make cross-border inheritance tax between Canada and the US simple and keep every dollar you deserve. The shocking fact is that in 2025, a Canadian inheriting a $1 million U.S. cottage or portfolio can owe up to $382,000 in U.S. estate tax before the CRA even touches it. Most families miss the rules that can eliminate or slash that bill.

In this guide from SAL Accounting, we’ll walk you through exactly how US inheritance to Canadian residents works, step-by-step, so double taxation never touches your inheritance. Keep reading.

Quick Takeaways

- Canada has no inheritance tax – you receive U.S. assets 100% tax-free.

- The U.S. has no inheritance tax either – only estate tax, with a $13.99 million exemption for citizens and just $60,000 for Canadians (treaty usually fixes this).

- Canadians never pay U.S. estate tax directly – the estate pays it before you get anything.

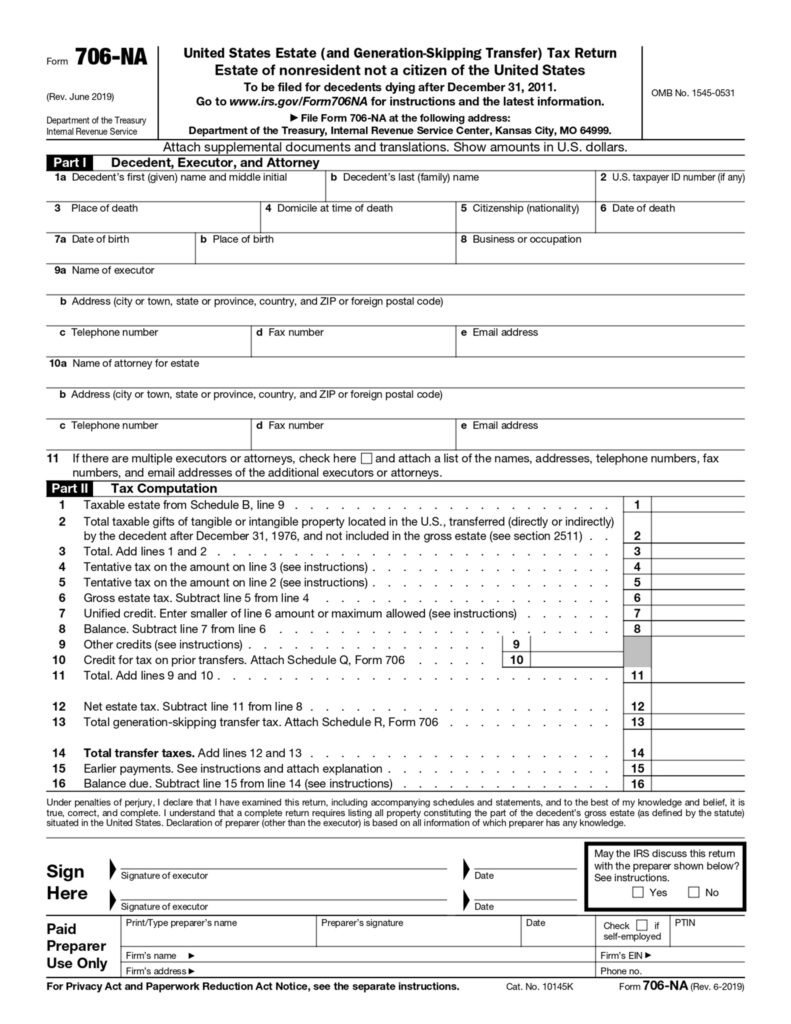

- One filed Form 706-NA + the Canada-U.S. treaty = zero U.S. tax for most estates under $15 million worldwide.

- Miss Form T1135 when foreign assets exceed $100k CAD → automatic $2,500/year penalty.

U.S. Inheritance to Canadian Residents: Why Cross-Border Estate Tax Matters

Picture this: you inherit a $600,000 Florida beach house from a U.S. relative. Exciting, until the tax bill arrives. As a Canadian, you could owe up to $216,000 in U.S. estate tax immediately (after the tiny $60,000 non-resident exemption in 2025), and that’s before the CRA even gets involved.

This is the hidden risk every U.S. inheritance to Canadian residents faces, along with Americans living in Canada. One oversight means double taxation; the right knowledge keeps far more in your pocket. Our cross border tax accountant helps you avoid paying too much. Let’s see how inheritance tax works in both the USA and Canada.

U.S. Inheritance to Canadian Residents: How the Rules Work

Let’s see how Canada and the US handle inheritance and estate taxes. This lays the groundwork for everything else.

