If you’re lending money to family or friends across the Canada-U.S. border, for a move, emergency, or big purchase, you’re in good company. We’re here to make everything clear and show you the safest ways to handle the money. These loans happen often, but they come with specific tax and transfer rules.

The surprising part for you is that the Canada-U.S. Tax Treaty usually eliminates withholding tax on interest (0% instead of up to 25% in other countries). Good paperwork and a reasonable interest rate unlock this benefit.

SAL Accounting Pulled this guide together to cover the important tax points, currency effects, reporting, and transfer options so you can do it right.

Quick Takeaways

- Cross-border personal loans between Canada and the US are not taxable as income—the principal is simply debt.

- The Canada-US tax treaty reduces interest withholding to 0% in most cases for family and personal loans.

- Charge at least the minimum rate (CRA 3% or IRS AFR) and document with a promissory note to avoid imputed interest.

- Use one currency for the loan and Wise for transfers to minimize fees and foreign exchange tax issues.

- Submit residency forms (W-8BEN or NR301) early to claim treaty benefits and ensure full compliance.

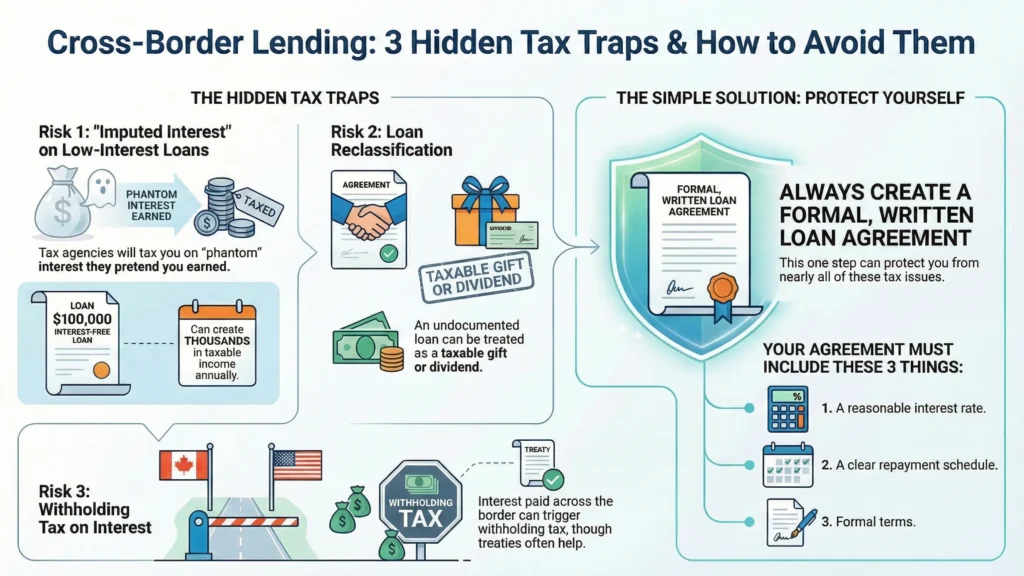

What Are the Biggest Tax Risks When Lending Money Across the Canada-US Border?

You don’t pay tax on the loan amount itself in either country. It’s just debt, not income (CRA guide on loans). You might think lending money to a family member across the border stays simple and tax-free beyond that. Both the CRA and IRS watch these loans closely to prevent hidden gifts or income shifting. A cross-border tax expert can help you along the way.

The main risks come in three areas: imputed interest, withholding taxes, and reclassification.

First, imputed interest

If you make an interest-free or low-interest loan, tax authorities pretend you charged a market rate:

- In the US: The IRS uses Applicable Federal Rates (AFRs), currently around 3.63% short-term, 3.81% mid-term, and 4.63% long-term for 2026 (check the latest Revenue Ruling for exact figures). They treat the “forgone” interest as income to you (the lender) and often as a gift for family loans.

- In Canada: The CRA imputes interest at its prescribed rate (3% for 2026) on low-rate family or related loans. The borrower may face a taxable benefit.

The larger the loan and the longer the term, the bigger the imputed interest amount becomes.

