US banks have strict requirements for Canadian businesses, even with an EIN. Most need extra documentation and minimum deposits. Look for banks experienced with Canadian business accounts to make the process smoother.

- Pro Tip: Check out TD Bank or RBC US – they’re used to working with Canadian businesses and might make things easier.

Remember, these bumps in the road are normal when expanding to the US. Most businesses face them. Need help? We’ve guided hundreds of Canadian companies through this exact process.

Frequently Asked Questions About EIN for Canadian Businesses

Not at all! Your Canadian business address works just fine. The IRS fully accepts Canadian addresses for EIN applications.

Canada does not issue EINs. You only have one if you previously applied to the IRS for US activities. If not, you don’t have (or need) one. To find a lost EIN, check your CP 575 letter or call the IRS at +1 (267) 941-1099 with business details.

It depends on how you apply. Phone applications get instant EINs. Fax takes about 4 business days. Mail? That’s the slowest – plan for 4-6 weeks. Call early morning EST for shorter wait times if need it fast.

Usually no. Online applications only work if you have a US Social Security Number or ITIN. Don’t have those? No worries – just apply by phone, fax, or mail instead.

Yes, if you’re making money in the US. But don’t panic! The type of tax return depends on your business structure. Corporations file Form 1120-F, while sole proprietors use Form 1040-NR.

Easy fix. Call the IRS Business line at 800-829-4933. They’ll help you track down your number. Just keep your business info handy when you call.

Yes. An EIN is a US tax ID number, also known as Federal Tax Identification Number (TIN) or FEIN — all mean the same nine-digit code. It is not your Canadian Business Number (BN), which has no US validity.

Absolutely. Amazon USA requires an EIN from all Canadian sellers. You’ll need it to receive payments and handle US taxes properly. Plus, it helps you access Amazon’s full range of seller tools.

Final Thoughts

Getting an EIN opens doors to the US market. This nine-digit number lets you open US bank accounts, hire employees, process payments, and handle your taxes right. While the process has its steps, it's totally doable with good planning.

Need help with your US expansion? Contact us at SAL Accounting. We've guided hundreds of Canadian businesses through their EIN and tax journey. Contact us now, we'll make sure you're set up right from day one.

Disclaimer: Services provided from a Canadian perspective only; results may vary; no guarantees; consult for your unique situation.