1. Canada: No Inheritance Tax on Receipt

Canada keeps it simple: there’s no inheritance tax. You don’t pay anything just for getting an inheritance, whether it’s from Canada or abroad, per the CRA’s tax rules. But there’s a catch.

The real tax trigger: Deemed Disposition

When someone dies, Canada acts like they sold their assets at today’s price, called a deemed disposition by the CRA. If the value has gone up since they bought it, the estate pays capital gains tax on the inheritance in Canada before you take it. Also, check out how pillar two tax affects Canada–U.S. cross-border payments.

Example: If someone bought a cabin for $100,000 and it’s worth $300,000 when they pass away, the estate pays tax on the $200,000 gain, about $50,000 at a 50% inclusion rate and 50% tax bracket. The heir gets the cabin tax-free after that.

What About the Money It Makes?

If the cabin earns money, like rent, the new owner reports that on their Canadian tax return. The inheritance itself stays tax-free, but income from it gets taxed.

Filing Details

The estate files this tax by April 30 of the next year (or October 30 for a graduated rate estate), per CRA deadlines. Late filing can add 5% penalties plus 1% monthly interest, so it’s worth ensuring it’s done right.

2. The USA: Estate Tax Rules on Inheritance

The US uses an estate tax, explained by the IRS. When a US citizen dies, their estate pays tax if it’s over $13.99 million in 2025 (a high bar).

Big Estates Pay

Smaller estates don’t owe anything. If the estate’s worth $5 million, it pays zero since it’s under the IRS’s 2025 limit. Rates start at 18% and hit 40% above $1 million over the limit.

Canadians with US Assets

For Canadian non-residents, the IRS applies estate tax on US assets (like a house or stocks). You should also know the tax rules when selling property in the U.S. as a Canadian.

- Basic exemption is $60,000

- Rates reach 40% on anything above this limit

Example: A $500,000 condo in Los Angeles could mean a $176,000 tax bill (40% tax on $440,000) without treaty help. The Canada-US Tax Treaty can lower this; we’ll explore that next.

Tax Rate Breakdown

The tax rate starts small at 18% for amounts over $60,000, then increases to 40% for larger estates over $1 million. For example, a $1.06 million estate could face about $404,000 in tax without treaty relief.

- Read more: “Corporate Tax Deadlines in 2025”

Do Canadians Pay US Estate Tax? When Does It Apply?

Let’s answer the question directly: Do Canadians pay US estate tax?

No, you never pay it as the recipient. The tax is always paid by the estate before assets reach you. But it can still affect U.S. inheritance to Canadian residents in two key situations. Here’s the breakdown.

When Estate Tax Comes Up

US estate tax pops up in two ways:

- A Canadian dies owning US assets, like real estate or stocks, and their estate might owe tax.

- A US person’s estate pays tax before you inherit, but you don’t pay it as a Canadian.

If a US estate worth $8 million leaves you $400,000 in cash, no estate tax applies since it’s under $13.99 million, per IRS estate tax rules.

Limits and Treaty Help

The basic limit for Canadians with US assets is $60,000, but the Canada-US Tax Treaty helps (outlined by Finance Canada). Your limit is based on what portion of your total estate is in US assets. For example, with a $2 million estate where $500,000 is US property (25%), you’d get a $3.5 million limit million limit—meaning no tax owed.

Pro Tip: File IRS Form 706-NA within 9 months of death (or 15 with Form 4768) to claim this bigger limit. It’s your key to skipping that tax. See how Canada-US Tax Treaty works for you.

Case Study: Margaret’s Arizona Condo – How the Treaty Saved $256,0001

Problem: Margaret, a Toronto retiree, owns a $700,000 condo in Scottsdale, Arizona, and wants to leave it to her niece Lisa in Mississauga. When Margaret passes away, the IRS initially applies the standard $60,000 non-resident exemption and sends a $256,000 U.S. estate tax bill, taxing $640,000 at rates up to 40%.

Lisa contacts us worried she’ll lose more than a third of the inheritance.

What We Do: We review Margaret’s worldwide estate, valued at around $1.5 million (the condo represents roughly 47%). By filing IRS Form 706-NA and claiming the Canada-U.S. Tax Treaty, we secure a pro-rated exemption of approximately $6.5 million on the U.S. assets.

Result: the tax bill drops from $256,000 to zero, and Lisa receives the full $700,000 value untouched.

Foreign Inheritance Tax Canada: What You Actually Pay When Receiving U.S. Assets

Canada does not tax the inheritance the moment it lands in your hands — but the type of asset determines what happens next. Here’s the clear 2025 breakdown.