Example: On a $100,000 interest-free loan, you could face thousands in extra taxable income each year. This hits harder on larger amounts because the “forgone” interest adds up quickly.

Second, withholding tax on interest

When you pay interest across the border:

- Canada generally does not withhold on arm’s-length interest payments to non-residents.

- The Canada-US tax treaty eliminates withholding on most interest (except contingent or participating interest).

You can often avoid this entirely with proper setup. See how to withhold taxes under the US-Canada tax treaty.

Third, reclassification risks

Undocumented or indefinite loans can be treated as dividends (taxed at a higher rate) or gifts. We’ve seen informal family loans trigger surprise tax bills years later.

Pro Tip: Always document the loan in writing. Include a reasonable interest rate (at least the minimum AFR or CRA prescribed rate), repayment schedule, and clear terms. This protects you from nearly all these issues.

➜ Read More: “Cross-Border Real Estate Transactions: Legal Guide for Canada and U.S.“

How Does the Canada-US Tax Treaty Save You on Loan Interest Taxes?

The Canada-US tax treaty offers real relief for personal loans between Canadian and US residents. This treaty prevents double taxation and reduces withholding on cross-border payments, such as interest.

The Main Benefit: Little to No Withholding Tax on Interest

For most personal loans, you face 0% withholding tax on interest payments. We break this down below by loan type and direction:

- Arm’s-length loans (not family or related parties): Canada exempts all interest paid to non-residents from withholding tax under domestic rules, no treaty needed.

- Non-arm’s-length loans (like family loans): Canada normally applies 25% withholding, but the treaty reduces it (often to 0% for standard fixed-rate personal loans without profit-sharing).

- US side: The US rarely withholds most interest paid to non-residents (portfolio interest exemption), and the treaty supports 0%.

Pro tip: In your typical family loan:

- Canadian borrower paying interest to US lender → Usually 0% withholding.

- US borrower paying interest to Canadian lender → 0% withholding.

The treaty also lets you claim foreign tax credits if any interest gets taxed twice. Use IRS Form 8233 to claim tax treaty benefits.

What the Treaty Doesn’t Fix

The treaty does not stop imputed interest rules. Charge below the minimum rate, and the lender still reports imputed income. Here’s what that means for each country:

US: Use IRS Applicable Federal Rates (check monthly, around 4-5% recently).

Canada: CRA prescribed rate is 3% for 2026.

How to Claim Treaty Benefits and Avoid Withholding

Submit proof of residency early so the payer withholds nothing (or less). We detail the exact forms and who submits them below:

- US resident lender (receiving from Canada): Provide a declaration like Form NR301 to the Canadian borrower.

- Canadian resident lender (receiving from the US): Submit Form W-8BEN to the US borrower. Check how to fill out Form W-8BEN to avoid mistakes.

Pro Tip: Charge at least the minimum rate (e.g., 3% now in Canada), document everything, and file the right forms. We’ve helped cross-border families avoid withholding this way entirely. The Canada-US tax treaty prevents double taxation and reduces withholding on cross-border interest for personal loans.

The table below explains different scenarios:

| Direction of Interest | Standard Rate Without Treaty | Treaty Rate (Most Cases) | Key Note |

| Canadian borrower → US lender (arm’s-length) | 0% | 0% | Domestic exemption |

| Canadian borrower → US lender (family) | 25% | 0% | Treaty reduction |

| US borrower → Canadian lender | Up to 30% | 0% | Portfolio exemption + treaty |

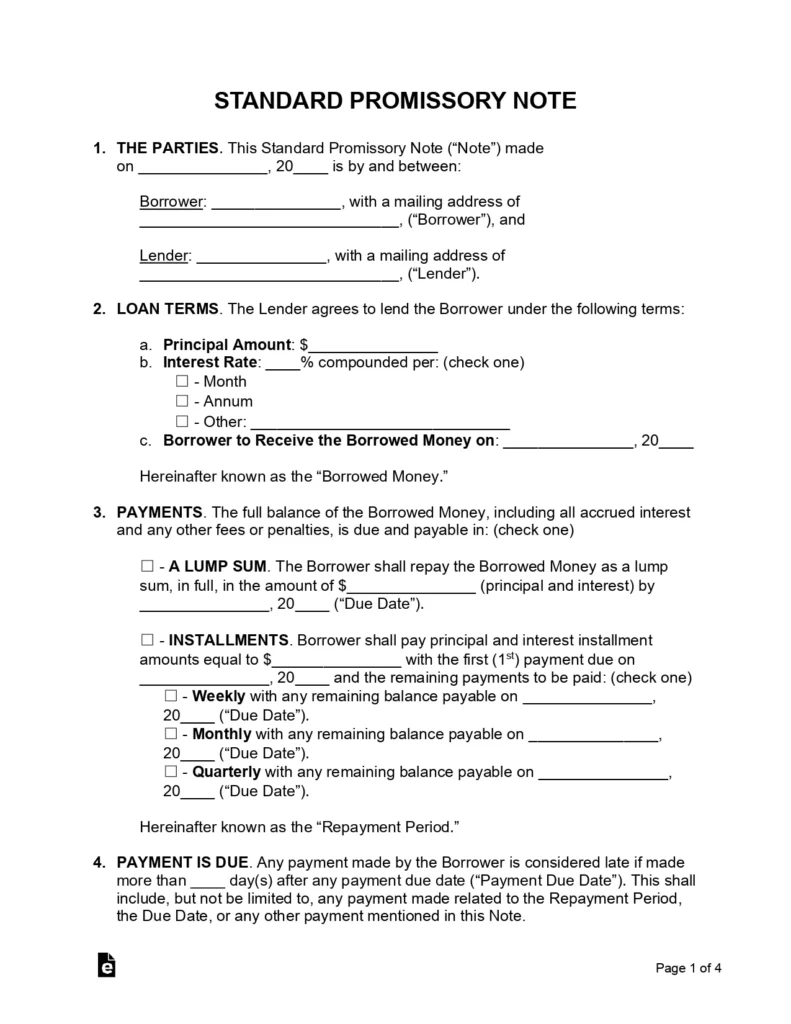

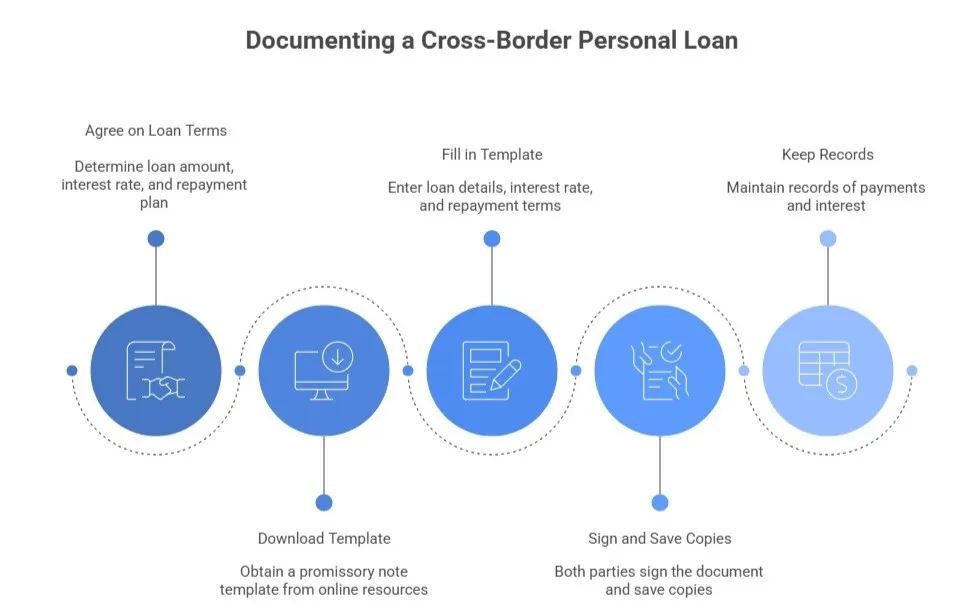

How to Document a Cross-Border Personal Loan Properly (and Why It Matters)?