1. Cash Inheritances

Pure cash is the simplest. The U.S. estate may have already paid estate tax, but once it reaches you, Canada adds nothing per CRA income rules. Only reporting applies: if the total foreign property you now hold exceeds $100,000 CAD, file Form T1135 with your return. Have a look at the form T1135 guide and what Canadian taxpayers must know.

2. U.S. Real Estate

You receive the property tax-free in Canada. When you eventually sell, Canadian capital gains tax applies on growth above the stepped-up value at death.

Example: Inherit a $400,000 Texas condo, sell later for $480,000 → $80,000 gain → roughly $20,000 Canadian tax (50% inclusion + top rate).

3. U.S. Stocks & Investments

U.S. stocks and non-registered investment accounts come with two ongoing rules:

- Dividends: 15% U.S. withholding (treaty rate). It is fully creditable in Canada.

- Capital gains: Taxed only in Canada when you sell, based on the inherited value.

4. U.S. Retirement Accounts (IRAs, 401(k)s)

Withdrawals are taxed in both countries, but Canada gives a foreign tax credit for the U.S. tax paid. Net effect: you pay the higher Canadian rate.

Comparing Asset Types

Here’s a table to show how assets get taxed:

| Asset Type | US Tax | Canada Tax |

| Cash | Estate tax (if it applies) | None (report if over $100K CAD) |

| Real Estate | Estate tax (if it applies) | Capital gains on sale |

| Stocks | 15% on dividends | Capital gains on sale |

| Retirement Accts | 10-37% on withdrawals | Taxed, with credit for US tax |

Inheritance Tax USA vs. Canada: Side-by-Side Comparison (2025)

Here’s a quick look at cross-border estate tax between Canada and US:

How to Reduce or Eliminate Foreign Inheritance Tax in Canada & the U.S.

You don’t have to let foreign inheritance tax in Canada or the US take much. Here’s how to keep more, with deeper options.

1. Use the Canada-US Tax Treaty

The treaty, per Finance Canada, cuts US dividend tax to 15%, raises your estate tax limit, and stops double taxation. A $1 million estate with $250,000 in US stocks saves $76,000 with it. File IRS Form 706-NA within 9 months, or 15 with Form 4768 to claim the bigger limit and dodge tax.

2. Set Up a Trust

A trust skips US estate tax by keeping assets out of your estate at death, per IRS trust basics. A $700,000 US house in a trust means no tax when you inherit. A revocable trust ($1,000-$2,000 setup) lets changes, while an irrevocable one locks assets but maximizes tax savings—ask a lawyer which fits.

3. Give Gifts Early

The US allows $18,000 tax-free gifts per person yearly (2025), per IRS gift rules. It shrinks the estate, and Canada doesn’t tax you—$72,000 over 4 years cuts tax risk.

4. Use a Canadian Company

A Canadian company owning US assets avoids personal estate tax—see CRA business tax info. Your company buys a $200,000 US rental, saving personal tax at death.

5. File the Right Forms

Missed forms mean penalties.

- IRS Form 706-NA: for estate tax on US assets.

- IRS Form 3520: for inheritances over $100,000 USD.

- CRA Form T1135: for foreign assets over $100,000 CAD.

Comparing Strategies

Here’s a table to weigh your options:

| Strategy | US Tax Saved | Canada Tax Saved | Complexity |

| Treaty | Estate tax (up to 40%) | Double taxation | Medium |

| Trust | Estate tax (full) | None | High |

| Gifting | Estate tax (partial) | None | Low |

| Company | Estate tax (full) | None | Medium |

Case Study: Helen’s Miami Rental – How a Trust Saved $336,0002

Problem: Helen, an Ottawa widow, inherits a $900,000 Miami rental property from her late U.S. husband. The IRS initially applies the standard $60,000 non-resident exemption and issues a $336,000 U.S. estate tax bill (taxing $840,000 at rates up to 40%). Helen contacts us in shock, afraid she’ll lose more than a third of the property’s value.

What We Do: We discover that Helen’s husband had started setting up an irrevocable trust before his death. We work with the estate lawyer, finalize the trust structure through probate, and provide the IRS with documentation proving the property is no longer part of the taxable U.S. estate.

Result: The IRS accepts the trust arrangement. The U.S. estate tax drops from $336,000 to zero. Helen keeps the full $900,000 rental property and continues receiving the income without disruption.