Good documentation proves to the CRA and IRS that your money is a true loan, not a gift or something else. This blocks reclassification, extra imputed interest, gift tax reports, and audit trouble. You only need one key document, a promissory note. It keeps your loan safe and on the right side of the rules. Here’s the easy step-by-step way to create one.

Step 1: Agree on the Loan Terms First

Open the template and add these details:

- The exact amount and currency (CAD or USD).

- The interest rate, set it at least at the minimum, so you skip the extra tax:

If the lender lives in Canada, use the CRA rate. 3% right now (good through March 2026).

If the lender lives in the US: Use the IRS AFR rate – check the latest monthly rate on the IRS website (usually 3.5% to 4.6%, depending on loan length).

- Repayment plan, pick fixed payments and a clear end date (for example, $500 a month for 5 years).

- Grab full names, addresses, and country of residence for both of you.

Remember that the Pillar Two Tax affects Canada–U.S. cross-border payments.

Step 2: Grab a Free Template

Head to sites like LawDepot.com, RocketLawyer.com, or eForms.com. Download a free personal loan promissory note template. Choose the Canada or US version based on where the lender lives. Have a look at the following personal loan promissory note for instance:

Step 3: Fill in the Main Parts

Open the template and add these details:

- The date and full names/addresses of both people (including the country).

- The loan amount.

- The interest rate and how you calculate it (for example, 3% simple interest each year).

- Repayment details – exact payment amounts, start dates, and final due date.

- Rules for late payments (for example, a small late fee and the whole balance becomes due right away).

- Which country’s laws apply (usually the lender’s country).

- Spaces for both of you to sign and date.

Step 4: Sign and Save Copies

Both of you read it carefully, sign it, and date it. Electronic signatures work great if you’re in different cities. Save copies on your computers and print one for your files. Also, keep proof of the first money transfer. Check the best US banks for Canadians.

Step 5: Keep Good Records After

Save proof of every payment (bank statements, e-transfer receipts, or a simple spreadsheet). Make interest payments on the schedule you picked. Many people just pay it once a year. At tax time, the lender reports the interest as income. The borrower can sometimes deduct it if the loan pays for investments or certain other things.

Pro Tip: Stick with the minimum interest rate and pay the interest every year. This setup keeps taxes clean on both sides of the border.

➜Read More: “Cross-Border Real Estate Transactions: Legal Guide for Canada and U.S.“

Case Study: Undocumented Family Loan Near the CN Tower in Toronto Triggers Imputed Taxes1

A Toronto resident living near the CN Tower lends $75,000 CAD to their sibling in Buffalo, NY, just across the border, to help buy a home near the Peace Bridge. They keep it informal, no promissory note, no interest charged, and money sent via bank transfer with a simple “family help” memo.

Problem: The CRA applies the prescribed rate, imputing about $2,250 annual interest as a taxable benefit to the borrower. The IRS treats forgone interest using the applicable mid-term AFR (3.81% annual for 2026)) as income to the lender and potentially a gift. Without documentation, both face audit questions about whether it is truly a loan.

What We Do: We help create a retroactive promissory note, charge minimum interest going forward, and amend prior returns where possible.

The Result: They pay roughly $4,500 in extra taxes and penalties over two years. Future loans now use proper notes and minimum rates, saving thousands long-term and avoiding reclassification risks.

➜Read More: “Cross-Border Inheritance Tax Between Canada and the US“

Best Ways to Transfer Loan Funds Between Canada and the US Without High Fees

You have your promissory note ready. Now send the loan money across the border the right way. This keeps fees low, avoids delays, and stays clear of extra reporting issues. The goal is to get the full amount to the borrower quickly and cheaply, without unnecessary tax or anti-money laundering flags. Below, we break down the best options, what to watch for, and simple steps to follow.

Best Transfer Options

Most people pick these for personal loans:

- Wise (top choice): Low fees (around 0.4-0.6%), uses the real mid-market exchange rate, and arrives fast (often same or next day).

- Bank wire: Safe but costs more ($15-50 + exchange markup).

- Personal cheque: Almost free but slow (2-4 weeks to clear).

- Cross-border bank accounts (RBC or TD): Often free and instant if you have linked CAD/USD accounts. See how to open a US bank account as a Canadian for more.