Tax Exemptions for Canadians Inheriting from the USA

Canadians can cut or skip U.S. inheritance tax with some handy exemptions. Here’s the breakdown:

Prorated Unified Credit for Canadians

Canadians get a $13,000 USD credit. This wipes out U.S. estate tax on U.S.-based assets under $60,000 USD. Plus, you can tap into a piece of the $13.99 million USD exemption (set for 2025) through the U.S.-Canada Tax Treaty. It depends on how the deceased’s U.S. assets stack up against their total worldwide estate. Here’s the formula to figure out that prorated credit:

Marital Deduction

A U.S. citizen can give assets to their U.S. citizen spouse tax-free while they’re alive. If the spouse is Canadian, no exemption unless the assets are in a QDOT trust. That lets the Canadian spouse use them without estate taxes, until they die or take the assets out. Then taxes might hit. You can have a tax deduction checklist for Canadian and U.S small businesses for more.

Marital Credit

Canadians can tap into a marital credit thanks to the US-Canada Tax Treaty. Moving U.S. assets to your spouse in Canada cuts your U.S. estate tax. You claim a credit based on the smaller of two figures:

- Your U.S. estate tax bill

- Your prorated unified credit.

Example: Jack hands over his $2 million Los Angeles home to his Canadian spouse, Sarah. His U.S. estate tax bill comes to $334,500. His prorated unified credit sits at $1.58 million. He claims a marital credit of $334,500, which shrinks his U.S. estate tax by that amount.

Common Cross-Border Inheritance Tax Mistakes Between Canada and the US

Mistakes can raise your taxes or delay your inheritance. Here’s what to watch out for with easy fixes.

1. Forgetting Form T1135

If you inherit a big amount from abroad, like cash or property worth more than $100,000 CAD, you need to file Form T1135 yearly with the CRA. Skipping it means daily penalties that add up fast. It’s a quick step to avoid trouble.

Pro Tip: Keep a list of foreign stuff you get. It makes filing easy.

2. Missing Treaty Help

The Canada-US Tax Treaty cuts US estate tax, but you need Form 706-NA to use it. Without it, you face a tiny limit, and extra tax can hit hard. It’s a simple way to save big. Learn more about US-Canada Tax Treaty benefits.

3. Guessing the Starting Price

Selling inherited stuff, like a house, means Canadian tax on the gain from its value when you got it. Guessing that value can make you overpay. A condo sale cost someone extra tax because they didn’t prove the start price. Contact our non-residents tax accountant for expert help.

Case Study: Sam’s $200,000 U.S. Stock Inheritance – Avoiding a $5,000 CRA Penalty3

Problem: Sam, a Toronto tech investor, inherits $200,000 in U.S. shares from a close friend’s estate. He doesn’t realize that once the value of his foreign property exceeds $100,000 CAD, he must file Form T1135 every year. After two missed filings, the CRA issues a $5,000 late-filing penalty notice and Sam contacts us worried about escalating fines.

What We Do: We immediately submit a Voluntary Disclosures Program (VDP) application to the CRA, file the overdue T1135 forms, and provide full supporting documentation. We also set up annual reminders in his tax calendar.

Result: The CRA accepts the VDP submission, waives the entire $5,000 penalty (plus any interest), and Sam continues to hold and grow the U.S. portfolio with zero penalties. One simple filing fix saves the day.

Final Thoughts

Figuring out US Canada inheritance tax rules and cross-border estate tax between Canada and the US is doable. Canada skips inheritance tax, the treaty lowers US estate tax, and smart steps keep your tax on receiving an inheritance from abroad low. Your inherited foreign assets in Canada stay safe with some planning.

SAL Accounting is here to assist. Need help with forms or a trust? Contact us for a free chat. We’ll keep it basic and clear.

FAQ: Answers on US Canada Inheritance Tax Rules

No. The U.S. does not have a federal inheritance tax paid by the recipient. It has a federal estate tax paid by the estate before distribution. Most people mistakenly call it “inheritance tax.

No, not when you get it. The US estate might owe tax, and Canada taxes gains if you sell—check values early.

The estate pays it, not you. Your share could drop if it’s over $13.99 million or $60,000 for US assets, but treaty limits help.

Stocks face Canadian tax on gains when sold, plus a 15% US dividend tax you credit. Retirement accounts get taxed both ways, credits cut the bite.

Yes, if it’s over $100,000 CAD and stays abroad, file Form T1135. It’s part of CRA reporting rules on foreign inheritance. Miss it, and penalties start.

Use IRS Form 3520 for gifts over $100,000 USD, CRA Form T1135 for foreign holdings, and 706-NA if you own US assets at death.

Yes, Form 706-NA gets you a bigger limit based on your estate’s US share. It often reduces tax to zero.