Here is a quick comparison (Sending $10,000 CAD to USD):

| Method | Typical Fee | Exchange Rate | Speed | Best For |

| Wise | $40-60 | Mid-market (best) | 1-2 days | Lowest cost overall |

| Bank Wire | $15-50 + markup | Bank rate (worse) | 1-5 days | If you need proof fast |

| Personal Cheque | $0-10 | Your bank | 2-4 weeks | Small amounts, no hurry |

| RBC/TD Linked Accounts | Often free | Bank rate | Instant | If you already bank there |

Currency Exchange and Tax Notes

Use one currency for the whole loan (state it in the note). This keeps foreign exchange gains/losses small. If rates change during repayments, you might have a taxable capital gain or loss (only if over $200). Repay in the same currency to minimize this.

Large Transfers ($10,000+)

Banks and services automatically report to FINTRAC (Canada) or FinCEN (US) for anti-money laundering. This is normal, no action needed from you. Electronic transfers are fine and handled automatically.

Easy Steps to Send

- Add a note like “Personal loan per agreement dated [date]” in the transfer memo.

- Pick Wise (sign up is quick) or your bank method.

- Pay from your bank account (cheapest).

- Save the confirmation receipt for your records.

- Have the recipient confirm they got it.

Pro Tip: Wise shows exact fees upfront and uses the fair rate. Many cross-border families save hundreds this way.

➜Read More: “US-Canada Joint Venture Tax: A Guide to Easy Compliance”

Can You Deduct Interest Paid on a Personal Loan Across the Canada-US Border?

The answer depends on how you use the loan money and which country taxes you. In most cases, for true personal loans (like helping family with living expenses), you cannot deduct the interest. But if you use the funds for investments or business, you often can. Below, we break it down clearly for both sides of the border.

In Canada (CRA Rules)

You deduct interest only if you use the borrowed money to earn income (from business or investments like stocks or rental property).

- Personal use (car, vacation, daily expenses): No deduction.

- Investment use (buy stocks, mutual funds, or income-producing property): Yes, full deduction on line 22100.

- Student loans: Separate non-refundable credit on line 31900.

The security on the loan (like your home) does not matter. It’s all about the use of the funds. A checklist for Canadian and US deductions will help.

In the US (IRS Rules)

Personal loan interest is generally not deductible.

- Home mortgage or qualified home equity (for buying/building/improving the home): Deductible as itemized on Schedule A (limits apply).

- Student loans: Separate deduction (up to $2,500).

- Investment interest: Deductible to the extent of investment income (Form 4952).

- Business use: Deductible as a business expense.

For typical family personal loans: No deduction.

Cross-Border Tip

If you are a resident of one country borrowing from the other:

- Report and deduct based on your residence country’s rules.

- The lender reports interest as income in their country.

Pro Tip: Track how you spend the loan money exactly. Keep records (bank statements showing transfers to investments). This proves the deduction if audited. Many cross-border families miss deductions because they mix personal and investment use.

Try our accounting and bookkeeping services at SAL Accounting to ensure compliance on both sides of the border.

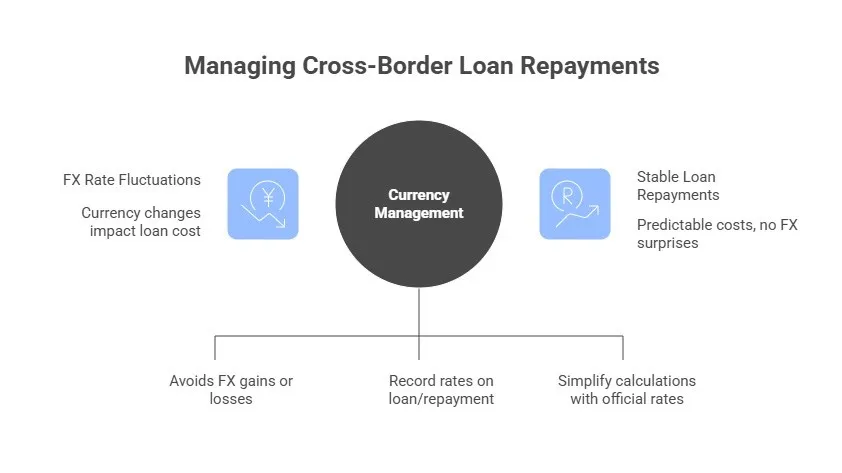

How to Manage Repayments and Handle Currency Changes in Canada-US Loans

Repayments themselves are simple; they’re just returning debt, so no tax on the principal you pay back. The issues come from interest payments and foreign exchange (FX) fluctuations if the loan crosses currencies.

Basic Repayment Rules

Repay on the schedule in your promissory note. Principal payments are not taxable, just returning debt (Know your rights for personal loan). Interest payments count as income for the lender (who reports it each year). Use the same transfer method, like Wise, for easy, low-cost repayments. Add a memo such as “Loan repayment – principal $X, interest $Y” for clear records. Check how to open a US bank account as a Canadian.

Foreign Exchange Gains and Losses

Foreign exchange issues arise only if the loan uses a currency different from your home currency. The principal amount in your home currency can change with exchange rates.

Example: A Canadian borrows $50,000 USD when 1 USD equals 1.35 CAD (cost: $67,500 CAD). If repayment happens when 1 USD equals 1.40 CAD, it costs $70,000 CAD. This creates a $2,500 CAD capital loss you can use to offset other capital gains.

The opposite creates a capital gain (50% taxable in Canada if over $200 total; report on Schedule D in the US).

How to Avoid or Minimize FX Problems

Denominate the entire loan in one currency, preferably the borrower’s home currency. This avoids FX gains or losses completely. Repay in the same currency you borrowed. If currencies differ, track exchange rates on the loan date and each repayment. Use Bank of Canada or IRS average rates for easier calculations.

Pro Tip: Stick to one currency from the start. Most cross-border families choose this and skip FX tax headaches altogether. Our US tax accounting services can help you stay mistake-free.

Case Study: Tax-Efficient Cross-Border Loan for a Mississauga Family Near Square One Shopping Centre2

A Mississauga family, based near Square One Shopping Centre, lends $50,000 USD to their daughter starting a tech job in Seattle. They want to keep it simple but compliant.

Problem: They worry about withholding taxes, imputed interest, high transfer fees, and currency fluctuations complicating repayments.

What We Do: We drafted a promissory note with 4.0% interest (above the applicable IRS mid-term AFR, which is 3.81% for January 2026). We submit Form W-8BEN for treaty benefits (0% withholding). We use Wise for the initial transfer and scheduled repayments (total fees under $250). We denominate everything in USD and track payments meticulously.

The Result: No withholding tax applies, no imputed interest arises, repayments run smoothly with minimal fees, and zero FX gains/losses issues occur. The family saves over $3,200 compared to an informal setup (avoided taxes, bank fees, and potential penalties). The loan runs hassle-free with automatic compliance.

➜Read More: “1042-S Form Instructions: Report U.S. Income & Claim Refunds”

Conclusion

Cross-border family loans stay simple and tax-smart with the right steps. The Canada-US tax treaty cuts interest withholding to 0% in most cases, solid documentation avoids imputed interest and reclassification, and Wise keeps transfers low-cost. Use a promissory note with the minimum rate (3% CRA or current IRS AFR), submit residency forms early, and choose one currency for repayments.

If you are planning a loan, contact us at SAL Accounting for a free consultation. We’ll make it compliant and easy.

FAQs: Cross-Border Personal Loans

No—the principal is not income. But low/zero-interest loans trigger imputed interest as a taxable benefit (CRA rate 3% now).

Yes—0% withholding on most standard personal loan interest. Submit W-8BEN or NR301 to claim it.

Tax authorities assume a minimum rate if you charge less. CRA: 3%. IRS: AFR (3.5-4.6%). The lender reports the “missing” interest as income.

No for personal use. Yes, if used for investments/business (Canada line 22100; US up to investment income on Form 4952).

Principal: No. Interest/imputed interest: Yes, as income to the lender. Large transfers auto-reported—no action unless asked.

Different currencies create capital gain/loss on repayment (Canada: 50% taxable over $200; US: Schedule D). Use one currency to avoid it.